I Don’t Think the CAD will See another Sunny Day Soon, After GDP Turned South

As I was writing the Midday forex brief, I saw USD/CAD jump around 80 pips higher. I immediately knew that the Canadian GDP report must hav

As I was writing the Midday forex brief, I saw USD/CAD jump around 80 pips higher. I immediately knew that the Canadian GDP report must have missed the expectations, at least.

The monthly GDP declined by 0.1% when expectations were for a 0.1% increase. The yearly number also took a dive. Last month, the annualized GDP stood at 3.9%, while today it dropped to just 3.5%.

The price of manufactured goods and particularly the raw materials also fell. We know that Canada is a big exporter of raw materials, so that’s another thing to weight on the GDP, as well as the massive 7.3% drop in chemical manufacturing.

The Canadian economy has performed pretty well during the past year, but the funny thing is that this turnaround comes after the Bank of Canada (BOC) increased the interest rates twice. I don’t think that hiking rates again will go through their mind again anytime soon now.

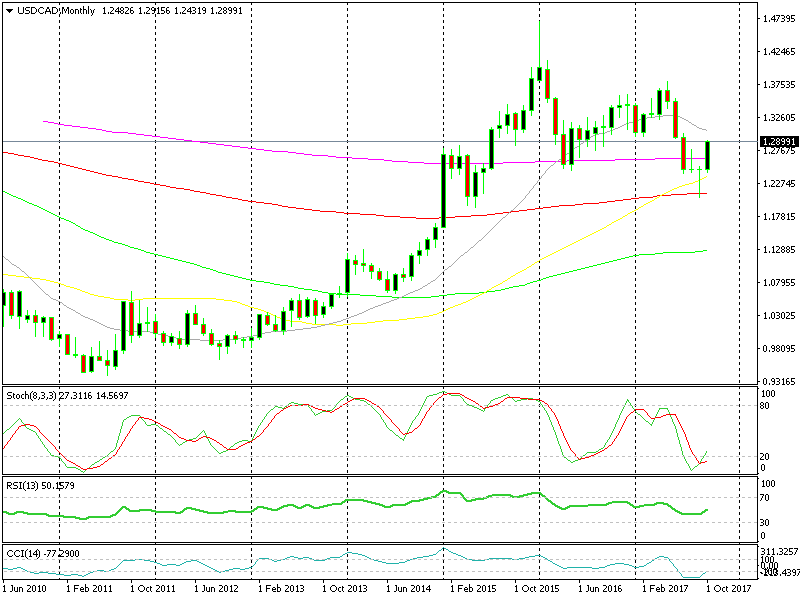

After failing to break the 100 SMA (red) and forming a pin, this pair is ripping higher

So, I expect the Canadian Dollar to continue sliding lower in the coming days/weeks. The monthly USD/CAD chart looks pretty bullish with a big bullish candlestick after a pin last month, which did signal a reverse. By the way, we just closed the Gold signal for a hefty profit.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account