EUR/JPY Regains 130.850 Region – Risk on Sentiment In Play

The safe haven currency Japanese yen is facing a headwind as trade war tensions between the U.S. and China were put on hold. Since we ...

The safe haven currency Japanese yen is facing a headwind as trade war tensions between the U.S. and China were put on hold. Since we don’t have much to see on the economic calendar, it will be nice to trade the technical setup on EUR/JPY. Are you up for it?

Risk on Sentiment

The remarks from the U.S. Treasury Secretary Steven Mnuchin has reduced the uncertainty over the trade war. As a result, the investors have started moving their investments from the safe haven assets to the risky investments such as the stock market. The Japanese yen carries a status of safe haven currency which is why we are seeing a sell-off in it.

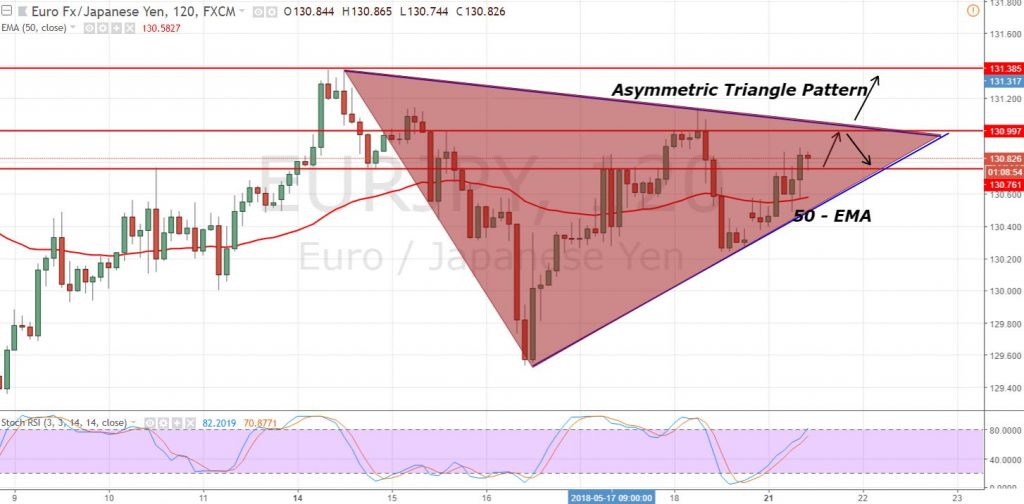

EUR/JPY – Asymmetric Triangle Pattern

Technically speaking, the EUR/JPY is consolidating in an asymmetric triangle pattern which is supporting the pair near 130.560 along with a resistance at 130.850. As per 50- period EMA, the EUR/JPY is trading a bullish trend and that’s why we should be looking for bullish trades. Moreover, the RSI is also holding above 50, supporting the bullish bias of investors.

Support Resistance

130.06 131

129.67 131.55

129.12 131.94

Key Trading Level: 130.61

EUR/JPY – Trading Plan

Fellows, I’m looking to share a forex trading signal to go long on EUR/JPY above 130.600 with a stop below 130.350 and take profit of 131.150. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account