The Doves Outweigh the Hawks at the BOE, GBP Tumbles

Today is another light day regarding the economic calendar, apart from the US consumer sentiment later on. But, there are a few BOE members

Today is another light day regarding the economic calendar, apart from the US consumer sentiment later on. But, there are a few members from the Bank of England (BOE) holding speeches now and they are sounding dovish to me.

In fact, one of them sounds pretty bullish since he is talking about rate hikes. Ian McCafferty said that waiting too long to raise interest rates creates a bigger shock then starting to hike them gradually. But, the market ignored his comments since everyone knows he is a hawk. He voted last week to raise interest rates, but 6 members voting to leave the interest rates unchanged, so they remained unchanged.

The other external BOE member sounded pretty dovish. Ian Haskel is an external member and he said that the “BOE has scope to cut interest rates further if there is an economic downturn. He also said that there’s slack in the economy and that might weaken it.

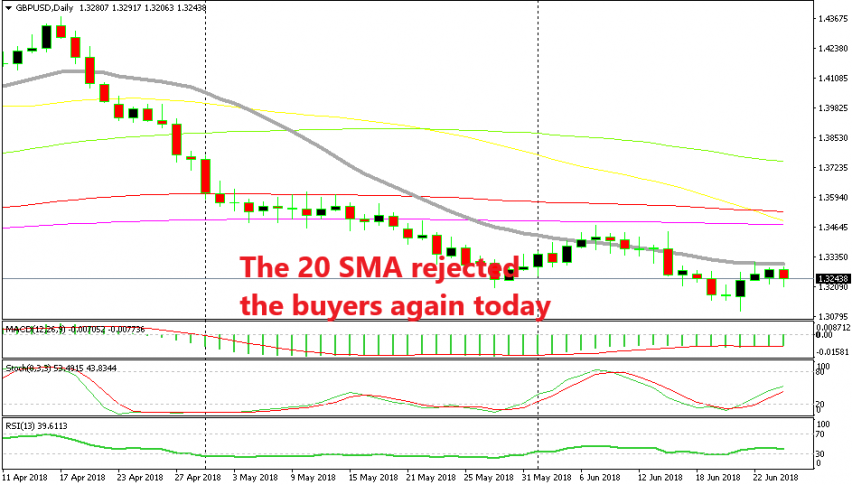

He also mentioned more QE (quantitative easing) if necessary but the market is not concerned much about it. What’s more dovish here is the fact that Haskel will be replacing McCafferty in a few months. So, it’s a dove for a hawk. That should be dovish for the GBP when Haskel takes the job. The GBP already lost nearly 100 pips on those comments and we cashed in on our GBP/USD sell signal, thanks to Haskel.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account