Oct 08 – EUR/USD, USD/CAD Trading Setups, & Key Economic Events to Watch!

The USD/CAD soared dramatically to complete the ABCD pattern which at $1.2975. The ABCD pattern historically drives the bearish moves....

Good morning, traders.

As discussed earlier, the global financial markets remain closed in the observance of Thanksgiving and Colombian day which is why the fundamentals side is on the lighter side. Nevertheless, forex brokers will be operative today. Trading volume and volatility are likely to remain very thin. Let’s take a look at the economic events and the forex trade setups today…

Today’s Top Economic Events

EUR – German Industrial Production m/m

At 6:00 (GMT), the Destatis will be releasing industrial production figures for Germany. It shows a change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. Economists are expecting a 0.4% rise in the production vs. a drop of -1.1%.

Traders, it’s a low impact economic event and usually drives no volatility in the market. But in the absence of major economic events, the market may focus on German industrial production to determine further trends for the Euro.

Today’s Top Trade Setups

USD/CAD – ABCD Pattern In Play

On the hourly chart, the USD/CAD soared dramatically to complete the ABCD pattern at $1.2975. The ABCD pattern historically drives bearish moves in the market.

The pair also has completed 61.8% retracement at $1.2975 on the daily chart which is making this level more significant. Below this, the pair can retrace back towards $1.29500 and $1.29350.

USD/CAD- Key Trading Levels

Support Resistance

1.2901 1.2969

1.2861 1.2996

1.2794 1.3063

Key Trading Level: 1.2928

USD/CAD – Trading Plan

We need to monitor $1.2925 as it’s a key level today. Selling is recommended below $1.2975, while I will be looking to go long above $1.2925 today.

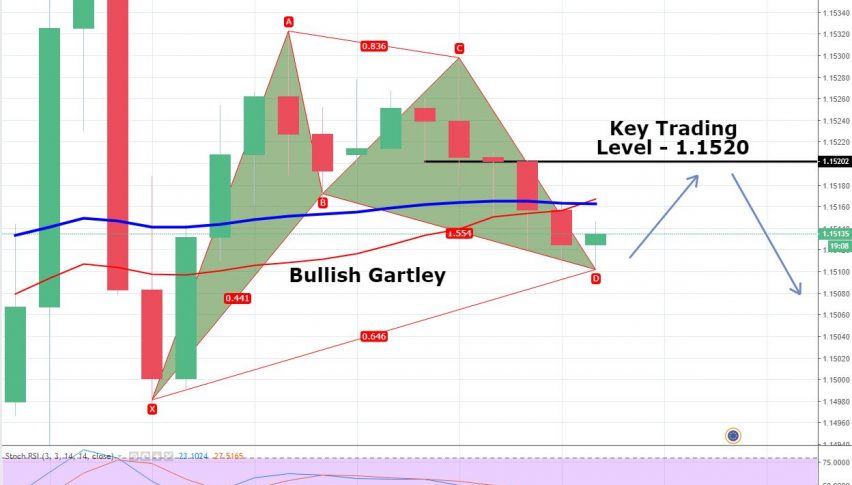

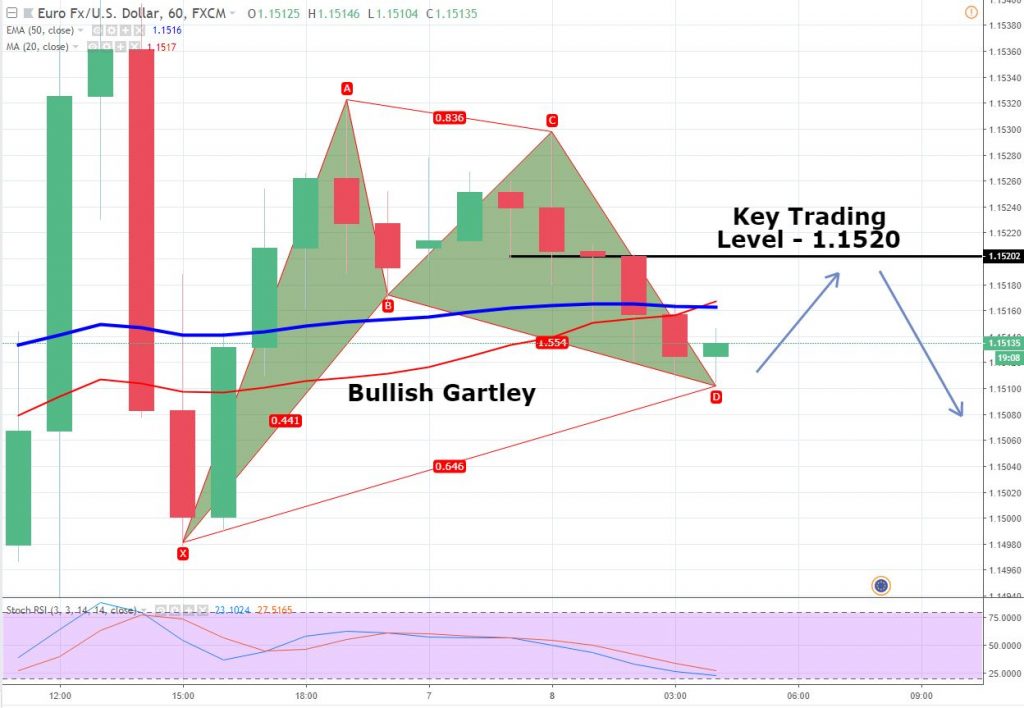

EUR/USD – Trading the Bullish Gartley

The single currency Euro has weakened as the investors seem to move their investments in the stronger dollar. The US unemployment rate dropped to 3.7% (the 49-year low), down from 3.9% in August.

On the technical side, the pair has formed a bullish Gartley pattern which has completed its CD wave at $1.1500. The same level is working as a strong support, while the resistance prevails at $1.1520 today.

EUR/USD – Key Trading Levels

Support Resistance

1.1488 1.1554

1.1453 1.1585

1.1387 1.1651

Key Trading Level: 1.1519

EUR/USD Trade Plan

Today, the violation of $1.1520 is likely to lead EUR/USD towards $1.1565. Whereas, the pair can stay bearish below $1.1520 until $1.1485.

Good luck for today!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account