Feb 2 – US NFP vs. Gold – Here’s What to Expect from the Market Today

This week has been a great success from the trading point of view. FX Leaders team has close some exceptional forex trading signals...

Happy Friday, traders.

This week has been a great success from the trading point of view. FX Leaders team has close some exceptional forex trading signals as the market remained highly volatile this week. If you missed these opportunities, don’t regret, economic events leader is due today. Yup, I’m talking about the Non- farm payroll. Let’s make some more green pips…

Top Economic Events Today

U.S Dollar – USD

The NFP (Non-Farm Employment Change) and Unemployment Rate, both of these economic data sets will be closely monitored at 13:30 (GMT). NFP is expected to be positive at 184K vs 148K in the last month. Considering the ADP figure, which upbeats the forecast with flying numbers, investors will be expected the same behavior from the NFP.

As we know, there’s a moderate positive correlation between ADP employment change and NFP employment change figures. That means, typically, the positive ADP forecast also leads to positive NFP sentiment. On Wednesday, the ADP figure came out as 234K which was exceptionally was better than the forecast of 186K.

So can we expect the same from NFP today?

It appears like the Greenback is less likely to strengthen on the news release (181K forecast) as most of it is already priced in. In fact, the investors are expecting something about 234K figure and disappointment will lead to bearish reversals in the Dollar. Besides that, the Unemployment Rate isn’t expected to change from 4.1%.

Great Britain Pound- GBP

Construction PMI – The data is due at 9:30 (GMT) with a slight change on forecast 52 from 52.2 in the last month. It won’t be hitting the pound so hard unless releases with huge divergence.

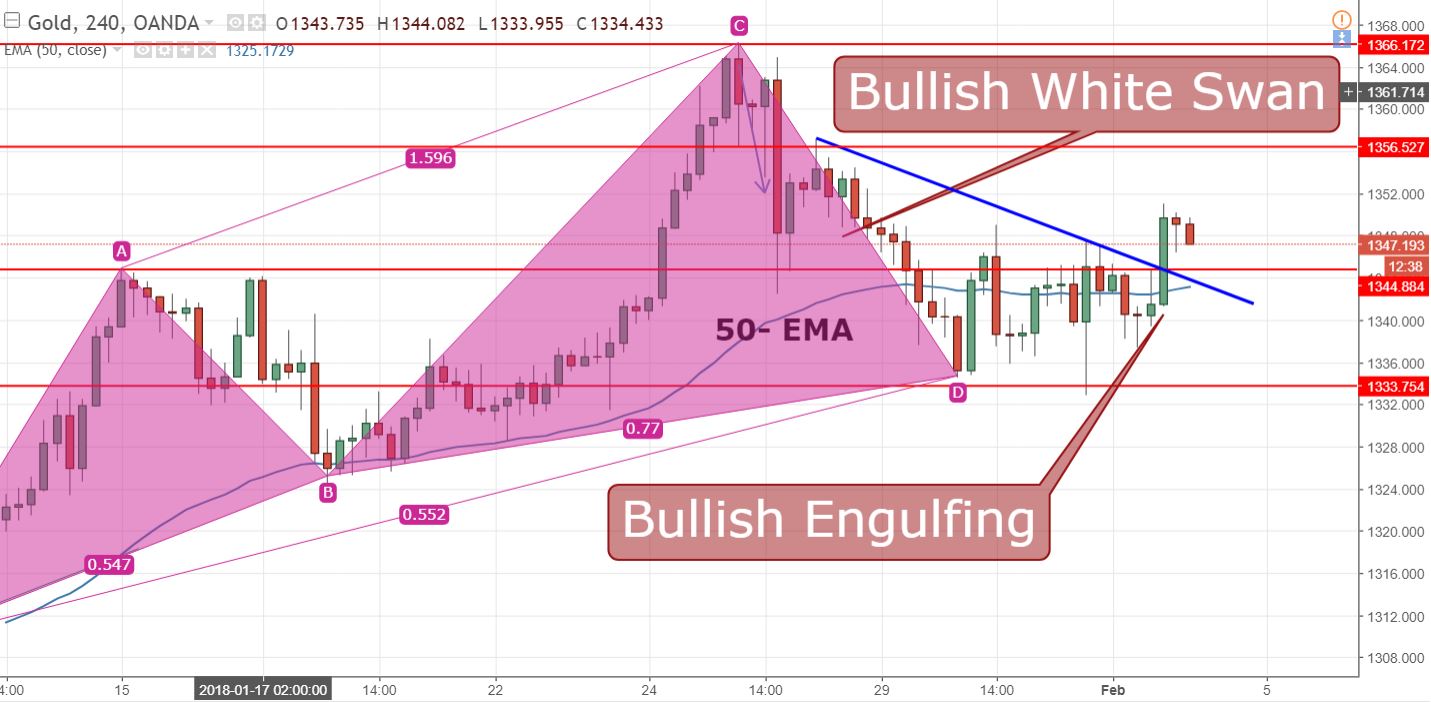

Gold – XAUUSD- Ascending Triangle Breakout

Yesterday, we remained fortunate enough to close our Gold’s sell position manually at $1,338 rather than waiting for $1,337. Gold bounced off this level ($1,337.16) to place a high of $1,350 in the Asian session today.

Now, we are seeing a tug of war between bulls and bears. This Tom and Jerry battle is likely to continue until the release of NFP figures today.

Key Technical Drivers

On the hourly chart, Gold has broken above the ascending triangle pattern at $1,346 to test the trendline resistance of $1,350. At this point, I’m expecting Gold to drop to $1,345 and the survival of this level will be a reason for me to go long.

Gold – 4 – Hour Chart

Gold – XAU/USD – Trading Levels

Support Resistance

1343.16 1357.26

1334.63 1362.83

1329.06 1371.36

Key Trading Level: 1,348.73

Gold// XAUUSD – Trading Idea

Traders, keeping the negative NFP in mind, I’m aiming to trade Gold with the bullish sentiment. Therefore, $1,345 is a key level to stay bullish above it and bearish below it. The bullish targets will be $1,350 and $1,353. Good luck.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account