We Turn Bearish on NZD/USD As It Turns Bearish on Itself

NZD/USD has been on a strong bullish trend during December last year and January this year as the USD was being heavily dumped during this..

NZD/USD has been on a strong bullish trend during December last year and January this year as the USD was being heavily dumped during this time. In February, the things got a bit difficult for buyers, so it hasn’t been so straightforward.

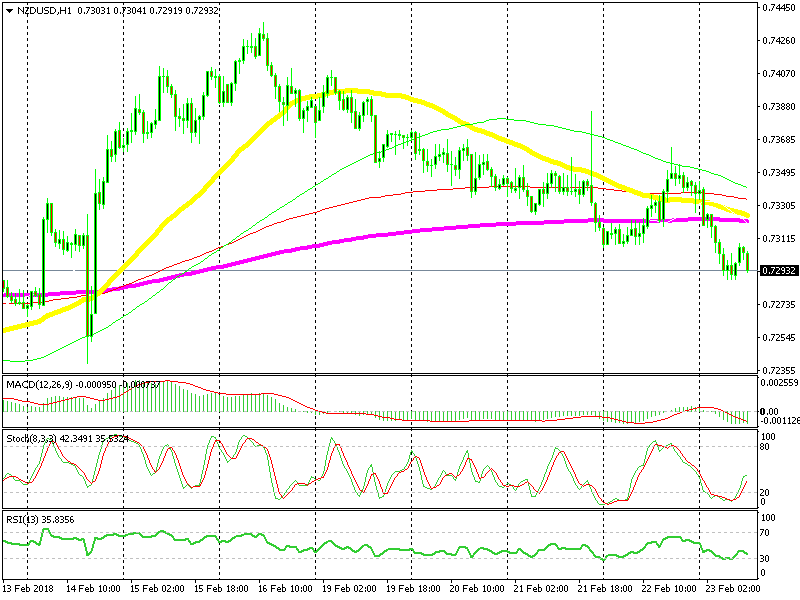

During this week, this forex pair has been slipping lower. Although there have been a couple of spikes higher as you can see from the hourly chart below.

These spikes have been met by sellers and eventually, this pair continued further below. So, the price action has been bearish all week, but now as bearish as the other commodity currencies.

The bearish trend picked up pace last night

If you see the AUD/USD chart or the USD/CAD chart, you can see that these commodity Dollars were about 200-300 pips lower until last night. So, the Kiwi was holding up pretty well considering the other commodity Dollars.

But last night, NZD/USD took a deep dive after midnight. I was still awake, so I checked the calendar to see if anything was up. But there was nothing on the forex calendar. So, it was just some normal selling.

Now, the Kiwi has turned as bearish as the Aussie or the Loonie. In fact, today it looks even more bearish than the other two peers. Therefore, I’m looking to open a sell forex signal in this pair.

The best thing is to wait for a retrace to the 50 (yellow) and 200 (purple) MAs. If they provide resistance, then I will be persuaded to go short. Seems like a good trading idea, but we should wait for that retrace first.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account