Forex Signals US Session Brief March 22 – Everyone Hates the USD, the FED Too

Time and time again in the last 15 months we have seen the USD try to get its head up, only to be slapped down by whoever's turn it is...

Time and time again in the last 15 months we have seen the USD try to get its head up, only to be slapped down by whoever’s turn it is to do so. The Fed has been on the Dollar’s side during this time, but yesterday they turned against it, or at least that’s what the market thought. The US Dollar took another tough beating yesterday despite the Fed increasing interest rates by 25 basis points (bps).

Powell didn’t sound as hawkish as the market was expecting. Well, Trump is watching him.

The Fed Hikes, the Dollar Falls

When a central bank hikes interest rates, the related currency turns bullish. We know that rate hikes are usually priced in by the market so the element of surprise is minimized. But there should be a decent spike on the currency. At least that’s what we have seen for decades in forex.

But the situation has become unbearable for USD traders in the last 15 months. The Fed has hiked interest rates several times during this period, more than any major central bank. In fact, most of the major central banks continue the monetary easing programme, such as the European Central Bank and the Bank of Japan.

The Fed increased interest rates again yesterday, yet the USD turned bearish. The main reason for this bearish turnaround is the Fed dot plot. The dot plot shows the rate hike projections by the Fed for the near future. The market likes this indicator since it is a leading one.

The dot plot showed earlier this year that the Fed was projecting four rate hikes in 2018, while after yesterday’s meeting, the dot plot showed just three rate hikes, including yesterday’s one. That’s when the market turned away from the US Dollar.

Powell sounded less dovish than the market was expecting at his first press conference as the new Fed Chairman. He said that “the Fed is trying to take the middle way on raising interest rates” which didn’t sound too appealing to forex traders, hence the tumble in the USD. Today, the Buck is trying to fight its way back up, but the safe haven currencies remain in charge.

Cryptocurrencies Forming A Bearish Reversal Pattern

As we mentioned yesterday, cryptocurrencies have been trading on a small uptrend in the last several days. They turned bullish after forming a bullish reversal pattern on Sunday. Major cryptos formed a pin or a hammer on the daily charts and subsequently reversed higher in the coming days.

Yesterday though, price formed the opposite of what we saw on Sunday. Major cryptos formed a doji yesterday which is a reversing signal. But the bullish pattern is not complete with only one indicator; in this case the candlestick.

There should be additional indicators to form a bearish reversal pattern. These indicators are the moving average and the stochastic indicator. Bitcoin is having trouble below the 100 SMA (red) which means that this moving average is providing resistance to Bitcoin.

Besides that, the stochastic indicator has reached the overbought area and it is now reversing down. Lest we forget, the trend has been bearish since the start of the year, so the pressure is on the downside. That’s the story in most major cryptocurrencies. They formed a bearish reversal pattern yesterday and today they have started sliding lower already. Bitcoin is around $500 lower from the highs, so the bearish trend has resumed.

How many bearish signals can you spot here?

Trades in Sight

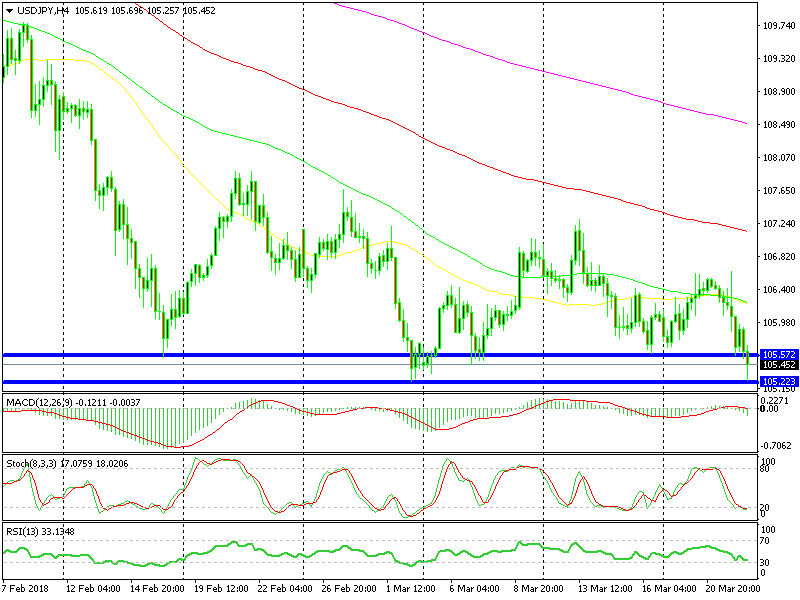

Long USD/JPY

- The major support at 105.50

- Additional support at 105.20s

The support levels are holding

These are the reasons that we went long on this forex pair today. The trend is bearish but price has bounced many times off the 105.50 level. It bounced off this level again this morning which why we decided to go long when price returned there. There was a quick spike lower just now, but the 105.20 level held its ground and now USD/JPY is slowly climbing back up.

In Conclusion

The Dollar had a terrible time again after the Fed rate announcement when it was supposed to be the opposite. The Fed hiked interest rates but the USD lost the ground beneath its feet. Although, it is fighting back today. So the picture is quite mixed. It’s difficult to trade right now; so be careful out there.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account