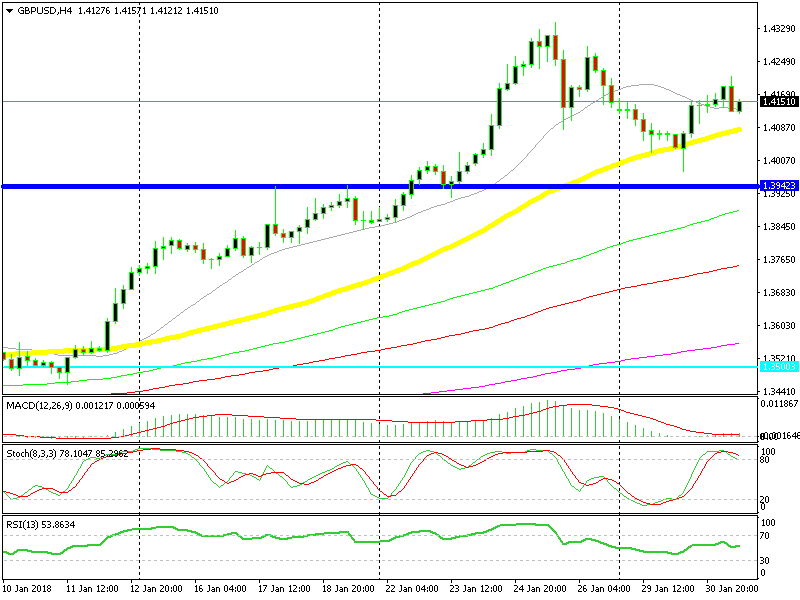

UK Manufacturing PMI Might reverse GBP/USD Lower

GBP/USD has been quite resilient recently, as comments on a possible soft Brexit have encouraged GBP buyers. The main push, however.

GBP/USD has been quite resilient recently, as comments on a possible soft Brexit have encouraged GBP buyers.

The main push, however, has come from USD sellers.

This morning, we are seeing yet another push higher, and it seems that both groups of Forex traders are in control. USD sellers are doing their thing, as the Buck is losing ground against the board (with the exception of the JPY, as this pair has climbed approximately 100 pips overnight.)

GBP buyers are looking active, as the GBP is making the most of the latest USD selloff, as GBP/USD finds itself 100 pips higher.

If this hourly candlestick closes as a pin, then it would be a bearish reversing signal

The UK manufacturing report published recently, although, we haven’t seen the economic figures impact the GBP so heavily. Last month, this report lost two PMI points, falling from approximately 58 to 56 PMI.

Today, this report lost yet another point, as it fell to 55.3 from 56.3. GBP/USD has just given back 25 pips. The 50 SMA (yellow) on the H1 chart has provided solid support this morning, so it will be a good opportunity to buy this Forex pair.

We have to slip lower in order to get there, and currently, it doesn’t look like the USD bulls want to get in the game. That’s the spot I have my eye on, and another update on this pair will be posted if the price moves below 1.42.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account