Deciding on A EUR/USD Forex Signal As It Returns to 1.22 After Breaking 1.23

Yesterday we opened a buy forex signal in EUR/USD when this pair reversed down from below 1.23. It had tried to break the 1.23 level a few times overnight but it failed and returned down.

We bought it at 1.2220s and our signal didn’t last long. The market had another go at the USD and all the majors pushed higher against the Buck. So we left this pair pushing higher last night.

Today I see that the 1.23 level has finally given up. EUR/USD reached s high as 1.2323 during the night but again, it turned back down. Now it is more than 100 pips lower.

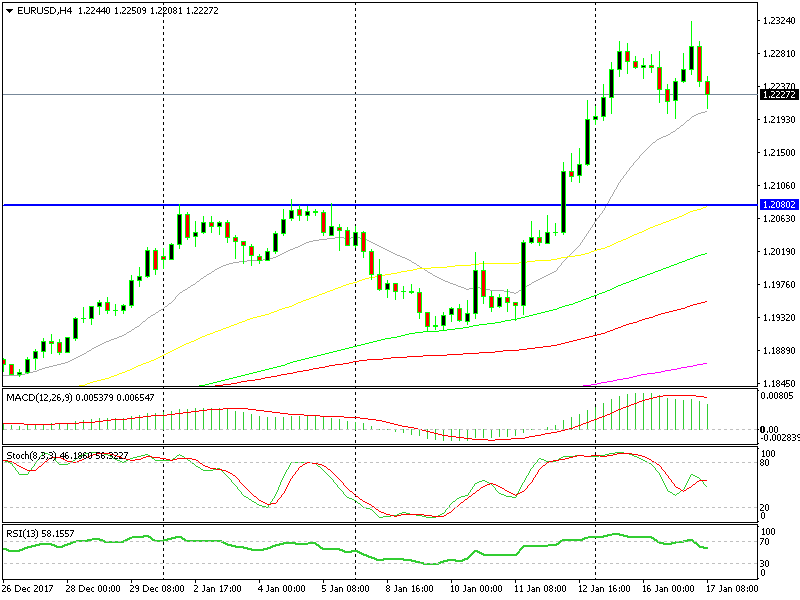

We are back to 1.2220s right now and a moment ago I saw the price at 1.2210. This is a good area to open another buy forex signal. Yesterday we opened our forex signal right here, so why not open another on today? After all, the 20 SMA (grey) has caught up now and it stands at 1.22 lows, so that is another indicator providing additional support down there.

The 20 SMA is now providing support as well at 1.22

Well, the reverse seems a bit scary. Breaking above 1.234 and diving back to 1.22 gives you the feeling that the market is done with the upside after having its candy at 1.23 overnight.

Another reason is fundamental. The Eurozone consumer inflation CPI (consumer price index) is about to be released in an hour. So, the market is expecting that data at the moment. Inflation is not expected to move much from last month, but it is an important release nonetheless.

So, I think I will just wait until the CPI numbers are out before making a decision. I’m only looking to buy down here, since the trend is still up.