Forex Signals Brief July 25th – The Day Before The Big Day!

The financial markets are trading sideways and the state of indecision in the market is expected to prevail for another day. Yesterday the US dollar was trading near a 13-month low, but now it's edging slightly higher against peer currencies. However, all this is expected to change tomorrow with the release of the Fed rate decision.

4 Events To Watch For Today

EUR – German Business Climate is expected to come out at 8:00 (GMT) with a forecast of 114.9 which is below the previous figure of 115.1. It is a leading indicator of how economic health and businesses react quickly to market conditions. Changes in their sentiment can be an early sign of future economic activity such as spending, hiring, and investment. Honestly, I'm not a big fan of this indicator as it generally causes only slight fluctuations.

USD – CB Consumer Confidence is of interest today. It's due to release at 14:00 (GMT) with a forecast of 116.5 which is below last month's figure of 118.9. This has a high potential to move the market during the US sessions.

Consumer confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity. The rule is simple: if your spending is increasing from time to time, it reflects that you are getting better. Ultimately the credit goes to the economic policies, such as fiscal & monetary policies.

GBP – MPC Member Haldane is due to speak about the international monetary and financial system at the Finance Foundation Annual Lecture, in London at 17:00 (GMT). However, we should not expect it to cause much movement.

NZD – RBNZ Assist Gov McDermott is scheduled to speak about economic trends and how they help implement the bank's flexible inflation targeting framework at Heartland Bank, in Auckland at 20:15 (GMT). Since McDermott is responsible for advising the Governor, it is important we figure out the tone of his remarks.

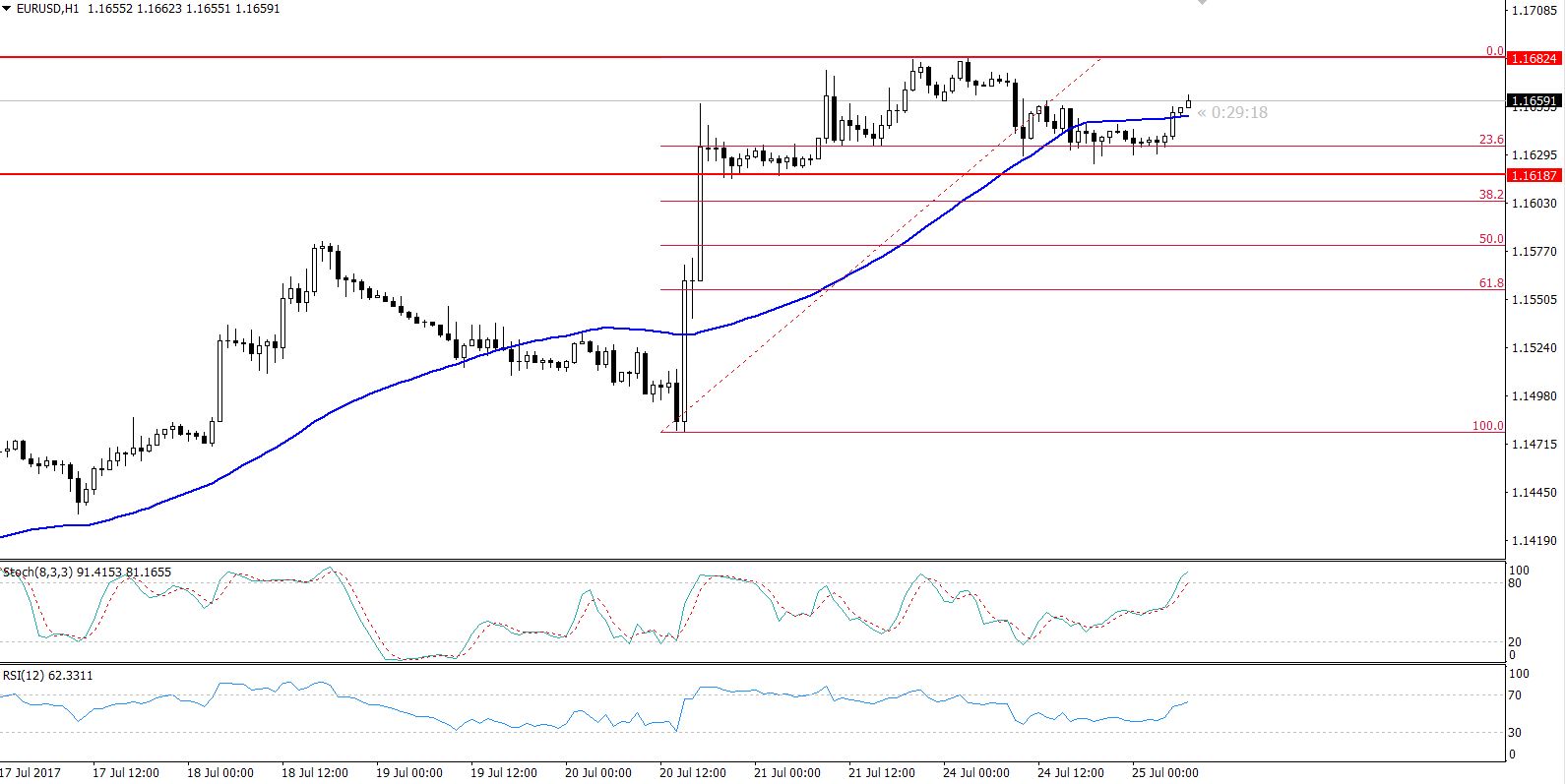

EUR/USD – 50 Pips Sideways Trend

In my previous update, I discussed how the EUR/USD has determined a new bullish region after breaking above $1.14750 to target $1.1710. Now, this trading range is getting squeezed from $1.1618 to $1.1675.

All the attention is shifted to the Federal Reserve, which is expected to hold a policy meeting tomorrow. The Fed isn't expected to increase the rates or surprise the market through a policy statement. That is why the US dollar is still under pressure and the Euro is still making bullish moves.

Technically, the overbought EUR/USD has already completed 23.6% Fibonacci retracement at $1.1635. Breakage of this level is likely to offer another selling opportunity to traders with a target of $1.1600, the 38.2% Fibonacci level. For tips on how to increase your profit when trading, take a look at our Fx Leaders support and resistance trading strategy article.

EUR/USD – Sideways Channel – Hourly Chart

EUR/USD – Sideways Channel – Hourly Chart

EUR/USD – Key Trading Levels

Support Resistance

1.1645 1.1752

1.1593 1.1842

1.1344 1.2001

EUR/USD Trading Plan

I'm not looking to target big profits. Today, my goal is small trades. The idea is to stay in buying above $1.1645 with a stop below $1.1615 and a take profit of $1.1675. To learn more about trading EUR/USD, read our FX Leaders article on how to trade the EUR/USD signals.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account