Forex Signals US Session Brief, January 2 – Bitcoin and USD Start the New Year on the Wrong Side

The US Dollar is following the same path as last year, which is not a surprise. I’m expecting new things this year, and will explain them

The US Dollar is following the same path as last year, which is not a surprise. I’m expecting new things this year, and will explain them further below. The surprise today comes from Bitcoin, which is lagging the other major cryptocurrencies, and that’s something we haven’t seen very often.

Bitcoin is not leading today

The USD Should Start Turning Around, but It’s Not Yet

As we know, the US Dollar has been dumped relentlessly throughout last year. The turnaround lower came right at the beginning of the year, after a few years of trading in a solid uptrend. It lasted the entire year, and it took the Buck way down the ladder.

That being said, we are in 2018 now. After last year’s 10-20 cent decline, there isn’t much room for the US Dollar to fall further. There’s no end to how far a currency can decline or climb, but logically, the USD has already completed most of the decline.

EUR/USD is close to 1.21, and it is already having difficulties up here. We will see how the price reacts when it touches 1.21.

USD/JPY is also at a big level. It is playing with the 112 level that we mentioned in one of our previous updates. GBP/USD is trading around 1.3550, which is also a big level for this forex pair.

So, it looks like most forex pairs are at important levels. This coincides with the beginning of the year. Last year the USD took a massive turn south. Will we see the Buck make a 180 degree turnaround this year? Chances are that we will. The tax plan passed late last year, and it will start showing its effects soon.

The US economy is on a good run and the world is getting used to Donald Trump. Remember, Trump’s comments and actions were one of the reasons for the USD decline last year. It was new for financial markets but now they’re getting used to it, so the reverse may come at any time.

Bitcoin Lags for the First Time

Bitcoin has lead the cryptocurrency market since it was the first digital currency to be conceived. It pulled the crypto market up with it even in the last few months, when Bitcoin approached $20,000 and the rest of the market gained 300-500%.

Today though, Bitcoin is not playing the leader anymore. After the sharp decline two weeks ago, this market does not look the same. It is not trading in the same way as before, and the other major altcoins are back on track now. Ethereum is making new highs, Ripple is ripping higher, and Litecoin has made a decent jump.

On the other hand, Bitcoin is not showing signs of life. It is not leading the pack and it isn’t even following it higher. Is this a sign that Bitcoin has run its course?

It might be- after all, getting to $20,000 in such a short time and failing right below it is not a good sign. It must have scared the hell out of buyers, especially the late comers. We’re long on Bitcoin so we hope it gets its act together. There are plenty of rumors going around, one of them being that Bitcoin has lost its appeal to the criminal underworld.

Trades in Sight

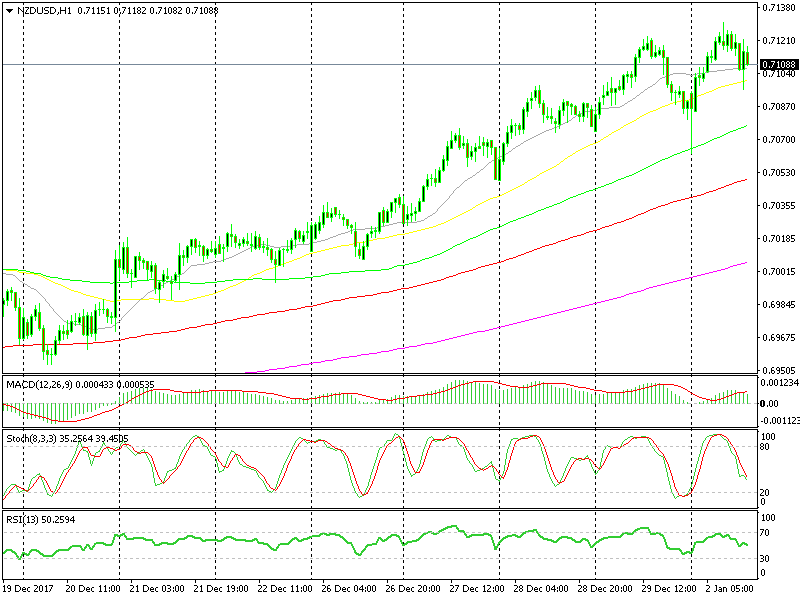

Bullish NZD/USD, Again

- The trend is bullish and strong

- The retrace lower seems complete

- 50 SMA is providing support

The 50 SMA (yellow) is a good place to buy

The trend is pretty strong in all commodity dollars, but at the moment we are seeing a pullback lower take place. The stochastic indicator is not oversold yet, but the 50 SMA (yellow) is providing support. I think that this might be a good opportunity to look for longs in this pair. We just sold USD/CAD and might open a sell signal in NZD/USD soon.

In Conclusion

The USD is continuing to slide lower, but most forex majors are at some important levels. So, we might see a turnaround soon, which I’m waiting for. Bitcoin has been static all day, but it’s moving right now, so hopefully it will resume the uptrend.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account