That Trade Didn’t Take Long Thanks to Canadian Inflation and Retail Sales

We highlighted this trade on USD/CAD in the midday brief. We bought USD/CAD a while ago as this pair completed a retrace on the H1 chart. T

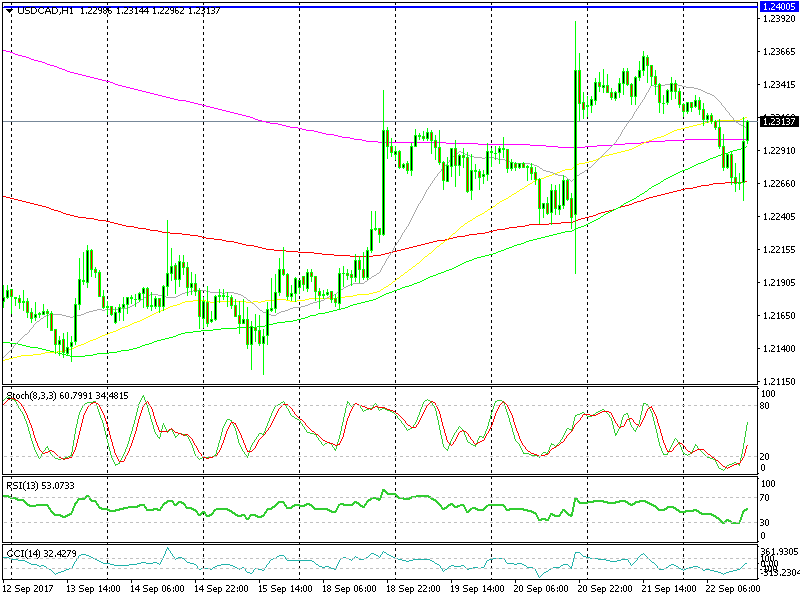

We highlighted this trade on USD/CAD in the midday brief. We bought USD/CAD a while ago as this pair completed a retrace on the H1 chart. The long term is bearish, but the short term is bullish, so we went long with a short-term signal.

I feared the economic numbers coming from Canada this afternoon, but they went in our favour. The core retail sales number came out half of what was expected and a quarter of last month’s reading, while inflation (consumer price index) came out at 0.1% from 0.2% expected.

The yearly CPI number also missed expectation even though Oil prices have remained upbeat during this year.

The short-term uptrend is back on its course

The short-term uptrend is back on its course

Well, that was it for USD/CAD bears and this pair surged around 60 pips afterwards. We don’t object such a move, do we guys? We got our pips so on to the next trade now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account