USD/JPY Continues the Bearish Trend, but Now Approaching That Indicator Again

USD/JPY continues to trade on this bearish trend that it started at the beginning of this year. It has been a straightforward trade with...

The Bearish Trend

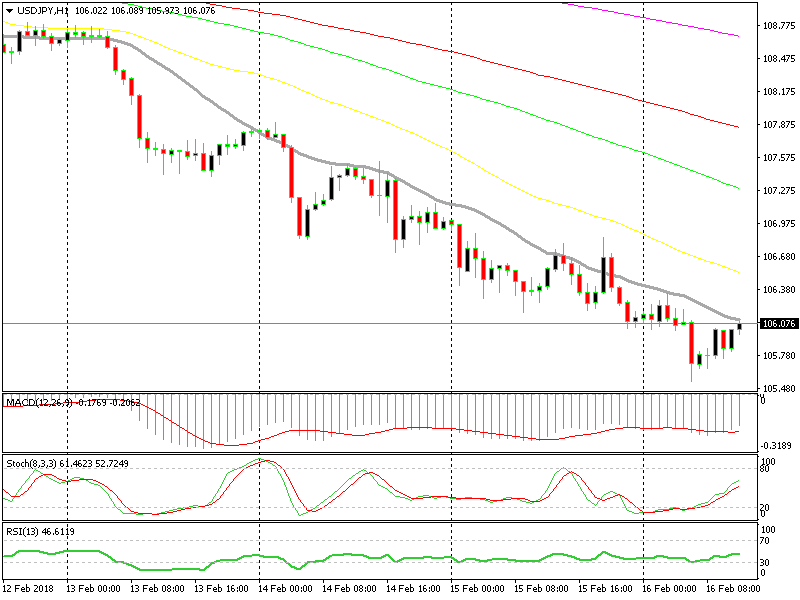

USD/JPY continues to trade on this bearish trend that it started at the beginning of this year. It has been a straightforward trade with only a couple of minor bounces from the 100 and 108 support levels. Those levels didn’t hold for too long though, so down we went.

I had some hope for the 107.30 level, but the selling pressure is enormous in this forex pair at the moment. The market is buying the JPY because it can’t buy any other currency and it is selling the Dollar for whatever reason. So, it has been a double whammy for this pair recently, hence the strong downtrend.

The 20 SMA has been a strong resistance indicator

Last night, the downside stretched further. The sellers broke below the 106 level and reached 105.50s. That is a big support area which stretches all the way to 105, but we will talk on the US session brief about it.

The 20 Moving Average

The price bounced off that support area and now it is heading towards the technical indicator which we have used to open sell signals. This indicator is the 20 SMA (grey). It has provided resistance throughout this week and we have used it one or two times from what I can recall.

Now, we are approaching this moving average again on this retrace up. The stochastic indicator is getting close to overbought levels, so the retrace is coming to an end.

Although, we are pretty close to this moving average and I see that the price has spiked above it occasionally. This might be another one of those cases, so I’m following the price action to see if USD/JPY might spike above the 20 SMA and probably reach the 50 SMA (yellow). Anyway, we are getting ready to sell this pair at any of these moving averages.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account