GBPJPY Completes 38.2% Fibonacci Retracement – What’s Next?

It's just another boring Monday as the market is trading the ranges. Our previous trading signal on GBPJPY was doing phenomenally well and was near to take profit. But unfortunately, the increased demand for haven assets spoiled our trade. No worries, I got another trade setup to trade GBPJPY.

GBPJPY – Oversold Market

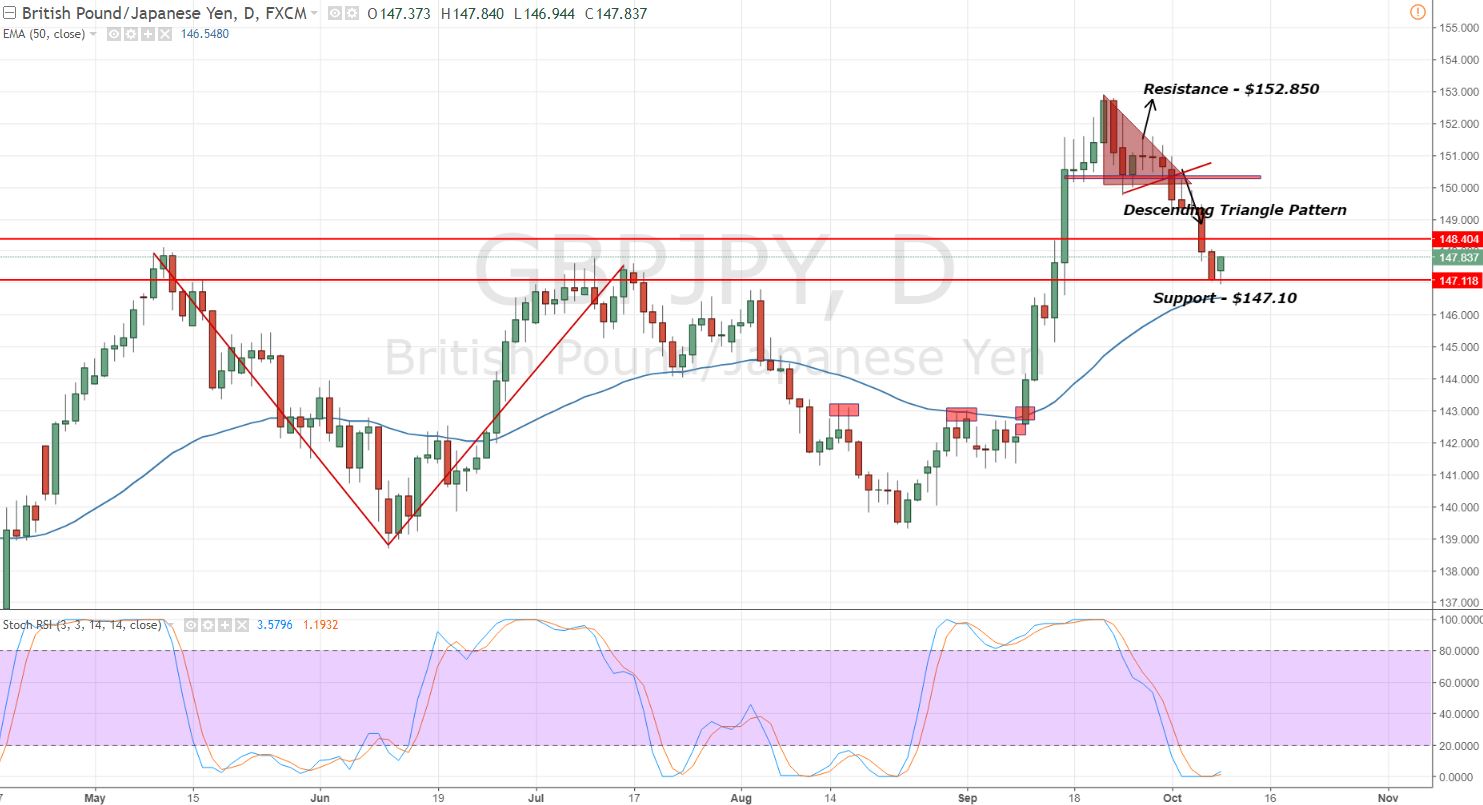

Back in May and July, the GBPJPY was facing resistance at $147.550 and made a double top pattern. But in September, the pair broke above this level. Now, the Guppy has dropped to the same resistance level and is now working as support area somewhere around $147's.

GBPJPY – Daily Chart – 38.2% Retracement

GBPJPY – Daily Chart – 38.2% Retracement

As we mentioned earlier, the pair also completes the 38.2% Fibonacci retracement level at $147.550, but the bearish momentum took some time to stop. Did you check FX Leaders Fibonacci Trading strategy? If not, I would highly suggest for understanding the Fibonacci trading levels.

Support Resistance

146.75 147.73

146.39 148.37

145.75 148.72

Key Trading Level: 147.38

GBPJPY – Trading Plan

Though the market is lacking volatility, it will be nice to stay bullish above $147.400 with a target $148.500 and stop below $147. Good luck!

GBPJPY – Daily Chart – 38.2% Retracement

GBPJPY – Daily Chart – 38.2% Retracement