Morning Brief, Nov 9 – Top Forex Trade Setups, Sterling Pairs In Focus

Today, the investor's focus remains on the U.K's GDP figures and it's time for us to capture some good trades in sterling pairs...

- Dollar rose against the Euro and Sterling as the US Federal Reserve kept interest rates steady, but reaffirmed the tightening monetary policy.

- UK’s third quarter preliminary gross domestic product is set to rise by 0.6% vs. 0.4% during the London session.

- The GBP/JPY daily forecast is yielding 50+ pips. What’s next?

- Quick trade setups for the GBP/USD & GBP/JPY today.

On Friday, the dollar advanced versus the Euro and Sterling as the US Federal Reserve kept interest rates unchanged but reaffirmed its monetary tightening tone, setting the stage for a rate hike in December. Today, the investor focus remains on the UK’s GDP figures, and it’s time for us to capture some good trades in Sterling pairs.

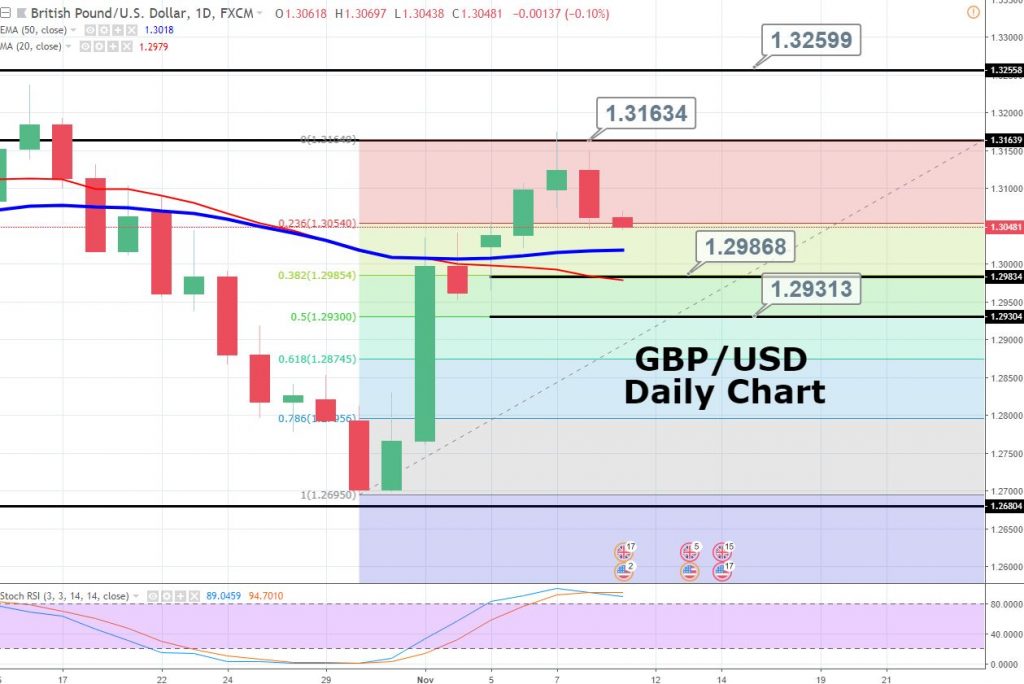

GBP/USD – Bearish Turn in the Overbought Pair

The GBP/USD is trading at $1.305, just below a strong resistance level of $1.3075. On the daily chart, the pair has formed a bearish engulfing pattern which is suggesting a potential for bearish reversal.

The Office for National Statistics is due to release GDP figures at 9:30 (GMT) with a positive forecast of 0.1% vs. 0.0% growth in September 2018. While the Prelim GDP q/q is also expected to jump from 0.4% to 0.6%. Although the GDP’s forecast should underpin the British Pound, hawkish FOMC and stronger dollar sentiment are dragging the pair lower.

Intraday Technical Levels

Support Resistance

1.3044 1.313

1.2989 1.3162

1.2903 1.3248

Key Trading Level: 1.3076

GBP/USD – Market Sentiment

Weekly – Neutral

Daily – Buy

Hourly – Strong Sell

Today, the idea is to stay bearish below 1.3075 to target 1.30.15 with a stop above 1.3085. In case of positive GDP and a bullish breakout of 1.3075, we may have a chance to take a bullish position.

GBP/JPY – An Update on Swing Trade Plan

The GBP/JPY is trading in line with our previous update Sellers Looming in GBP/JPY – A Potential +100 Pips on the Cards. The pair has dropped more than 50 pips so far and another 50 pips are on the cards.

Technically speaking, this pair has tested 149.450 for the third time, yet failed to surpass this level. On the daily timeframe, the RSI and Stochastics were trading in the overbought zone which triggered the profit taking.

On Thursday, the intraday closing candle is Doji which is right below a significant resistance zone of 149.450, another signal for a bearish reversal.

Intraday Technical Levels

Support Resistance

148.49 149.39

147.97 149.76

147.07 150.66

Key Trading Level: 148.86

GBP/JPY – Market Sentiment

Weekly – Neutral

Daily – Buy

Hourly – Strong Sell

I’m sticking with the same old plan of selling below 149.450 to target 148.450 and 148. The stop loss should be above 149.450.

Good luck and keep following FX Leaders for another profitable day.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account