Forex Signals US Session Brief, February 2 – Is This the End for Cryptocurrencies?

The US Dollar is getting some bids today while cryptocurrencies are under heavy selling pressure. There is no relation between the crypto...

The US Dollar is getting some bids today while cryptocurrencies are under heavy selling pressure. There is no relation between the crypto market and the USD. So, it is just the cryptocurrecies that are losing the ground beneath their feet today. They have broken December lows, so it is getting pretty nasty out there.

Cryptocurrencies were falling apart a minute ago but they are fighting back now

The Bubble Is Bursting but There is Still Life Left in Cryptocurrencies

After declining for several weeks, it seems as the cryptocurrency bubble is bursting. All major cryptocurrencies have lost more than half their value during this period since topping out two days before Christmas.

In fact, at some point today, cryptocurrencies were down about 15% on the day and the day is still young. Bitcoin broke below the December and January lows, reaching $7,934, while Litecoin lost nearly a third of its value just today.

Recent developments have hit the cryptocurrency market pretty hard. Certain governments are trying to regulate the market and some altcoin exchanges have been closed. This week a cryptocurrency called AriseBank has been shut by the SEC. Evander Holyfield was endorsing it apparently, but that doesn’t matter.

Facebook also said earlier this week that it was restricting cryptocurrency adds. Tether has been one of the main altcoins for Bitcoin holders to cash out, since tether is pegged to the USD. But it has struggled to gain access to the main banking system, so that has scared Bitcoin holders.

However, the crypto market is reversing as I speak and it is reversing pretty quickly. Now. cryptocurrencies have paired most of today’s losses. It has become pretty difficult to trade cryptos nowadays; the declines don’t seem to stop while the reverses are pretty violent too. We’re still looking to get long in Litecoin again or perhaps in Ripple.

US Earnings Give Hopes to USD Bulls

The USD remains to trade on a strong downtrend, but today the buyers have something to be positive about. The US Dollar started to fight back this morning and as the day progressed, the USD buyers gained more confidence.

But, the surprise came from the US employment report. The new jobs came 20k above expectations and last month’s number was revised higher as well.

Although, the wages took the spotlight, as it is usually the case. Average hourly earnings came a 0.3% against 0.2% expected, while the previous number was revised higher a decimal point. That’s encouraging, considering that the personal income has been sluggish, while the other sectors of the economy have been performing pretty well.

This is a very positive sign. If next month surprises us again, then the US Dollar should start reversing this strong downtrend. There’s still plenty of time until then and politics remain in the way of the USD reversal. But, the US official might relax their dovish rhetoric if the data keeps coming like today.

Trades in Sight

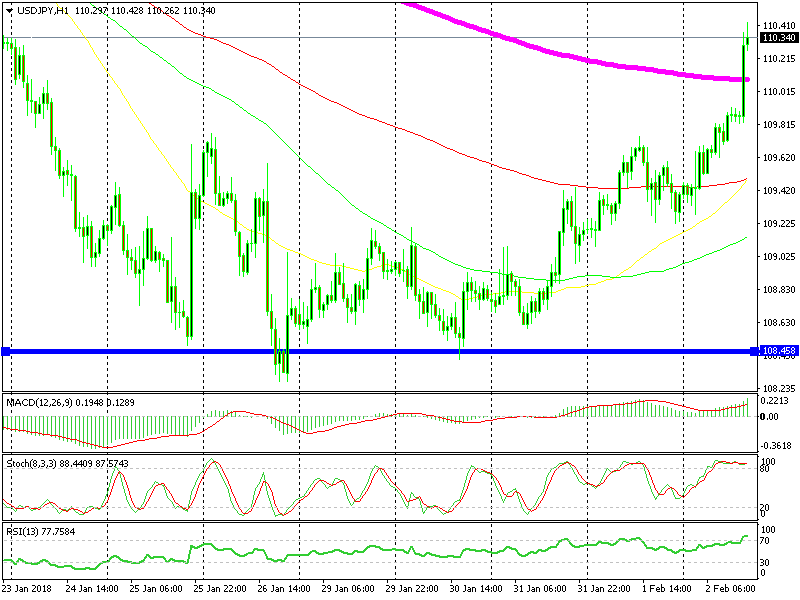

Bullish USD/JPY

- The downtrend has ended

- The reverse is underway and it has picked up pace

I’m waiting on a retrace to any of the moving averages below

The downtrend finally ended for USD/JPY and the reverse is underway. Today this forex pair is more than 100 pips higher from opening levels and 200 pips higher from the lows. Although, I will wait for a retrace lower to the 200 SMA (purple) before going in. The risk/reward ratio will be much better.

In Conclusion

The volatility has just picked up in forex after the US employment report came out stronger than expectations. The volatility in the crypto market remains extremely elevated since they have lost and then gained a large part of their value. So, be careful out there guys.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account