Forex Signals US Session Brief, June 4 – USD Continues to Pull Back

The US Dollar has been on a strong bullish trend in the last several weeks. Although, now it is on a pullback mode.

The US Dollar has been on a strong bullish trend over the last several weeks. Now it has started to pullback. The USD started to retrace lower Wednesday last week. From the price action that we are seeing, we can say that the pullback is continuing. The US economic data that came out on Friday was very strong. The unemployment rate declined again to 3.8%, after declining two decimal points in the previous month.

The average hourly earnings also increased. Nevertheless, there was no follow-through from USD buyers. We have seen USD buyers jump in at any half decent US economic data during the last couple of months. But, we didn’t see that happen on Friday, despite the great round of data. That tells us that USD buyers have paused and the sellers are currently in control. Today’s price action reinforces this idea.

The European Session

- Spanish Employment Change – The Spanish unemployment change came at -86.7K. This is more or less the same level as last month. It was expected to decrease further to 105K, so this is considered a miss. Though, it is not a soft number by all means. The unemployment change numbers have been decreasing in the last several months, which means that unemployment is falling and the new jobs should be on the increase. This trend is positive for Spain and for the Eurozone.

- Eurozone Sentinex Investor Confidence – The Sentinex investor confidence took a dive this month. It was expected to decline to 18.6 points from 19.2 points the previous month. It dove to 9.3 points, half of last month’s figure. In January, the investor confidence number was up to 33 points, but it has kept declining every month. Now, we are at 9.6 points. The trend is worrisome here. If investors don’t feel confident, then that’s a major problem. Although, the European politics have affected this indicator negatively, so it’s all economic.

- UK Construction PMI – The construction numbers from the UK have been close to 50 points for months. Above 50 means that the sector is expanding, below 50 means that the sector is contracting. It dipped to 47 points in April but it climbed up to 52.5 points last month. This month remains unchanged, a positive sign for the UK. At this level, this sector is not exactly booming, but at least it moved away from the 50 region.

- Eurozone PPI – The Producer Price Index or producer inflation as we call it, was expected to grow by 0.2% but remained flat. At 0.1%, PPI has been pretty weak in the last few months. On the other hand, the good consumer inflation numbers from the Eurozone last week increased hopes for a better PPI reading this month. That didn’t happen, the opposite happened in fact, and PPI dived to 0%. Not a good sign.

The US Session

- US Factory Orders MoM – The US factory orders are a leading indicator of economic health. It means that factories will increase their production activity to meet the orders. But, they are expected to decline by 0.4% today. That isn’t good obviously. The last two months have been pretty decent, increasing by more than 1%. This decline comes as a bit of a surprise.

- The USD Retrace – As mentioned at the beginning of this brief, the USD is pulling back lower. Commodity currencies are advancing higher and so is EUR/USD and GBP/USD. This move looks exhausted at the moment, indicating that a reverse might be underway. After all, the bigger trend is still up for the USD.

- Declining Cryptocurrencies – Cryptocurrencies reversed the bearish trend last week. They have been on a bullish run for several days, but today they are tumbling lower. This might be a good opportunity for buyers.

Trades in Sight

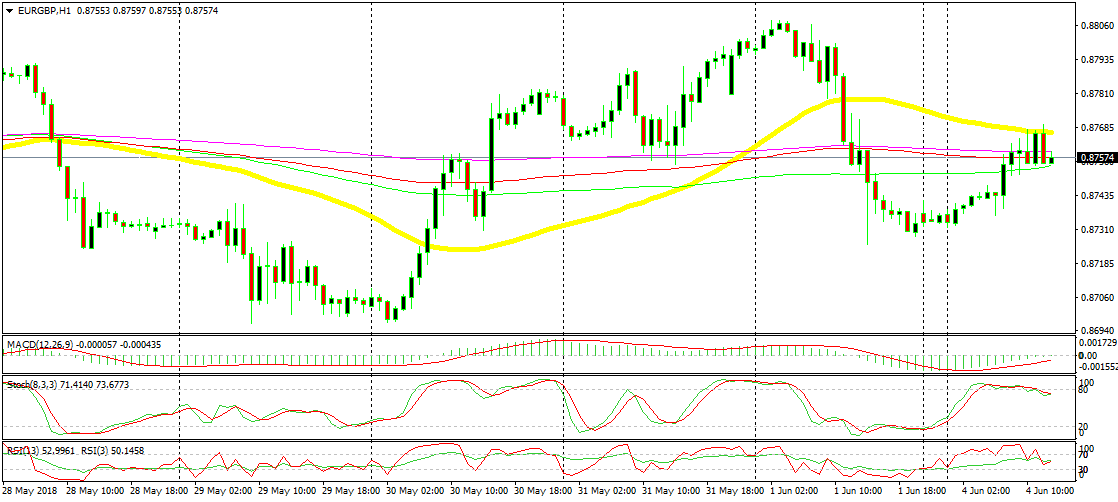

Bearish EUR/GBP

- The trend turned bearish last Friday

- The pullback is complete on the H1 chart

- Stochastic is overbought

- The 50 SMA is providing resistance

The reverse has already started for EUR/GBP

We sold EUR/GBP a while ago when it was at the 50 SMA (yellow). That moving average was providing resistance and stochastic was overbought, so we thought that the retrace higher was complete. Now, this pair is heading down, showing that we were right.

In Conclusion

The USD is on a major pullback now. It has lost considerable ground in the last few days, but that pullback might be coming to an end. We have to be careful not to get caught on the wrong side when the reverse happens and the uptrend resumes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account