USD/JPY Forming A Bullish Reversal Chart Setup After Giving Us A Heart Attack

A while ago we opened a buy forex signal in USD/JPY. This forex pair has been on such a strong uptrend in the last few days that every dip

A while ago we opened a buy forex signal in USD/JPY. This forex pair has been on such a strong uptrend in the last few days that every dip looked like a great opportunity to buy.

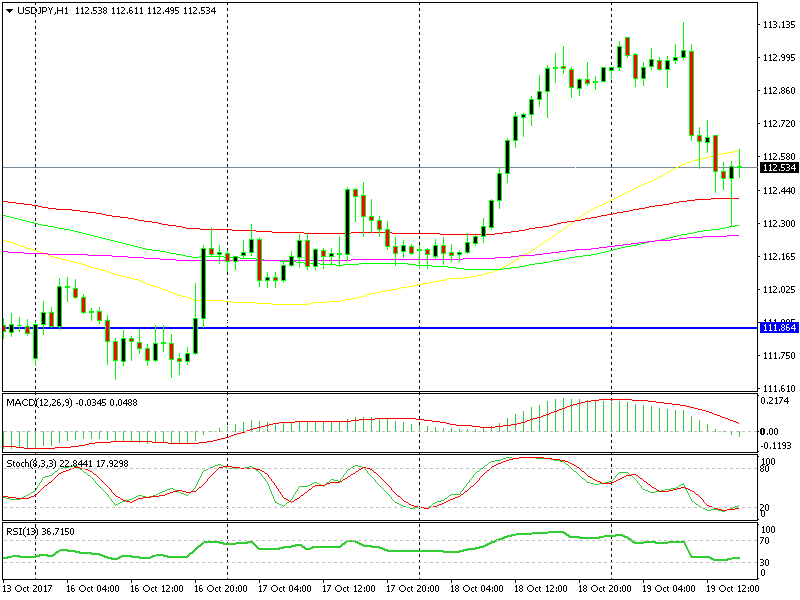

That’s what we did today; we waited for a retrace lower and after a few bullish signals we decided to go long. These signals included the stochastic being oversold on the hourly chart, the 50 SMA (yellow) providing support and a couple of doji candlesticks.

The 50 SMA was providing support previously but it has now turned into resistance

The 50 SMA was providing support previously but it has now turned into resistance

But, this forex pair dipped about 30 pips after the US unemployment claims and Philly FED manufacturing index which were pretty good, so I don’t know why this pair dived.

It didn’t last long though and the reversed was just as quick. The previous hourly candlestick closed pretty bullish since it formed a hammer. Although, the 50 SMA has turned into resistance now.

So, our buy signal is not out of the woods yet, but it looks a lot better now. Let’s hope the bullish trend resumes again soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account