Gold Gaining Pace After Trading In A Tight Range

Gold has been trading in a “tight” range during most of the day today. I say tight because a $3 range seems tight compared to the $13 surge we saw yesterday or the $70 climb that we have seen gold achieve since the beginning of July.

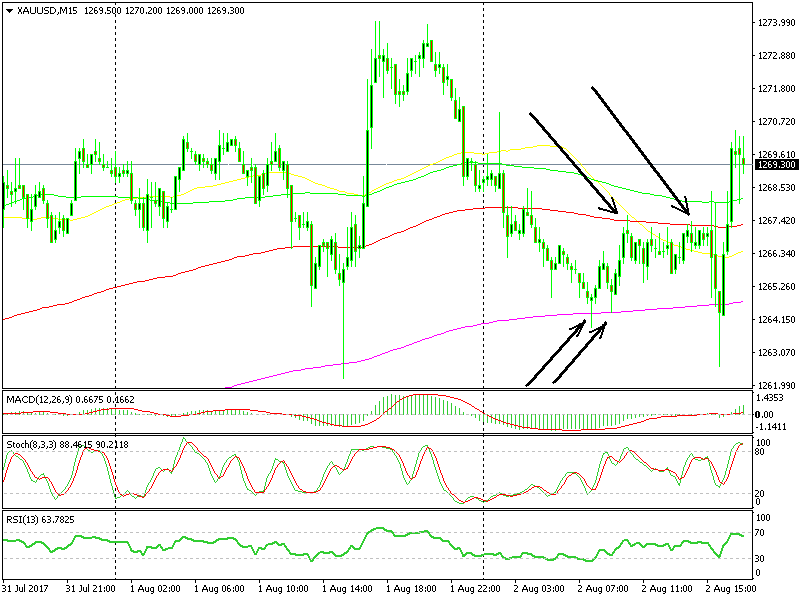

During the morning today, gold has been stuck between the 100 (red) and 200 (purple) moving averages on the 15-minute chart, which are respectively lying at the top and at the bottom of the range. The 100 simple MA (green) also provided resistance a few times.

This range was perfect to trade Gold

This range was perfect to trade Gold

It looked like gold traders were trying to make up their minds. They tried the top side first but failed to close above the 100 simple MA. Then they had a go at the bottom of the range, which they pierced briefly. Yet, after failing to break yesterday´s low, they changed their mind again and back up we went.

In the last hour or so, the buyers finally made up their minds and found the courage to break the moving averages at the top of the range and the gold took off.

But, judging by the last few 15-min candlesticks which allow you to read the price action, the buyers had enough and it looks like they have already taken profit.

Now it seems like gold wants to get back in the range, but the 100 SMA (green) is stopping that.

Trade idea: Personally, I would wait for gold to get back in the range again and then trade the range with stops above/below it, as the range trading strategy suggests.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account