Gold Bears Are Facing a Big Challenge. Buy Now?

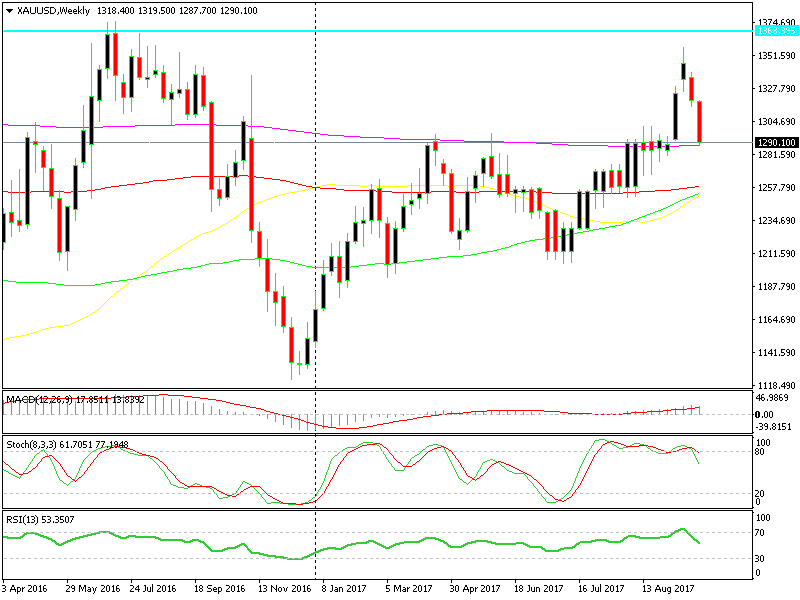

Gold has climbed higher throughout this year but this month it bumped into the 100 SMA on the weekly chart, which placed a lid for the time being to this climb.

So, in the last couple of weeks, Gold prices have reversed lower and the bears have been in charge during this time, but they are now facing a difficult level to take out.

The 200 SMA is a very important indicator

The 200 SMA is a very important indicator

As you can see on the weekly chart above, we are hanging around the $1290 level now where we can find the 200 SMA (purple). That moving average has provided resistance in the last 2 years, so I think that would be a damn strong level for the sellers to take out.

The daily chart is well oversold

The daily chart is well oversold

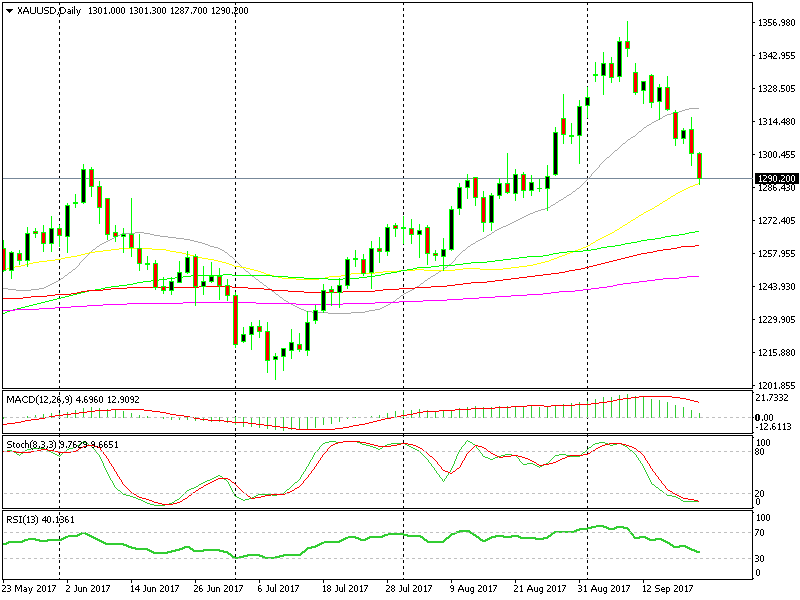

If we switch to the daily Gold chart, we can see that the 50 SMA (yellow) is standing right at the same place, so it will add additional strength to this support level.

The stochastic indicator is oversold as well in this timeframe chart, so there is a case here for longs. I don’t know if I will open a buy trade, but if it fits your money management technique, then you can use this trade setup yourself, just give it some room to breathe with the SL.