Can Crude Oil Sustain Bullish Breakout? EIA Inventories Ahead!

Crude Oil gave us a good trade yesterday when the trading signal closed at the take profit point. Today, we may experience another wave of

Crude Oil gave us a good trade yesterday when the trading signal closed at the take profit point. Today, we may experience another wave of volatility during the New York session. Make sure to buckle up…

API Inventories Report

In our previous update, Quick Trade – WTI Crude Oil Retesting 61.8% FIbo Level, we shared our forecast for the API inventories. The numbers were expected to drop because of the current issue with Saudi Arabia. That's exactly what happened. The API reported a draw of -6.35M barrels last week.

EIA Crude Oil Inventories

At 15:30 (GMT), the Energy Information Administration will be releasing the inventories figures. It's expected to report a draw of -1.4M. However, considering the API report, we can expect a draw of up to -6M/ barrels.

What If EIA Reports Draw Less Than -5M Barrels?

We need to be careful of market reversals. Even if the EIA reports a draw of -5M barrels, I will be hesitant to buy Crude Oil. Though there will be a spike in price, the market could always reverse later on.

This is important because the Crude Oil has already "Priced In" the API report and any divergence in data will cause sharp reversals.

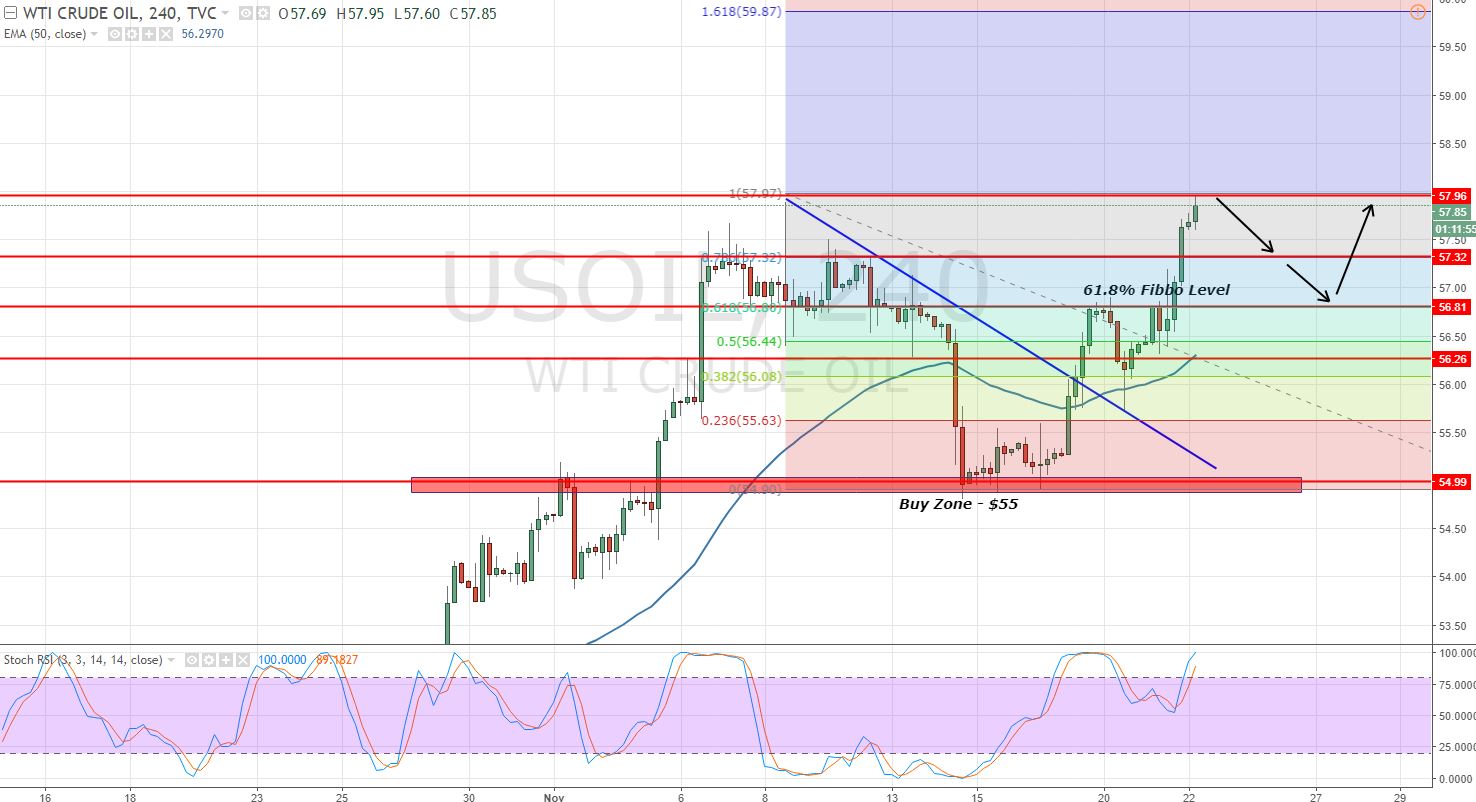

Crude Oil – 4 – Hour Chart – Bullish Breakout

Crude Oil – 4 – Hour Chart – Bullish Breakout

WTI Crude Oil – Trading Plan

Crude Oil is facing a strong resistance at $58 after having a bullish breakout at $57.30. Below $58, reversal chances are high. Therefore, we shared a trading signal to enter a sell below $57.80 with a stop above $58 and a take profit of $57.45 and $56.90. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Crude Oil – 4 – Hour Chart – Bullish Breakout

Crude Oil – 4 – Hour Chart – Bullish Breakout