A Quick Reversal for EUR/USD. This Is A Bearish Sign

EUR/USD has been trying to turn bearish in the last month or so. It failed to break the 1.25 level even though it pierced it a couple...

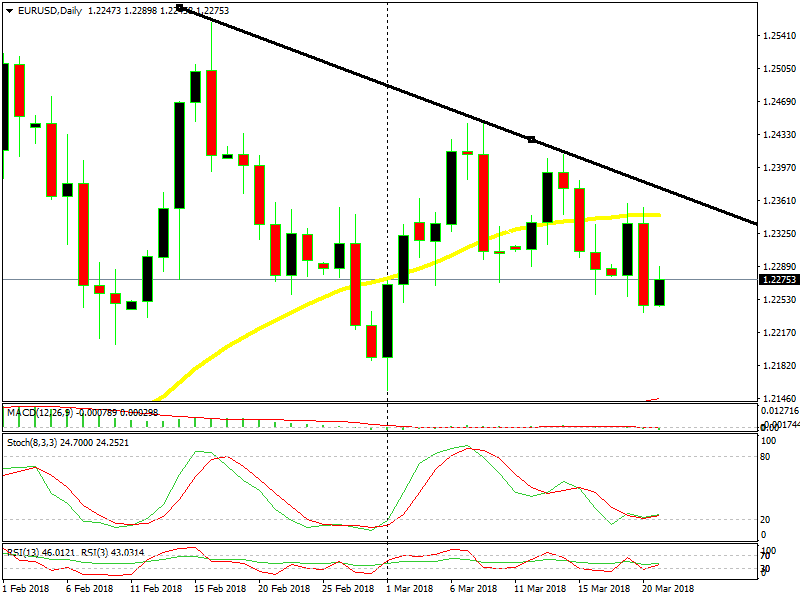

EUR/USD has been trying to turn bearish in the last month or so. It failed to break the 1.25 level even though it pierced it a couple of times. The buyers gave up in trying to push the upside further above 1.25, so the sellers have been gaining confidence.

Since then, this pair has been getting bearish. The highs have been getting lower and every attempt from the buyers to reverse the trend back to bullish, has been met by sellers. Every jump has been getting smaller, so the pressure has shifted to the downside.

One such occasion happened this week. EUR/USD surged around 100 pips higher on Monday as the EU and the UK agreed on most of issues on the Brexit draft. I thought that the uptrend would continue a little higher, probably to 1.2450 or 1.25. But, the price reversed pretty quickly.

The 50 SMA has turned into resistance now

In fact, the buyers couldn’t even push above the 50 SMA (yellow). They pierced it a couple of times, but eventually the sellers won the battle and the price reversed. The descending trend line was out of question, so the downtrend is forming. That is a bearish sign.

Although, the biggest bearish sign is the daily candlestick. It closed below the low of the previous candlestick, so it engulfed it completely. The bearish engulfing signal is a very bearish sign, so it seems the downside is gaining pace. The FED is expected to hike the interest rates today so I expect some more upside for the Buck and some more downside for EUR/USD. Our long term sell forex signal is well in profit now, but we will let it run some more. Hopefully, the FED will give us some more pips this evening.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account