Trying the Big Level on USD/JPY

USD/JPY has been trading on a downtrend for quite some time. The bears have been in control during the last three months, sending this...

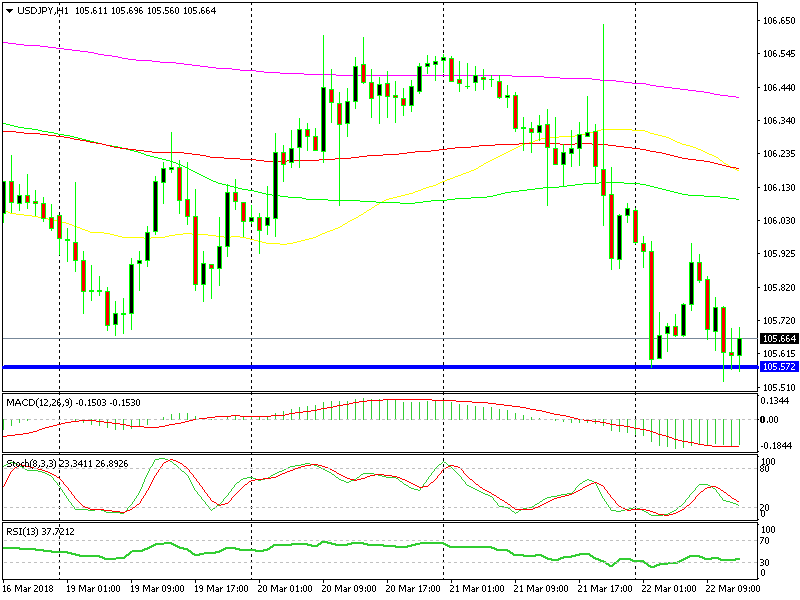

USD/JPY has been trading on a downtrend for quite some time. The bears have been in control during the last three months, sending this forex pair 500 pips lower. But, there is this major level which is not letting the downtrend progress further.

The sellers are aware of it since they are packing their bags when the price gets close to it. The buyers are aware of it as well, because we have seen them become active around this level. This level is the area around 105.50 that we have highlighted so many times recently.

The 105.50 level has been a major support and resistance area for more than a year and it is playing that role again now. It has been pierced once about three weeks ago, but the price reversed back up at 105.20s, so the support area remains intact.

The 105.50 level is providing support again

USD/JPY moved above 106 this week, but the price returned back down after the FED rate hike last evening. Again, the sellers are having trouble pushing below the 105.50 level. The sellers gave up in the first attempt last night and this pair tried to break above 106 again.

But they returned this morning and now they are attempting to break below 105.50 again. Although, it looks like they are failing once more. The price is returning back up, the stochastic indicator is oversold and the previous H1 candlestick closed as a doji. All these are reversing signals, so we decided to open a buy forex signal. Now, USD/JPY is reversing higher, so we will probably get our pips soon.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account