UK Inflation Dives, Together with GBP

The UK inflation report was released earlier today. This is the consumer inflation report CPI (consumer price index) which is important.

The UK inflation report was released earlier today. This is the consumer inflation report CPI (consumer price index) which is more important that the producer inflation (PPI), but no one was expecting fireworks today.

Inflation has been surging for the past year in Britain. The target from the BOE (Bank of England) is at 2% but CPI has been around 3% form more than a year. So, no one expected a sudden dive in consumer prices this time, but it happened.

The main inflation number fell to 2.5%, while the core inflation number fell to 2.3% against 2.5% expected. The monthly number came lower as well as you’d expect and it posted a 0.1% decline. From this report we see that inflation is cooling off in the UK.

Inflation was the reason why the BOE was thinking about hiking the interest rates. But now we se tht inflation is cooling off, right when the BOE is about to hike the rates. The market was pricing in a May rate hike, but now nothing is so certain.

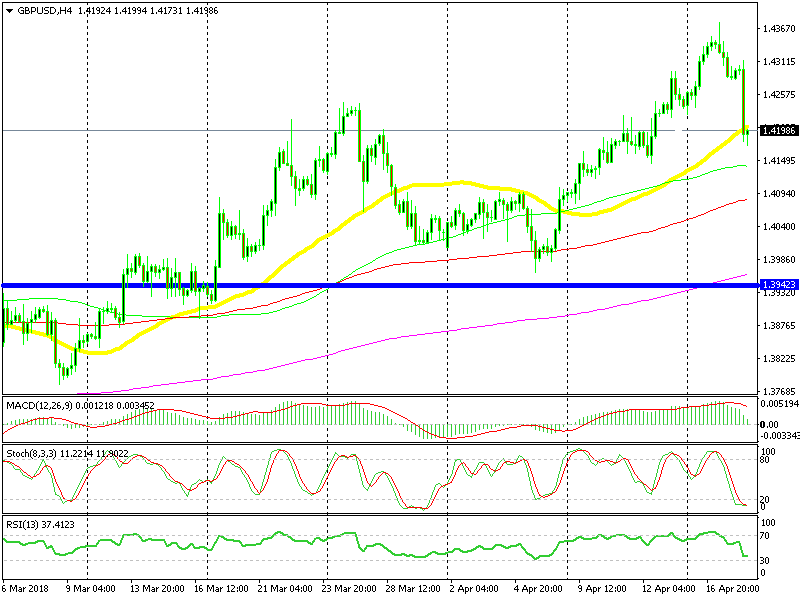

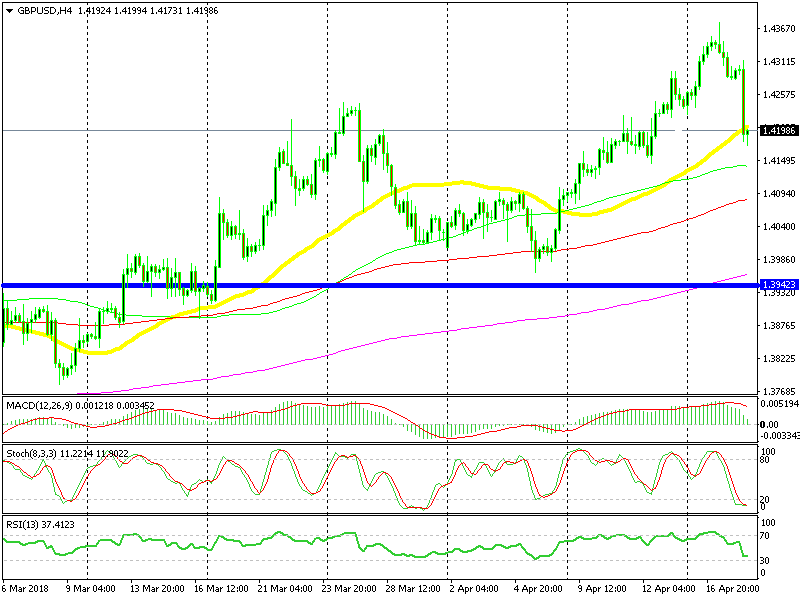

We are below the 50 SMA now, which means that the trend might be changing

GBP has dived hard as a result. GBP/USD has lost around 140 pips and it is now nearly 200 pips lower from the highs. The buy forex signal that we opened yesterday in this pair has been smoked by this major move.

Although, this move opened up another opportunity for a trade in EUR/GBP which we will explain in the next update. So, rallying for weeks on hopes of a soft Brexit, then diving hard on inflation. That’s how the forex market is behaving nowadays, especially GBP pairs; that’s why I say that we must be extremely careful.

Inflation has been surging for the past year in Britain. The target from the BOE (Bank of England) is at 2% but CPI has been around 3% form more than a year. So, no one expected a sudden dive in consumer prices this time, but it happened.

The main inflation number fell to 2.5%, while the core inflation number fell to 2.3% against 2.5% expected. The monthly number came lower as well as you’d expect and it posted a 0.1% decline. From this report we see that inflation is cooling off in the UK.

Inflation was the reason why the BOE was thinking about hiking the interest rates. But now we se tht inflation is cooling off, right when the BOE is about to hike the rates. The market was pricing in a May rate hike, but now nothing is so certain.

We are below the 50 SMA now, which means that the trend might be changing

GBP has dived hard as a result. GBP/USD has lost around 140 pips and it is now nearly 200 pips lower from the highs. The buy forex signal that we opened yesterday in this pair has been smoked by this major move.

Although, this move opened up another opportunity for a trade in EUR/GBP which we will explain in the next update. So, rallying for weeks on hopes of a soft Brexit, then diving hard on inflation. That’s how the forex market is behaving nowadays, especially GBP pairs; that’s why I say that we must be extremely careful.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account