Forex Signals US Session Brief, Oct. 19 – The Kiwi and the Pound Are Under Pressure, While Cryptocurrencies Bounce Back

Cryptocurrencies finally found their bottom yesterday and since then, they have been rallying like they’re on steroids. We can’t say th

Cryptocurrencies finally found their bottom yesterday and since then, they have been rallying like they’re on steroids. We can’t say the same about the Kiwi and GBP though. I understand the fall in GBP, but the Kiwi should have jumped higher instead of tumbling, but that’s the forex market.

The GBP and NZD are the main losers today.

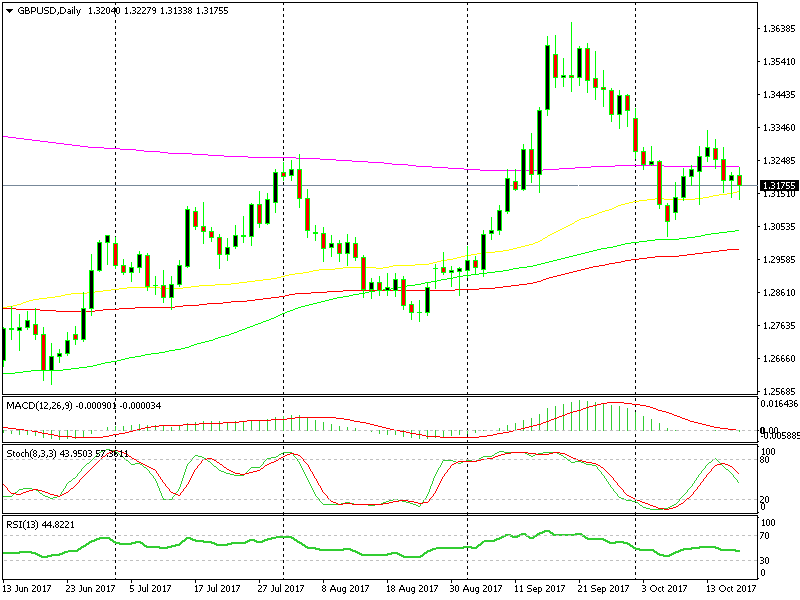

GBP Takes the Second Punch Today

GBP/USD has been climbing higher last week amid some USD weakness, but it didn’t start this week on the right foot. The inflation report came out all mixed on Tuesday which wasn’t exactly what the Bank of England (BOE) wanted, so the Pound started to turn lower.

This morning, the UK retail sales report came out, and it was horrible. Retail sales fell by 0.8% last month which slashed the yearly number in half, and the previous report was revised lower, too.

I did say after the UK inflation report was published on Tuesday that higher prices and softer wages were going to catch up with the British consumer sooner or later. It looks like they’re catching up sooner rather than later.

That round of data commenced the second round of selling in GBP pair. GBP/USD lost nearly 100 pips after the release, but it is slowly crawling higher at the moment. Although, I see this climb as a retrace before the next move lower, so I’m looking to sell but will explain this trade further below.

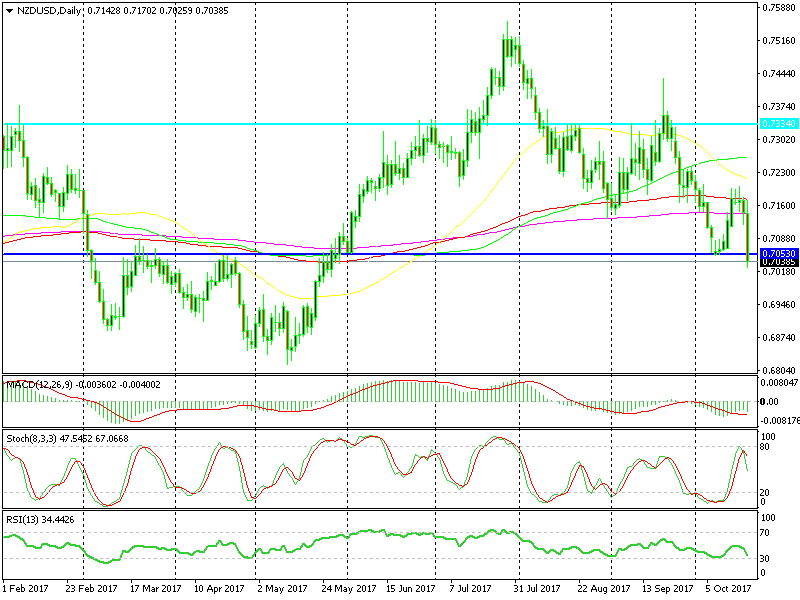

Who Is Selling the Kiwi?

The elections in New Zealand are over and a new government is about to form. The Greens and the First Party are backing up the Labours, so it seems like we will have another woman prime minister besides Frau Merkel in Germany and the “Not So Iron Lady” in the UK.

That should have been positive for the NZD, but the market is looking too far ahead of itself. As a result, the Kiwi is getting smashed with NZD/USD and losing about 130 pips so far.

I almost sold this forex pair a while ago by mistake but stopped at the last minute as the slide had extended too far without any pullbacks whatsoever. Well, that trade would have reached take profit now, but I never put my trust on luck when it comes to this business.

Anyway, the bigger picture has turned really bearish for NZD/USD as I explained in one of the previous forex updates today, so I will be looking to sell this pair, but we have to get a retrace higher first.

There's nothing stopping the fall in NZD/USD.

There's nothing stopping the fall in NZD/USD.

Cryptos Are Back on their Feet

After losing a good chunk of their value, cryptocurrencies formed a base in the near term yesterday. They started to reverse in the afternoon, and today they have only been climbing without much resistance.

Bitcoin was the first to reverse yesterday, and the best performing so far today, as it is usually the case with digital currencies. Ethereum and Litecoin joined Bitcoin, albeit on a slower march.

We have a live signal in Litecoin which we opened on Sunday. That signal was getting worrisome as Cryptos were accelerating the decline, but today we feel a lot better. Digital currencies are back on their feet, and our forex signal in Litecoin is doing much better.

The price is now back above the 50 SMA (yellow) which has acted as support and resistance previously. Hopefully, this moving average will keep the sellers in check and give the buyers another reason to push higher.

Trades in Sight

Bearish GBP/USD

- The trend has turned bearish this week

- Fundamentals are mostly bearish

- The daily chart is headed lower

This pair is headed lower, too, but the 50 SMA (yellow) must be broken first.

This pair is headed lower, too, but the 50 SMA (yellow) must be broken first.

We missed the tumble in GBP pairs this morning after the horrible UK retail sales report, but GBP/USD is retracing higher now, so that’s an opportunity to get in on the short side. The technical analysis looks all bearish, and we know fundamentals are not that great in the UK. In this case, I will wait until the retrace up takes this forex pair to oversold levels and then go short. The area around 1.3180-32 looks like a good place for sellers since it has been resistant before, and we can also find the 50 SMA up there.

In Conclusion

Cryptocurrencies are turning higher today, so we are on the right side of the market with our Litecoin signal. On the other hand, the Kiwi and the GBP are tumbling lower, so we will try to look for shorts on NZD/USD and GBP/USD today.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account