EUR/CHF Traders Play with the SNB after Threats of Intervention

The Swiss National Bank chairman Jordan spoke in his home at Davos earlier today and he said hat the SNB is ready to intervene in EUR/CHF.

The Swiss National Bank chairman Jordan spoke in his home at Davos earlier today and he said hat the SNB is ready to intervene in EUR/CHF. I think this is the first time he speaks of intervention after setting the forex market afire exactly three years ago when the SNB removed the 1.20 peg against the Euro.

You remember that time when some forex pairs lost about half their value in a few minutes. That sent some reputable forex brokers in bankruptcy back then.

Anyway, he said that they might intervene again and EUR/CHF popped 60 pips higher. That was pretty great for us sine we had opened a buy forex signal in this pair only minutes ahead. That signal hit take profit in no time.

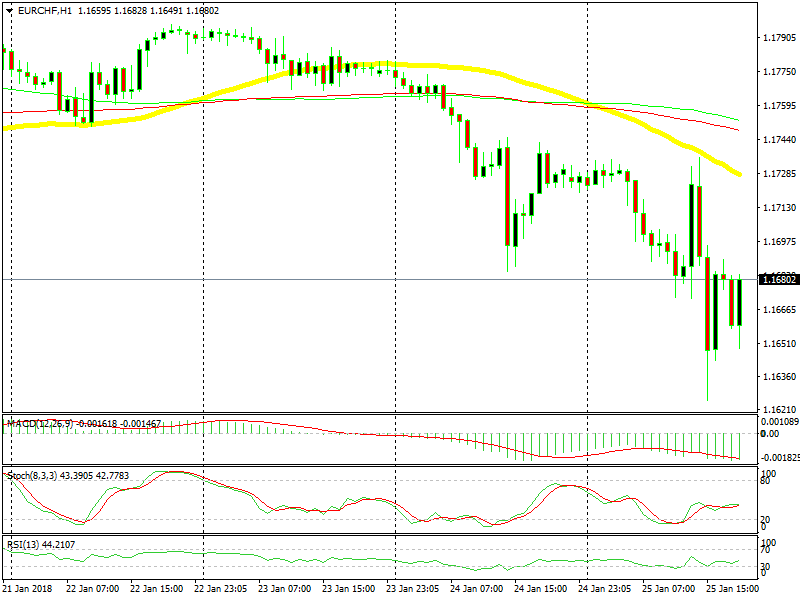

The sellers jumped in just below the 50 SMA

But as you can see from the H1 chart above, the sellers jumped in at the 50 SMA (yellow). That took this forex pair 110 pips lower to 1.1625, from 1.1735. I think that the traders are daring him to intervene and I find that pretty funny.

The SNB kept intervening back in 2014-2015 when the price got close to 1.20 after trading around 1.25-30. This pair jumped higher at first, but the traders kept selling it. So, the SNB gave up and removed the peg at 1.20. that sent CHF pair stumbling around 50 cents lower.

Now the same thing is happening. Jordan is threatening to intervene and send EUR/CHF higher, forex traders are daring him by selling this pair. Who will win? Who knows. But it gets dangerous for us now. We had a nice uptrend where we kept buying dips. Now that uptrend might reverse, although we will take a deeper look at the bigger technical picture first thing tomorrow morning.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account