Forex Signals US Session Brief, May 28 – US and UK Are Off, But Politics Keep the Markets Moving

The market sentiment is driving the market today since the economic calendar is empty. The sentiment is really dovish

UK and the US markets are closed today for the last spring weekend. But, the Italians are keeping us entertained with their politics and the markets are moving. Donald Trump was a factor again in the forex markets today as his tweets implied that the meeting with North Korea is actually happening. The economic calendar is empty today, so let’s have a look at other market factors today.

The European Session

- Market Sentiment Improves After Trump’s Tweets – Donald Trump tweeted yesterday that “the US team has arrived in North Korea to prepare the ground for the summit between the two leaders”. This improved turned the sentiment positive in forex in the morning. The USD made a pullback lower in the first hours of the Tokyo session but is back on its feet now.

- The New Italian Government Failed to Form – The proposed candidate for the post of the Italian Prime Minister Conte resigned today. The two parties that proposed him, Legga Nord and Cinque Stelle had/have some dangerous plans which might bring another major headache for the EU. So, the market feared the coalition, that’s one of the reasons the sentiment has been really bearish for the Euro. When Conte resigned, the sentiment improved, hence the gap higher in EUR/USD this morning and the climb that followed this morning.

- New PM Candidacy – A new name has emerged shortly after Conte’s departure after the US President refused a member of his cabinet. The new guy is Cottarelli. The name might sound as a type of cheese but he is a technocrat which used to work at the IMF. The markets haven’t taken this very well and EUR/USD has dived more than 100 pips since topping out at the 100 SM on the hourly chart.

- New Elections in Horizon, Italian Stocks Dive, Yields Surge – The new PM candidate is a technocrat so he is not liked very much by the political scene in Italy. We heard voices advocating for new elections in September, which would probably strengthen the positions for the two main parties who are seen as populists by the EU and the financial markets, who would bring more trouble. As a result, the 10year Italian yields are surging and they have climbed above 2.60 points while the Italian stock market FTSE MIB is in freefall.

- Brexit and Anti-Brexit comments – Boris Johnson published an article this morning saying that the UK must leave the Customs Union with the EU. A couple of hours later, the Scottish PM said in Brussels that Scotland wants to stay in the Customs Union and the single market. Scotland has plans to have another independence referendum and if the UK Government goes with hard Brexit, the referendum will come and Scotland might claim independence.

The US Session

- Risk Currencies on the Decline – Risk currencies are such as the commodity Dollars are on the slide today. AUD/USD has lost around 30 pips but the 100 SMA is holding its ground on the H1 chart, so we might actually see a bullish move in the afternoon.

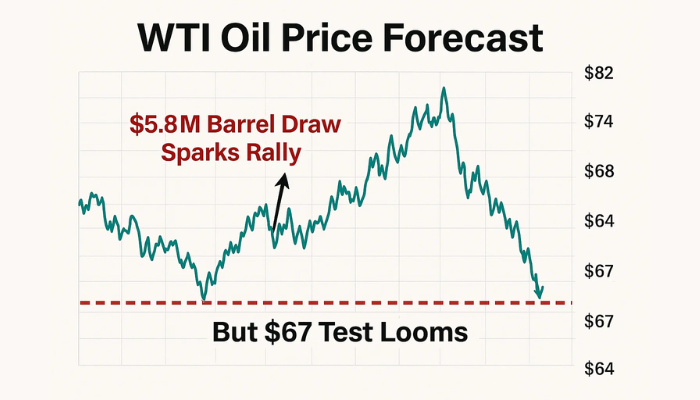

- Oil Prices Are Tumbling – Crude Oil continues to slide lower today. OPEC wants to increase the Oil output while the market sentiment has deteriorated. Both of these factors are weighing on Oil, which has slipped below $66 today.

- Safe Haven Currencies Remain Bid – EUR/CHF and USD/JPY opened with a gap higher last night as the sentiment improved somewhat. But, the sentiment has turned sour again in financial markets and these two safe havens are finding some strong bids again.

Trades in Sight

Bearish WTI Crude Oil

- The trend turned strongly bearish on Friday

- The bearish trend has extended further today

- The bounces seems over

- Technicals are pointing down

We opened a sell forex signal in WTI Crude Oil earlier today which just closed in profit. Although, I still see some more downside potential. The pullback up looked complete when we sold Oil since the stochastic indicator reached overbought levels. The 20 SMA was also providing resistance. The price has turned back down now and we just booked profit on that Oil signal.

In Conclusion

As we said above, there is no economic data in the calendar today until late in the evening. So, the sentiment will run the financial markets today and the sentiment is not positive. Oil prices still look very bearish and we might try to open another sell signal here, so hang around guys.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account