Forex Signals US Session Brief, June 14 – The FOMC is Over, Time for the ECB and Draghi to Steal the Headlines Now

Yesterday, the FED increased interest rates for the second time this year. In fact, they have hiked interest rates three times in the last..

Yesterday, the FED increased interest rates for the second time this year. In fact, they have hiked interest rates three times in the last six months. Yesterday the FED hiked the rates from 1.75% to 2%. They also sounded pretty hawkish and the odds increased for two more rate hikes this year, instead of just one more that the markets were pricing in before the meeting.

The USD made a quick jump higher after the interest rate decision. But, it started to reverse soon and closed the day down against most majors. Today, the decline continues so this sort of price action looks very strange. The ECB press conference will start soon and the US retail sales report will be published at the same time. Perhaps these two events will reverse the trend in the forex market today.

The European Session

German Final CPI MoM – The German CPI (consumer price index) report was expected at 0.5% and it came exactly as expected. This was a positive reading considering that inflation came at 0% last month, so inflation is back up in Europe.

French CPI MoM – Just like in Germany, the CPI inflation picked up nicely in France too. Last month it came at 0.2%, this time it doubled up to 0.4%. This is positive for the Euro.

UK Retail Sales MoM – The retail sales are very volatile. They have been increasing and decreasing, turning positive and negative from month to month. Today, retail sales were expected to grow by 0.5%, but they grew by 1.3%. Last month’s number was revised higher as well, from 1.6% to 1.8%. This was a very decent report and the GBP received a push higher on these numbers.

ECB Refinancing Rate – The ECB has set the interest rates at 0% and they aren’t expected to change them. The rates remained unchanged, so the press conference will steal the spotlight later on.

The US Session

ECB Press Conference – The press conference from the ECB President Mario Draghi will commence soon. The ECB has decided to end the QE programme by the end of December but keep interest rates unchanged at least until next summer. This sounds a bit dovish. The market was expecting the end of the QE programme but it was hoping for the ECB to get started with rate hikes; the FED is not waiting any longer. The chances are that Draghi sounds even more dovish and the Euro is feeling that as it loses 100 pips as of this moment.

US Retail Sales MoM – The US retail sales are expected to grow by 0.4% today, up from 0.3% last month. Core retail sals are also expected to pick up by 0.5%. Both numbers have been missing expectations this year, so if retail sales come as expected, then it would be USD positive.

US Unemployment Claims WoW – The US unemployment claims have been in the 220K region the entire year and today’s number is expected to remain the same. This won’t have any effect on the USD, but there is always the chance that unemployment claims might jump higher or decline considerably, so we must keep an eye on this data as well.

US Business inventories – Business inventories are expected to grow by 0.3% today. Last month they came out flat at 0%. If inventories came below expectations today, it will be mildly positive for the USD since businesses are likely to increase purchases.

Trades in Sight

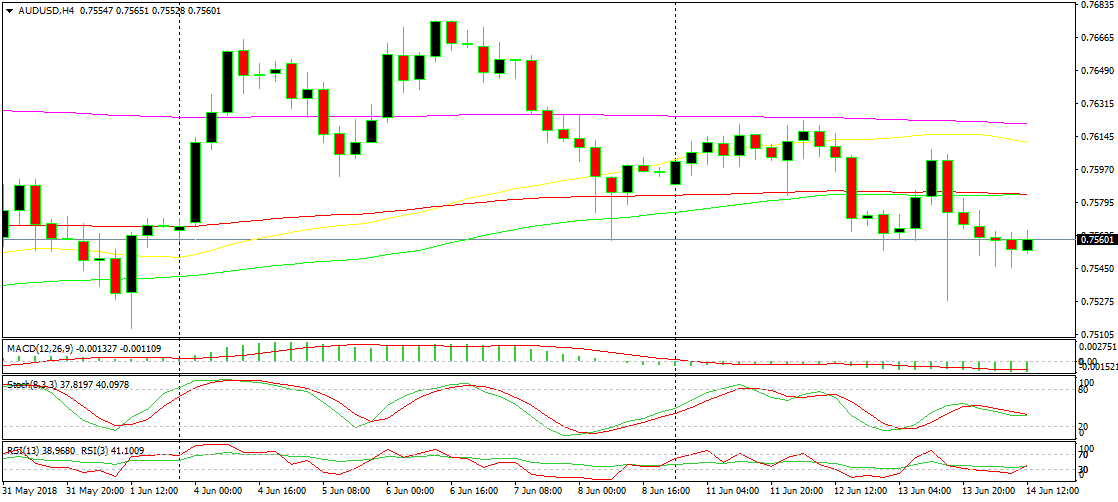

Bearish AUD/USD

- The Chinese data missed expectations this morning

- The AUD is the only losing currency against the USD today

This chart is heading down

While the rest of the major currencies reversed all the losses against the USD yesterday after the FED hiked interest rates, AUD/USD only claimed back half the losses. Today, this forex pair is still declining, while other majors are gaining in on the USD. The weak economic numbers from China this morning are weighing on the Aussie. We sold this pair earlier today and that trade is still live.

In Conclusion

The Euro has already started to fall before Mario Draghi comes in. Draghi has usually been dovish on the Euro, so chances are that the Euro takes another slip lower when he comes in. Let’s get this brief posted and hear what he has to say.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account