The USD Retreat Continues – Euro and GBP Lead the Way

The USD continues to pullback this morning. The pullback started about a week ago when EUR/USD touched 1.1510.

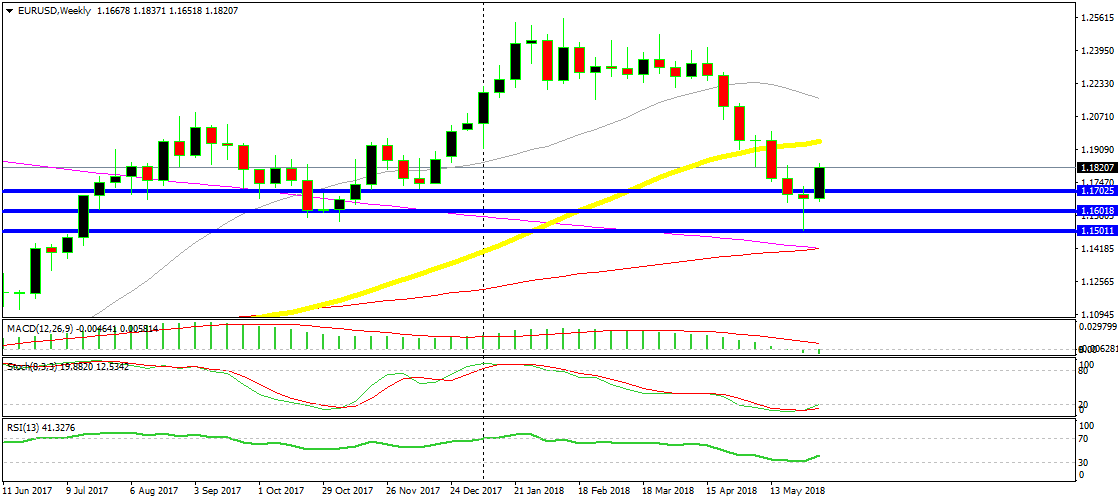

The USD continues to pullback this morning. The pullback started about a week ago when EUR/USD touched 1.1510. The area between 1.1500 and 1.1550 used to be a strong resistance zone, and now it has turned into solid support.

That area seems to have been the target for EUR/USD sellers. Once they reached it, the decline stopped and the pullback began. The thing is that the USD uptrend stopped in all major pairs when EUR/USD reached that zone. The Dollar index started reversing lower after that. So perhaps, the strong USD uptrend that we saw in the last couple of months was coming from EUR/USD.

Anyway, the USD pullback is stretching further today. EUR/USD is leading the way as it has climbed around 70 pips up to the top while GBP/USD follows next with around 60 pips from the lows to the highs today.

The Reverse began when EUR/USD touched the bottom of the support lines

USD/JPY is back below the 110 level, so the USD is down against safe havens as well. The commodity currencies, on the other hand, are not making much gains. The best performing commodity Dollar is the Kiwi. NZD/USD is 20 pips higher today and that’s great for us since we have a buy forex signal open in this pair.

There isn’t much on the economic calendar today so the market sentiment will do all the talking. We will follow the markets closely today to get a feel of the price action, which makes trading easier in such times.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account