When Inflation Is More Important Than Economic Growth (GDP)

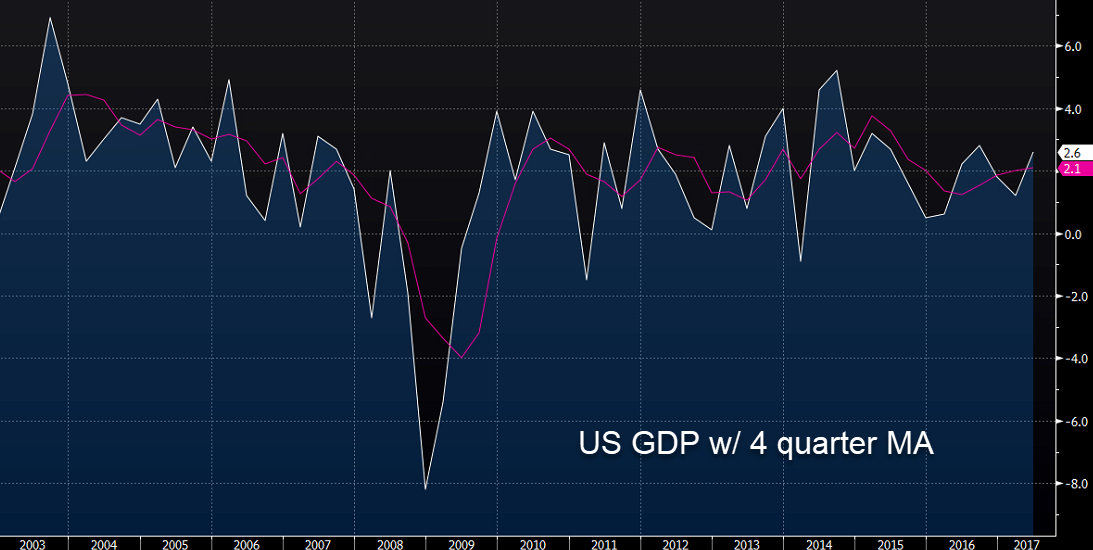

Following the previous forex update, the US GDP number came out a blip above expectations at 2.6%, although the consensus differs in different forex calendar websites.

That´s nearly double the previous month, and as we mentioned in the previous update, the first quarter was revised twice as high as the previous reading.

The US economy looks a lot better this quarter, compared to the previous one

But looking into the details, we can see more positive signs; personal consumption rose to 2.8% and investment on equipment increased by 5.2% and consumer spending on durables jumped by 6.3%.

In normal times, this would have been positive for the USD, but we´re not living in a normal world anymore, nowadays inflation is more important than GDP, even though we´re a long way away from the 0.1-0.2% inflation that we were seeing until a year or so ago.

Last month´s GDP price index was revised down to 1.9% from 2.3% and this month it fell lower to just 1% against 1.3% expected. Employment cost (wages) index also fell to 0.5$% from 0.8% previously.

So, earnings and inflation which is what the FED is looking at right now, declined and that sent the Buck lower.

Although, the USD decline seems to have stopped now, so we opened a sell forex signal in AUD/USD. The 50 SMA is providing resistance on the H1 chart, so hopefully we will see this pair reverse back down.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account