Forex Signals US Session Brief March 2 – USD Down, Safe Havens Up on Trump’s Trade War Tweets

Donald Trump just doesn’t want to let the US Dollar get itself back on its feet, does he? Just when the Dollar was starting to gain some...

Donald Trump just doesn’t want to let the US Dollar get itself back on its feet, does he? Just when the Dollar was starting to gain some strength, he goes and declares another trade war. So, tariffs and a weak Dollar, two birds with one stone again. The GBP, on the other hand, is also lagging as we await Prime Minister May to present the Brexit draft.

Ok, that’s enough! Now give me all your money World.

Trump Loves Trade Wars, the Dollar Hates Them

Donald Trump tweeted yesterday that the US would impose tariffs on steel and aluminum imports. That came after Powell’s testimony earlier which didn’t sound as hawkish as the market was expecting. So, the Dollar received a double whammy and it has been on a slippery slope since yesterday.

Today, Donald Trump tweeted again on the topic. Here is the comment:

“When a country (USA) is losing many billions of dollars on trade with virtually every country it does business with, trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!”

Sounds to me like a teenager in a power trip. A large part of western societies (US & UK) look and sound increasingly like a bunch of teenagers lately but that’s another story.

So, the Buck started falling yesterday and it is continuing to slip lower. EUR/USD has climbed above 1.23 again, so the bearish trend of the last two weeks has ended and it looks like this pair wants to resume the year-long bullish trend.

The rest of the world jumped off their chairs after Trump’s tweets. French, German, Canadian, Chinese etc officials have threatened to fight back, so it is getting real ugly out there. Of course it is weighing on the USD now, but in the long term it might turn out positive for the Buck. Tariffs mean higher import prices and eventually higher consumer prices, thus higher inflation.

Safe Havens Are the Winners

Always when there is trouble in the world, the money flows into safe haven assets, hence their name. So, Gold has seen some strong bids since yesterday. Much like EUR/USD, Gold has been trading on a downtrend in the last two weeks. But the reversal in the last 24 hours might shift the trend to the upside. So, Gold traders be careful because that downtrend might be over.

Safe haven currencies are also among the strongest beneficiaries of market uncertainty, so the CHF and the JPY have been receiving some strong bids during this time. That reversed EUR/CHF which went pretty well for our sell forex signal in this pair.

USD/JPY has also been declining pretty fast and it just broke the lows from two weeks ago. So, we’re finally below the big support level at 105.50. This looks pretty bearish for USD/JPY.

Although, the support zone stretches until 105, so the bulls still have some hope. This looks like a great place to go long from, to be honest. The risk/reward ratio is great, but the situation has suddenly become toxic. The financial markets are in fear and fear is great for safe havens. So, we’re not going long on this pair just yet. The fear is acceptable and tradable, but the panic which might set in at any time will mess the markets and the charts.

Trades in Sight

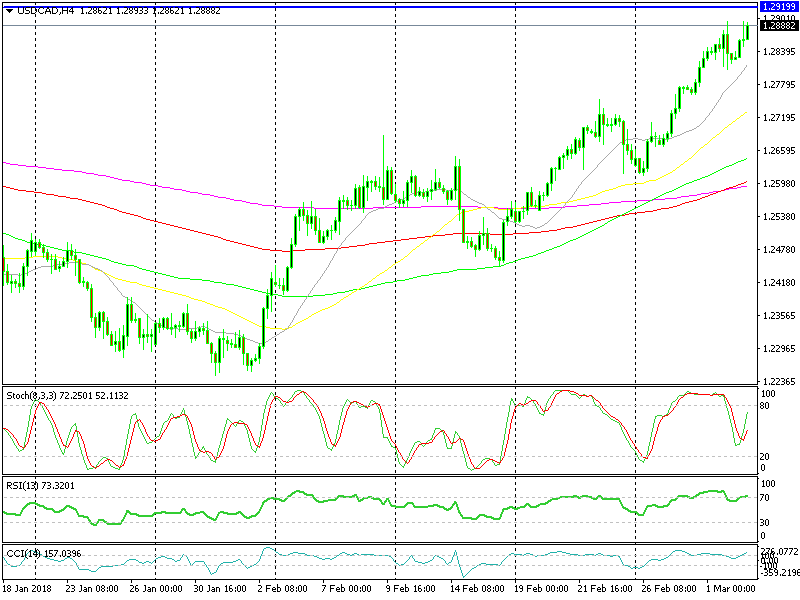

Bullish USD/CAD

- The trend is bullish

- Tariffs on steel and aluminum imports

The 20 SMA (grey) is the first place I would look to buy

USD/CAD has been on a bullish trend since the beginning of February and the trend has become stronger. The Canadian GDP report that was just published showed a decline, from 0.4% last month to just 0.1% this month, so that is weighing on the CAD as well. But the main concern for CAD traders are the tariffs that the US will (will it?) impose on Canadian exports. So, all dips are great buying opportunities in this pair at the moment.

In Conclusion

Many things going on right now in the forex market. Theresa May is holding a speech about what the UK intends the Brexit process will go, so the GBP and the Euro are taking notice. The trade war is coming and the volatility has increased considerably. Today is a tough day to trade.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account