⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

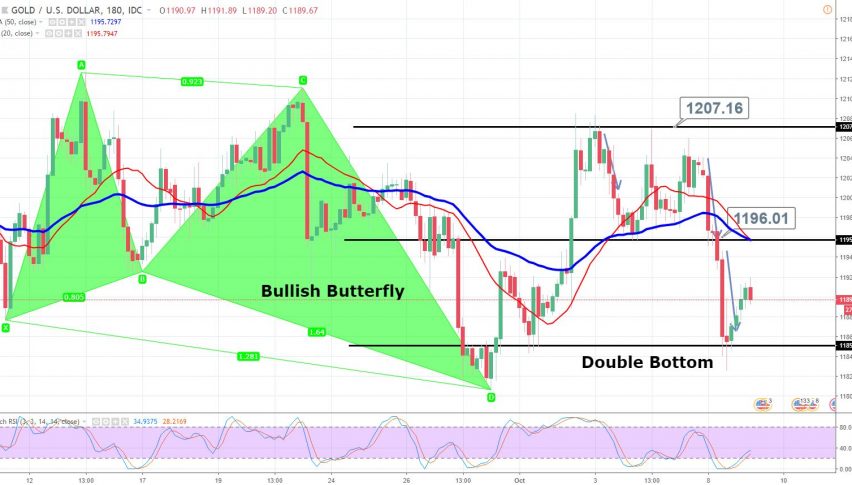

Gold’s Safe Haven Fades – Double Bottom Pattern Plays!

A day before, the yellow metal GOLD fell sharply by more than 1% alongside sliding equities as investors sought shelter in the dollar. Better than expected economic events, especially the unemployment rate has fueled the FED’s rate hike sentiment. Investors seemed unsure about buying gold as it wasn’t able to break above $1,210, a strong resistance.

- The technical side of the market remains strongly bearish as the precious metal broke below the double bottom support level of $1,195.

- The moving averages are suggesting a bearish trend in gold, despite the oversold RSI.

For now, the immediate support prevails at $1,182 along with a resistance near $1,195. The market can give us an opportunity to sell below $1,195 and buy above $1,182. Good luck!

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments