Shorting EUR/USD Again. Are We Pushing Our Luck?

Recently, we have been concentrated on shorting the Kiwi and the Euro against the USD. These two forex pairs have been slipping lower in th

Recently, we have been concentrated on shorting the Kiwi and the Euro against the USD. These two forex pairs have been slipping lower in the last two weeks or so, and we have tried to stay on the right side, opening a few sell forex signals here.

We had two winning forex signals in NZD/USD yesterday and another signal in EUR/USD which hit take profit overnight. Now, we opened another sell signal in EUR/USD, but are we pushing our luck too far with these signals?

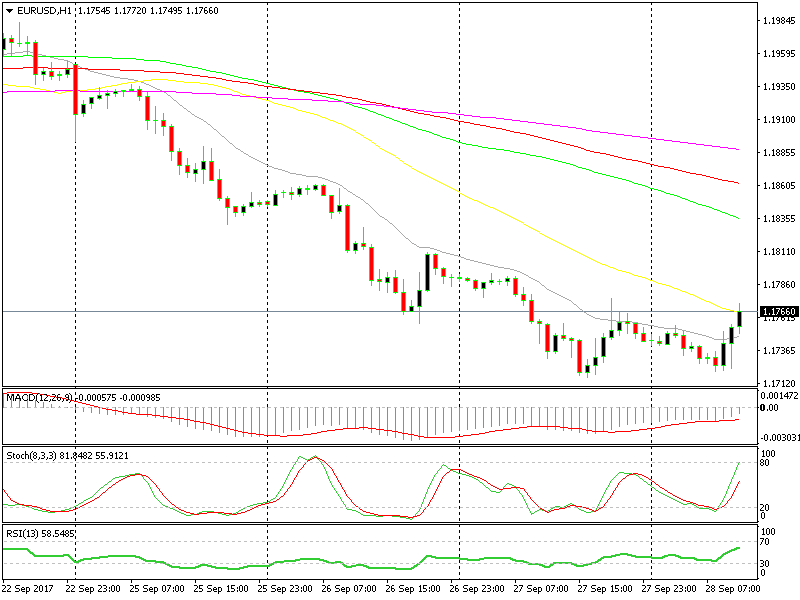

The 50 SMA is providing resistance after the 20 SMA gave up.

The 50 SMA is providing resistance after the 20 SMA gave up.

We for starters, we can’t go on the opposite side of the trend. Actually, we do sometimes, but it is a dangerous strategy and you need lots of experience to do that. So, we’re going with the trend.

We waited until EUR/USD made a retrace higher then we opened the sell signal. The 20 SMA (grey) has kept the downtrend in place this week, which means that the downtrend has been pretty strong.

Although, today we decided to wait until we reached the 50 SMA (yellow) because the sellers couldn’t break yesterday’s low overnight, which means that the trend might be slowing somewhat.

Now, stochastic is oversold, and the 50 SMA is providing resistance on the H1 chart, so the odds are much better and that’s why we went short. The trend might as well change, but we have to trade and you can’t get a better chart setup for sellers than this.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account