EUR/USD after the FED, Double Top or Double Bottom?

The FED left everything as it was with interest rates unchanged and nothing new on the monetary policy. That should have sent the USD down

The FED left everything as it was with interest rates unchanged and nothing new on the monetary policy. That should have sent the USD down because no one was expecting a dovish FED, so at best, yesterday's FOMC was on par with expectations.

Yet, the Buck rallied immediately after the FOMC statement as rate hike odds for Decembers picked up considerably, from around 40% to above 60%.

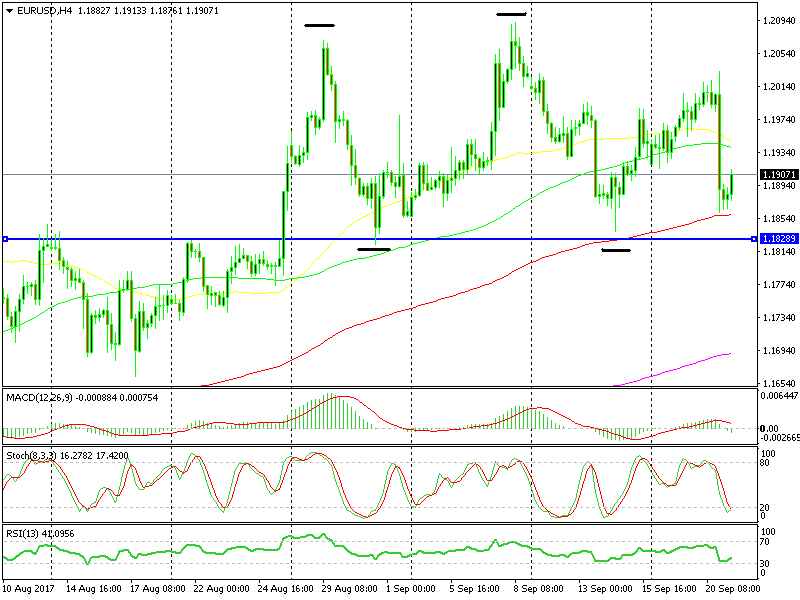

That’s all the sellers needed, and the USD surged around 100-140 pips across the board sending EUR/USD below 1.19. Although, the 100 SMA (red) halted the initial decline on the H4 forex chart.

We have a double top and a double bottom chart patterns here.

We have a double top and a double bottom chart patterns here.

I don’t know if this decline will resume and break the 100 SMA, or if this pair will reverse back higher as we have seen it do so often after every dip.

Although on this chart, we can see two patterns. We see a double top near 1.21 and a double bottom at 1.1820-30. Yesterday we tried the upside and the downside but didn’t quite reach them.

If the resistance breaks, the technical strategies suggest that the price will fall for another 250 pips, which is the difference from top to bottom and vice versa if the resistance goes.

According to the price action, we saw yesterday, I think that the downside is more at risk since EUR/USD lost nearly 150 pips on a neutral statement.

So, the logical trade would be to sell EUR/USD below 1.1820 when/if the sellers manage to push below it. Another trade would be selling when this retrace higher comes to an end, which would be near the 100 SMA (green), but we’ll have to follow this pair closely in the following hours.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account