Forex Signals US Session Brief, May 31 – Finally Some Inflation in Europe

Low inflation has been a headache in Europe for a long time. Today though, we saw some really decent inflation numbers form the continent.

Today’s market saw some improvement. Yesterday, we saw a decent pullback after the major bearish moves in the beginning of the week. That was a sign that the panic was wearing off. The political situation remains the same in Italy but the markets seem a bit tired of trading Italian politics. Today, risk currencies have recovered some more ground while safe havens are getting sold off.

EUR/USD was trading at 1.1720s earlier on, which is more than 200 pips up from the lows on Tuesday. Inflation was a huge factor which helped the Euro and market sentiment in general. Inflation has been a headache for the European Central Bank lately but today we saw some really decent inflation numbers all over Europe. With the promising inflation numbers, hopefully, wages will start going up as well.

The European Session

- Swiss GDP & Retail Sales – The Swiss Q/Q GDP beat expectations this morning when it came at 0.6% as opposed to 0.5%. This is the second quarter which comes at 0.6%, twice what we saw last year. It seems like a trend is forming here and it is good. Retail sales jumped by 2.2%, which is another great number. Last month’s number was revised higher too. Well done Swissies.

- French & Italian Inflation – French and Italian CPI inflation came in at 0.4% today. That’s quite a jump from the 0.1% that we have seen in previous months. It is also a good increase for a single month. Although, it is just one month. Inflation should remain at these levels for several months to be considered a trend.

- Italian Unemployment Rate – Last month, the unemployment rate in Italy was at 11% and it was expected to decline to 10.9% this month. Instead, it increased to 11.2%. Inflation might be going in the right direction, but the economy is not doing that well. Take notice Italian politicians.

- Eurozone Inflation – Eurozone inflation jumped from 1.2% to 1.9% this month. It beat expectations and at this level, the ECB should be really pleased. The ECB target is at 2%, so we’re getting close. Core inflation also beat expectations, jumping to 1.2% from 0.7% previously.

- UK Money Supply – The money supply increased in the UK. M4 money supply represents the domestic currency in circulation and bank deposits. It increased by 0.2% while net lending to individuals came at 5.7 billion, up from 4.2 billion last month. You can increase the cash in the economy, but when fundamentals are not right, the economy still suffers. That’s what’s happening in the UK now and it is all because of Brexit.

The US Session

- Canadian GDP – The Canadian GDP report is due shortly. Expectations are not great and after the soft numbers we saw yesterday, it will be interesting to see today’s data. The Bank of Canada (BOC) turned hawkish all of a sudden yesterday and the CAD rallied. I don’t think they will remain hawkish if the GDP today is bad again.

- US Data – The US price index, personal spending, personal income, and unemployment claims will be released at the same time as the Canadian GDP. The price index is expected to decline to 0.1% from 0.2% last month while the rest of the data is expected to remain unchanged. Inflation picked up nicely in Europe today. We will probably see some surprising numbers from the US as well.

- US Crude Oil Inventories – The US Crude Oil inventories are another factor which might affect the CAD. CAD and Oil are closely related. If inventories increase, then the CAD is expected to decline since this means more supply in the market.

- FED Members Speak – Later in the afternoon we have two FED members speaking. Bostic and Brainard have speeches scheduled today. It will be interesting to see what they have to say about the US economy, the trade war and the USD. I have a feeling that they will sound a bit hawkish, potentially giving market sentiment another boost.

Trades in Sight

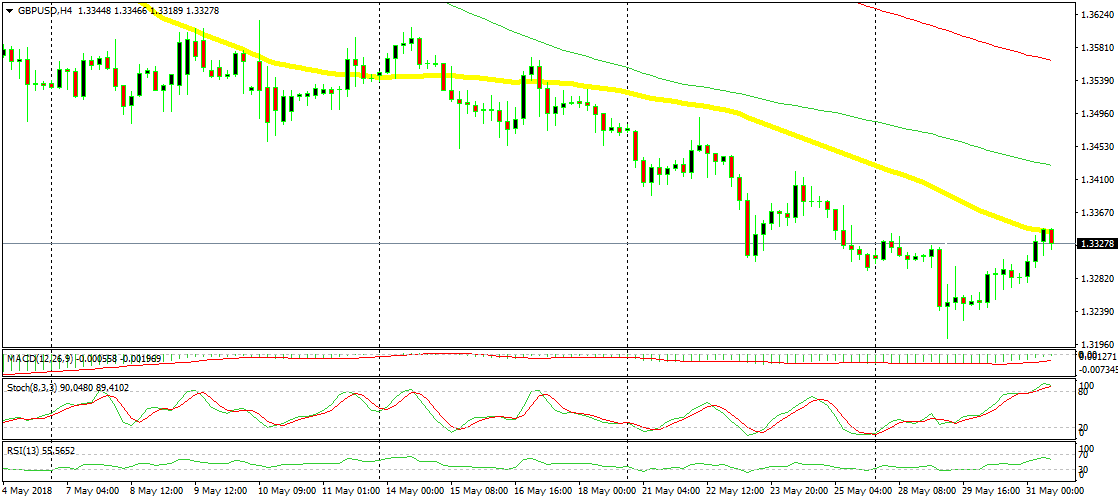

Bearish GBP/USD

- The trend is bearish

- The pullback is complete on the H4 chart

- Stochastic is overbought

- The 50 SMA is providing resistance

Theis chart setup looks pretty bearish to me

A while ago we opened a sell forex signal in GBP/USD. The trend is still down despite the pullback over the last two days. In fact, the pullback is complete now that stochastic has become overbought. The 50 SMA which has provided resistance previously is doing the same job again. That chart setup is screaming sell so that’s what we did.

In Conclusion

Today has been great for the Eurozone including the Swiss. We’re used to seeing weak inflation numbers in Europe, but inflation picked up considerably today. Maybe this is the turning point for Europe. We wil have to wait a few more months to see if this is a trend or just a one off.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account