Counter Trending GBP/USD After UK Construction Dives

After yesterday´s jump in UK manufacturing numbers, the market was expecting another positive surprise from the UK, this time from the construction sector. But instead it dived hard and we decided to counter trend GBP/USD just because of that.

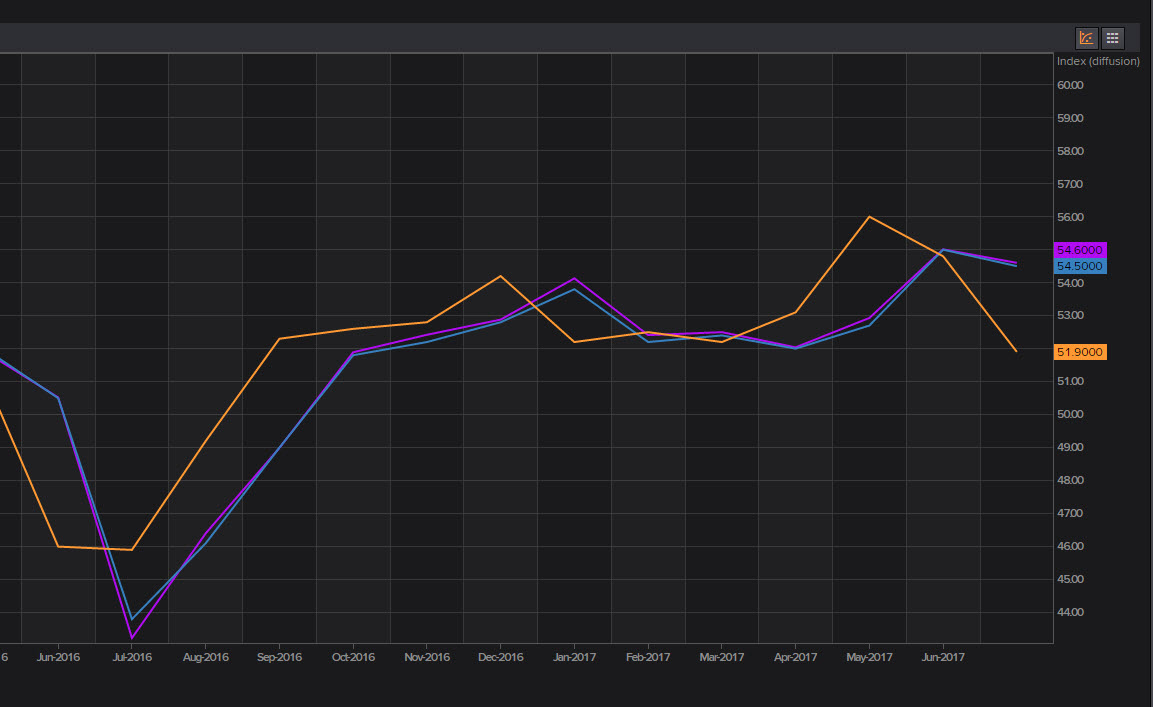

UK construction PMI was expected at 54.3 PMI points, which is lower than the last reading. At 54.8, the last reading was lower than the previous one and lower than expectations.

That´s a nasty dive

Although, a reading above 54 points would still be positive for the Quid since it is a long way away from the 50 flat level. But this month’s reading was horrible; the UK construction sector PMI came at 51.9, which is nearly 2.5 points below expectations and getting close to contracting.

This number falls in line with the disappointing numbers we have seen from the UK in recent weeks/months and it kills hopes for an economic rebound in the UK, considering that construction sector is very robust, or was.

So, we decided to take a short trade in GBP/USD, We opened a sell forex signal in this pair just a short while ago. This is a trade which goes against the trend, but I somehow got the feeling that we´re going to see a pullback soon.

The USD weakness that we have seen in the last few hours seems to be fading as EUR/USD and commodity Dollars pull back, so I think it´s time for GBP/USD to pull back too.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account