Forex Signals US Session Brief, January 9 – The Risk Is Off Across All Markets as Uncertainty Prevails

Yesterday, the financial markets looked confusing as they were trying to make their mind up as the New Year got underway.

Yesterday, the financial markets looked confusing as they were trying to make their mind up as the New Year got underway. Today the picture is clearer; all the financial markets look cautious. The risk sentiment is switched off as risk currencies are under pressure.

The risk aversion sentiment is prevalent today

All Majors Are Down Against the USD But the Yen

The US Dollar is among the strongest currencies today. It has been rallying against most major currencies, which is a sight for sore eyes after being dumped for weeks and months.

The British Pound lost about 70 pips this morning, the Kiwi is also slightly lower and even the Canadian Dollar has lost some ground. Remember that the CAD has been the strongest currency in the last few weeks.

It’s for this reason that we took a sell trade in this forex pair. This is a good opportunity to go long on the CAD during this retrace when the trend is down and still pretty strong.

So, it looks like the US Dollar is getting back on its feet now. EU/USD gave the first signal of this as it started reversing last Friday. It failed at the 1.21 resistance level once again and it hasn’t looked back since then.

Although, the biggest loser today is the Aussie. AUD/USD has made a sharp reversal overnight and ended up about 50 pips lower from the top. Our buy forex signal here was headed for the TP last evening but a few hours ago it was just several pips above SL. Although, it looks safe now as this pair has claimed back some of the losses.

The Yen, on the other hand, has found some strong bids. The risk aversion sentiment has played a role on USD/JPY, but the Swiss Franc is lower. So, the fall in USD/JPY is also due to the technical setup which we explained in one of our previous forex updates.

Cryptocurrencies Are Grinding Lower

Yesterday, the crypto market went through another flash crash, although it wasn’t like the one we witnessed before Christmas. Litecoin Mini lost about $50 which is nearly 20% of its value while Bitcoin lost around $2,500.

Even the two digital currencies which have been surging in the last two weeks suffered some heavy losses. Ripple Coin fell to $1.90 from $3.25 a few days ago. That is a 40% decline in just as few days, but hey, this is the new financial market which has appeared out of nowhere. It is unconventional for old fashioned forex traders, that’s why we must keep the leverage very low. Now Ripple is back above $2, but it is still grinding lower.

Ethereum also fell hard yesterday. It was trading at the highs close to $1,120 at midday, but it suddenly reversed and fell below the watermark at $1,000. Although, that didn’t last long. Ethereum reversed back up and today it made some new highs.

So, looking at crypto market in general, I can see uncertainty at the moment. That’s not too bad though; every trend needs a correction now and again.

The picture doesn’t look too bright for Litecoin

Trades in Sight

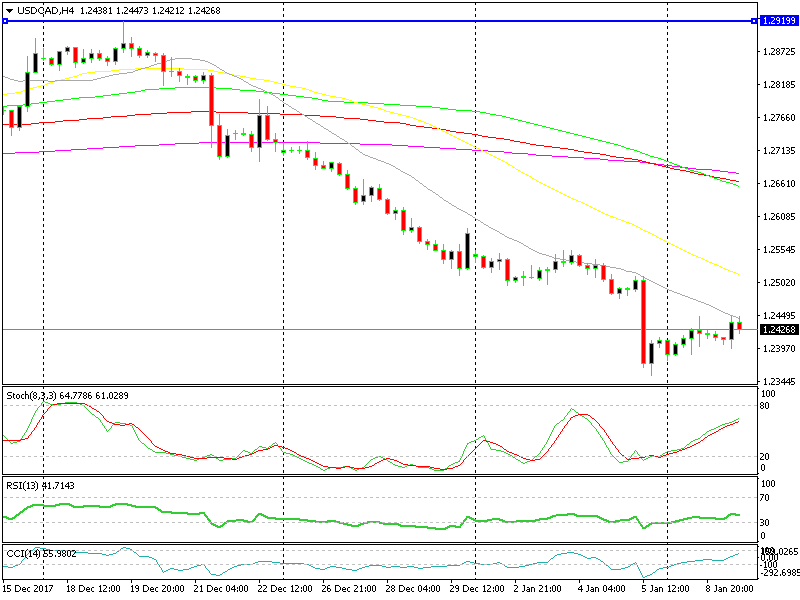

Bullish USD/CAD

- The trend is strongly bearish

- The H1 chart is overbought and heading down

- Two dojis on the H1 chart

- 20 SMA on the H4 chart

The 20 SMA has provided solid support during the downtrend

We opened a sell forex signal earlier on. We sold USD/CAD at 1.2440, which is where the 20 SMA (grey) was providing resistance on the H4 chart. That wasn’t the only bearish signal though; the hourly chart was overbought and it had formed two doji candlesticks at the top. Dojis are reversing signals, so we decided to sell. Now, we are about 20 pips in profit.

In Conclusion

The US Dollar is finally feeling some love which is uncommon nowadays. Forex traders seem uncertain, so they are finding comfort on the USD and the JPY today. The US JOLTS job openings will be released later, although the market sentiment will be the driving force today in my opinion.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account