Forex Signals US Session Brief, June 1 – A Quiet Session in Forex Besides GBP Pairs

Yesterday the markets were more relaxed after three days of extreme price action. Today the markets seem even more relaxed, until now.

Yesterday the markets were more relaxed after three days of extreme price action. Today the markets seem even more relaxed. All forex majors have traded in quiet ranges apart from GBP pairs. GBP/USD has gained around 80 pips so far. The UK came above expectations. We have seen a number of disappointing economic reports from the UK, so today’s manufacturing report has improved the sentiment for this currency.

The sentiment has improved across the markets to be honest. The safe havens are pulling back as EUR/CHF and USD/JPY climb higher. Safe havens were on a strong bullish trend this week, meaning these two forex pair were in a freefall. But today we see that they have reversed so the market sentiment is back to slightly positive.

The European Session

- Swiss Manufacturing – Yesterday, the Swiss retail sales jumped by 2.2% and last month’s number was revised higher as well. Today, manufacturing came close to expectations, but at 62.4 PMI points, it is at a very decent place. It’s a good sign for the Swiss economy.

- Eurozone Manufacturing – The manufacturing reports from the Eurozone countries were sort of mixed. The French and Spanish manufacturing missed expectations while the Italian and the German numbers as well as the whole Eurozone numbers came as expected. Inflation really picked up in Europe from what we saw yesterday. But the manufacturing is not backing it up today.

- British Manufacturing – The UK manufacturing report was a positive surprise today. It came at 54.5 PMI points up from 53.5 expected. That is the first positive economic report from the UK recently because we have seen a string of really bad reports in the last several months.

- Italian GDP – The Q1 Italian GDP came at 0.3% as expected but the number for Q4 2017 was revised higher to 0,.4% from 0.3%. That’s not great but a positive sign nonetheless.

The US Session

- US Employment Report – The US employment report includes the non-farm employment change, the unemployment change and the average hourly earnings. Unemployment is expected to remain at 3.9% as last month, but that’s already a really good number. The problem for the US has been low wages. Despite low unemployment, the wages have been picking up very slowly. Today, average earnings (wages and salaries) are expected to grow by 0.2% from 0.1% last month. That would be a good start and it would improve the situation for the USD. If it is a bad numbers, then I expect a decent pullback in the USD.

- US ISM Manufacturing – The manufacturing report is expected to come at 58.3 PMI points today, up from 57.3 points previously. That would be another positive piece of data which points to the right direction if there are no nasty surprises. The ISM manufacturing prices are less important, unless we see a major deviation.

- US Construction Spending – The US construction spending is another aspect which shows the shape of the economy since money spent on construction gets distributed fairly quickly in the economy. It is expected to grow by 0.8%, which would be positive after three disappointing months. Last month, the spending declined by 1.7%, so this would be a nice turnaround.

Trades in Sight

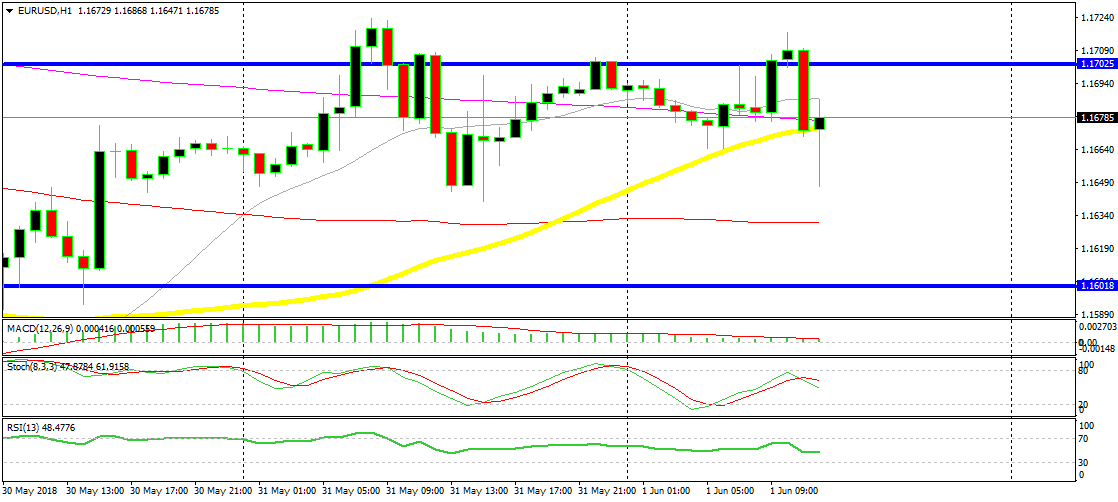

Bearish EUR/USD

- The main trend is still bearish

- The pullback is complete on the H1 and H4 charts

- Stochastic is heading down

- The upside down hammer candlestick

The reverse has already started

We sold EUR/USD a while ago at 1.1685 when the price was trading below the 100 SMA (red). It moved higher above 1.17 earlier today, but the price formed an upside down hammer and the stochastic became overbought on the H1 chart. That looked like a nice bearish chart setup and the price has already started to reverse down now.

In Conclusion

The US employment report just came out and it is another great one. Unemployment declined again while wages picked up nicely. Let’s get this update posted and take a better look at that report. We just cashed in on our EUR/USD signal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account