Forex Signals US Session Brief, November 9 – USD Gets Back on Track After the FOMC Statement

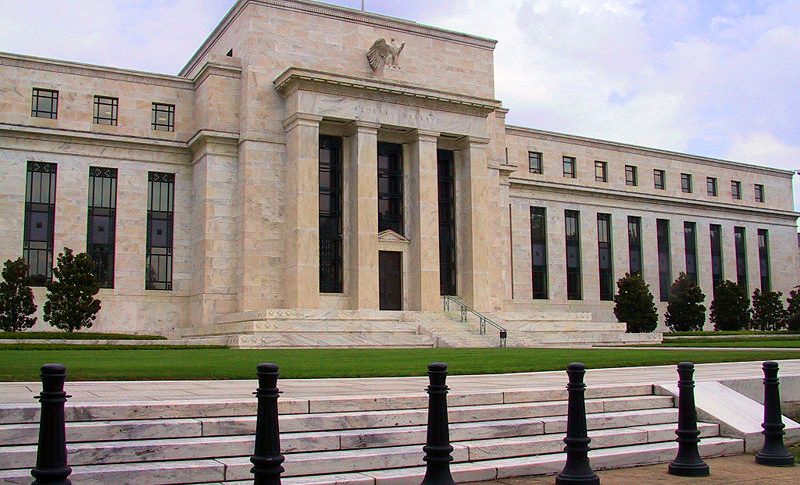

The effect of the US midterm elections and the shift of the Congress to the Democrats on financial markets wore off pretty quickly and yesterday, the attention shifted to the FED. The Federal Reserve was due to release its November statement in the evening so the market was pretty quiet all day yesterday.

The statement was pretty much the same as the last one, basically a carbon copy of the one from September. But, the USD made a strong bullish move after the FOMC statement was released. In fact, the FED saw fixed investments moderating as compared to the previous months. So what was all the fuss about last night?

The market was expecting the FED to tone down its language and place interest rate hike on hold in Q1 next year. But, that didn’t happen and the odds of another increase in December remain unchanged at around 80%. This puts the balance for the USD on the positive side. Yesterday, the Buck jumped 100 pips higher and it is pushing higher today as well.

The fundamentals regarding the GBP weighed on the negative side this morning after the UK GDP and manufacturing reports were released but Brexit rumours keep messing with the GBP, so the effect was limited.

The European Session

- French Industrial Production – Industrial production was revised lower in France last month, from 0.3% to 0.2%. But, this month’s number was even worse, showing a 1.7% decline in the sector against a 0.3% decline expected.

- Italian Budget Deficit – Italy’s head of budget committee said this morning that the EU used made up numbers while judging the Italian budget. He questioned whether the EU has the guts to sanction Italy. Finance Minister Tria backed him saying that Italy will stick with the 2.4% deficit next year which should help boost the economy by 0.6%.

- Brexit Comments – Irish Prime Minister Theo Vadarkar commented earlier today that he expects the EU Brexit summit to be no earlier than end of November. Wilson from the DUP Party of Northern Ireland said later that the letter from Theresa May doesn’t deliver on the promises regarding the Irish border. Many issues ring alarm bells over the integrity of the Union (UK) and the DUP Party wouldn’t support it. If the DUP Party leaves May’s cabinet, then that’s it for Theresa May and for Brexit.

- UK GDP – The GDP number for Q3 came at 0.6% as expected, up from 0.4% previously. But, I don’t see where that came from because growth in August and September fell flat. Imports also fell flat against 0.8% expected. But worse news came from business investment which declined by 1.2% in Q3 and by 1.9% annually. The index of services also declined by 0.1% against increasing by 0.1% as expected. Pretty bad figures.

- UK Manufacturing and Trade Balance – The trade deficit narrowed to £9.7 billion from £11.7 billion previously. The manufacturing production increased by 0.2% against 0.1% expected and the construction output jumped 1.7% higher. This report was a bit better than the previous one.

- Threats of US Car tariffs on EU Still Remains – Comments coming from the EU Trade Commissioner Cecilia Malmstrom. She added that the EU will retaliate if the US pushes ahead with tariffs.

The US Session

- US PPI – The US producer price index was expected to grow by 0.2%, instead it jumped 0.6% higher. Core PPI number also posted a nice 0.5% jump. These are pretty good numbers and they are supposed to affect the consumer inflation later in the year so the USD jumped 20 pips higher.

- More Form Italy – The Italian Economy Minister appeared again saying that EU’s worries about next year’s Italian budget are baseless and they will reaffirm budget plans in response to the EU, which means not changing them as the EU wants.

- FED’s Williams Speaks – Williams is holding a press conference. The opening remarks were that a healthy jobs market supports sustainable growth. Well, the jobs market has been great as new jobs increase and the unemployment rate is at historical lows, so the economic growth should accelerate, right?

- Final Wholesale Inventories – Wholesale inventories increased by 0.3% last month and they are expected to increase by the same amount today. Higher inventories mean higher GDP since inventories are calculated in the report but lower orders from manufacturers in the coming weeks.

Trades in Sight

Bullish USD/JPY

- This pair is on a bullish run

- The bullish trend has picked up pace in the last few days

- The retrace down is complete

The reverse happened before reaching the 50 SMA

A while ago we opened a forex signal in USD/JPYe. We were waiting for this pair to complete the retrace down and reach the 50 SMA, but the price action showed that USD/JPY was about to turn higher so we just bought right there.

The trend has been bullish for quite some time in this pair and the stochastic indicator was nearly overbought on the H1 chart, so we decided to go long and it proved right since the buyers are in control now.

In Conclusion

The week is almost over now. All the main fundamental events such as the US midterm election, the FOMC statement and the UK GDP figures are out of the way. I don’t expect much action in the US session, so let’s hang around until the action dies off in forex.