Forget NZD, We’re Sticking to AUD Shorts Today

In recent times we have been going short on NZD/USD since its downtrend has been stronger than the other commodity dollars. Today, things ha

In recent times we have been going short on NZD/USD since its downtrend has been stronger than the other commodity dollars. Today, things have changed; we will switch to AUD shorts.

If you compare the daily AUD/USD chart and the daily NZD/USD chart, you will see that the range from top to bottom starting in September is about 50 cents in the Aussie. The range in NZD/USD is about 10 cents. This forex pair is less volatile, so the downtrend is even bigger here.

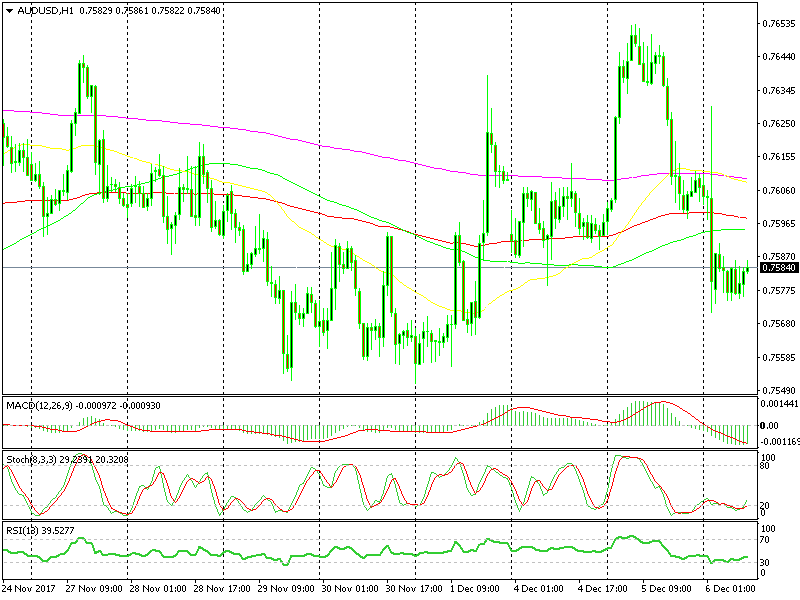

The red and green MAs is where I’m looking to sell.

We have been opening more sell forex signals in NZD/USD than in AUD/USD; it was safer. But, the situation changed yesterday, at least in the short term.

The Australian GDP missed expectations, and it slipped three points from last month. It’s not a big miss, to be honest, but it came as a surprise after yesterday’s impressive retail sales.

AUD/USD lost about 50 pips after the release, and it has now turned more bearish than NZD/USD. So, we’re thinking of switching our shorts to AUD/USD from the Kiwi for the next few days. The sentiment has really turned bearish on this forex pair.

Although, I would wait for a retrace higher. The hourly chart is oversold, so a retrace might be coming. I’m looking at the 100 SMAs (red or green) as a possible selling spot. They’re standing around the 0.76 level. By the time we get up there, the hourly chart will be overbought and the retrace up will be over.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account