EURJPY – Get Ready To Catch Retracement!

During the last week, Japanese Yen had haven appeal due to a "risk-on" sentiment. Due to which most of the Japanese currency pairs entered..

During the last week, Japanese Yen had haven appeal due to a “risk-on” sentiment. Due to which most of the Japanese currency pairs entered into overbought zone. EURJPY is one of them and I’m eyeing to cash this opportunity.

EURJPY – Overbought Pair

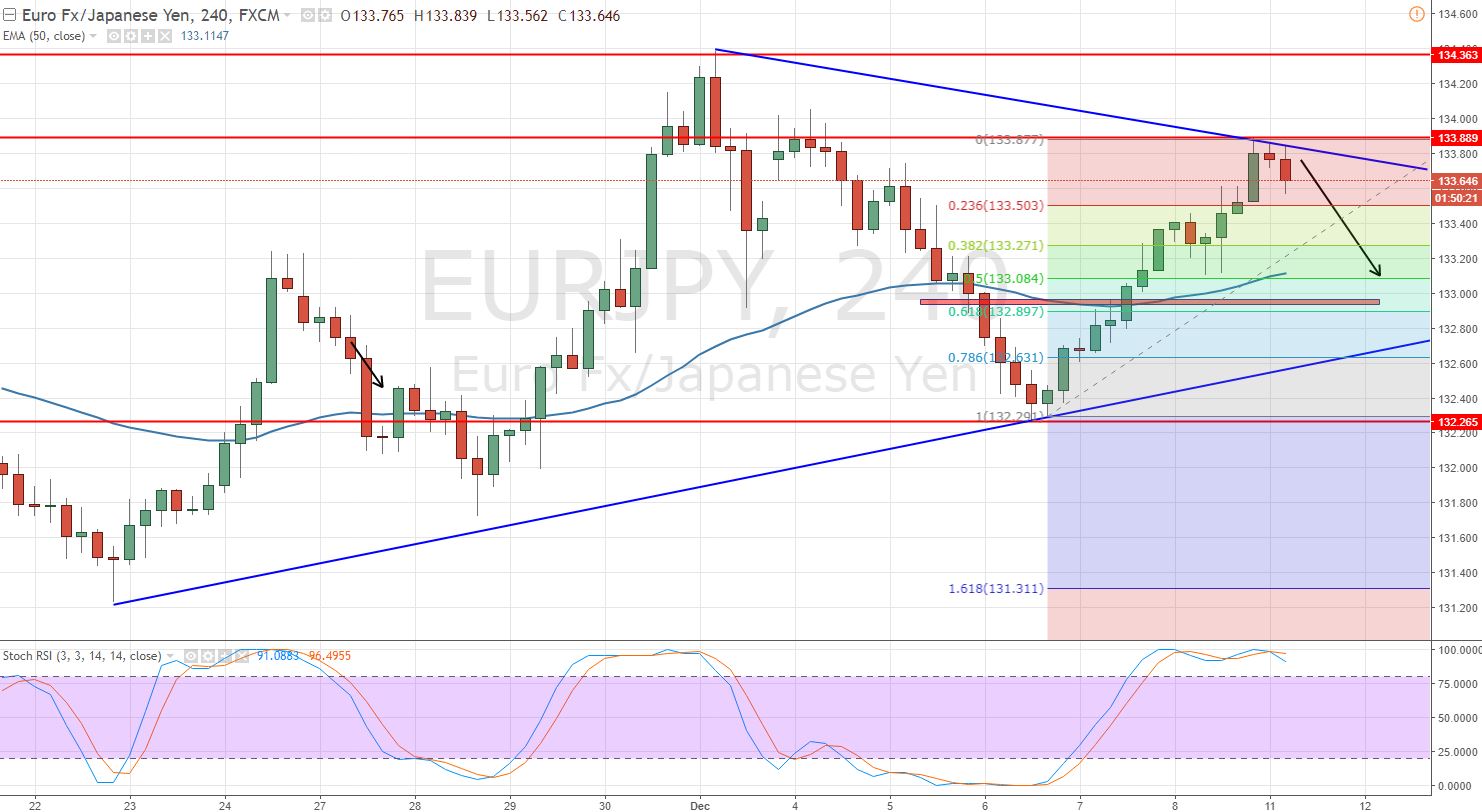

The cross currency pair is consolidating below a strong resistance level of $133.900. The resistance is extended by the bearish trend line on the 4-hour chart.

EURJPY – 4-Hour Chart

The Doji candle followed by a bullish momentum demonstrates the neutral sentiment of investors. At the same time, the Stochastics are in the overbought zone.

Applying the Fibonacci indicator, the pair is likely to gain support at 133.500 (23.6% Fibo level) and 133.270 (38.2% Fibo retracement).

Support Resistance

133.23 133.61

133.1 133.74

132.91 133.93

Key Trading Level: 133.42

EURJPY – Trading Plan

Considering the technicals, we opened a sell signal to target 133.360 with a stop above 134.06. Investors are suggested to move their stops at breakeven as soon as the signal shows 15-20 pips profit. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account