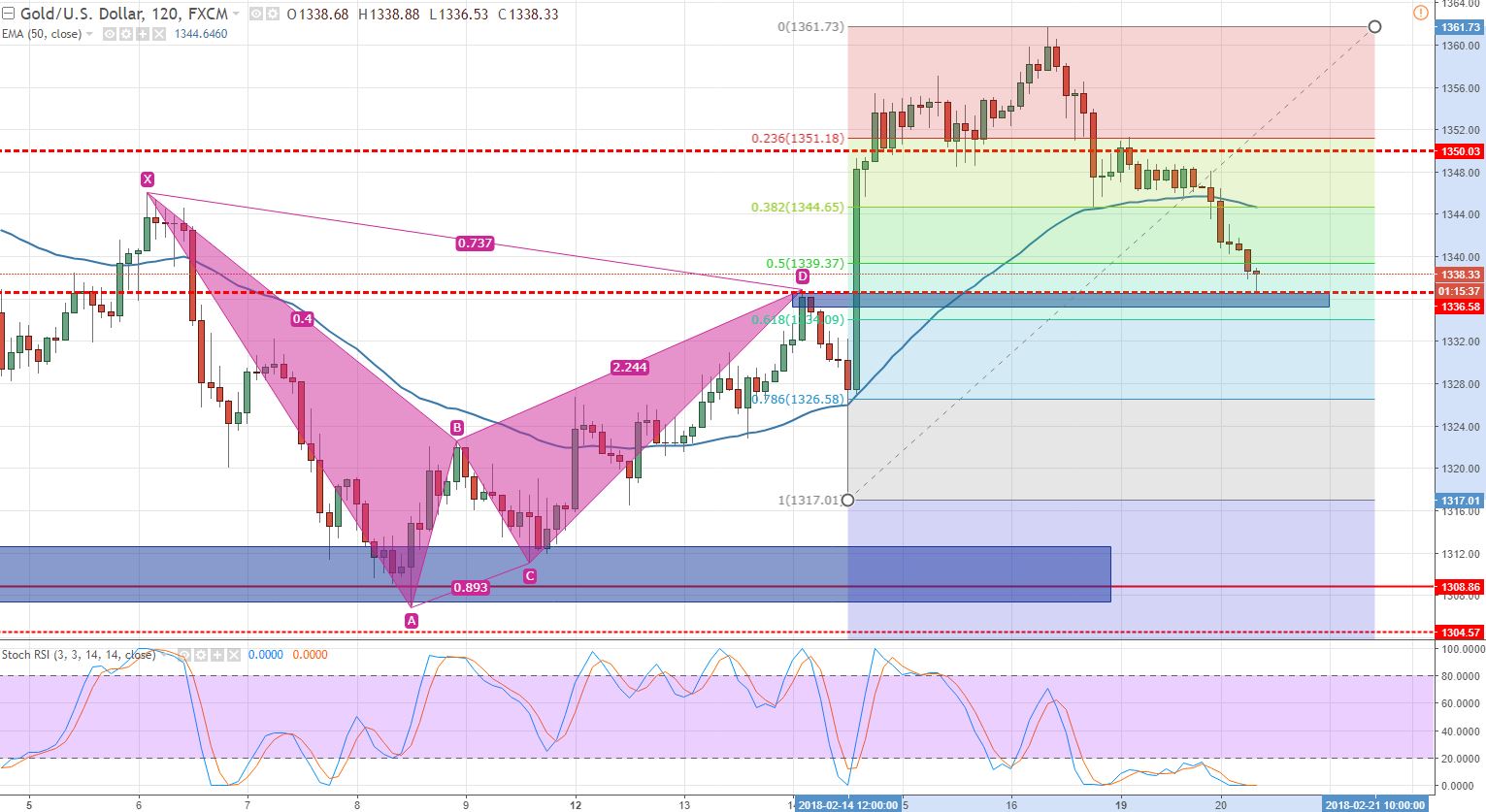

61.8% Retracement In Gold – Potential Buying Opportunity Ahead

Our previous forecast on Gold played really nicely. Gold sellers are still dominating the market as the Chinese markets remain closed due to Spring Festival. Investors also await the FOMC meeting minutes tomorrow and it seems like the Gold is dropping in the wake of hawkish minutes, but it can reverse soon on the release of events. I’m getting ready to take a buying position, are you up for it?

Gold/ XAUUSD – Technical Outlook

Technically, the Gold was trading in the overbought zone and it was supposed retrace back. Therefore, I just applied the Fibonacci indicator on the daily chart. You can see, the yellow metal has already completed 50% retracement at $1,340.

Gold – 120 – Min Chart

Despite the oversold market, the Gold is still keeping up the bearish momentum. It looks like the investors won’t stop selling until the market completes 61.8% retracement at $1,334. I’m sitting tight to trigger my buying at that particular level but after confirmation of certain technical indicators.

Gold / XAUUSD – Trade Idea

Traders, the Gold is heading south sharply, but the bulls seem to loom near $1,334. So, the idea is to stay bullish only above $1,334 with a stop below $1,331 and a take profit of $1,340. Good luck!