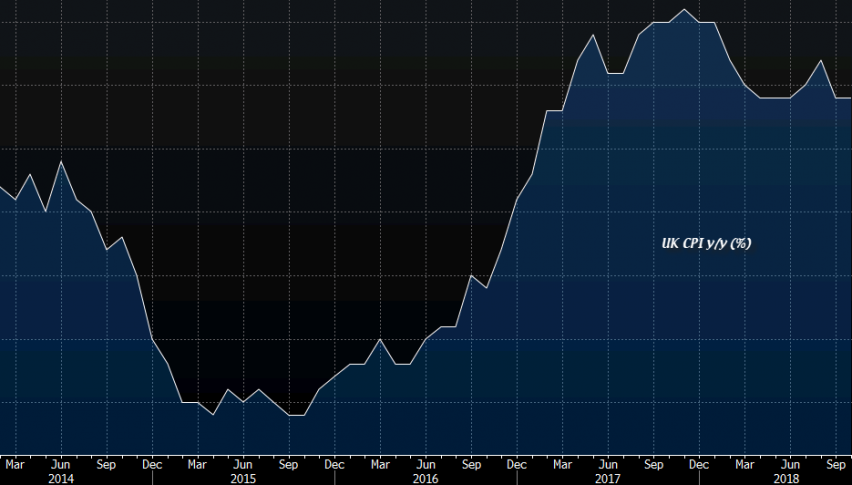

UK Inflation Slightly Misses Expectations

UK CPI inflation missed expectations while PPI came a it higher than expected this month. House prices increased considerably though.

The UK CPI (consumer price index) report was released a while ago. Yearly inflation was expected to grow by 0.1% and come at 2.5%, up from 2.4% previously but it remained unchanged. The monthly inflation also remained unchanged at 0.1% against 0.2% expected.

There was a slight possibility that the inflation numbers today might be positive after the great earnings report yesterday. But, inflation remained more or less around the same levels as last month, which is not bad by any means, since main inflation is at 2.4% while core inflation is at 1.9%. Have a look at the numbers for yourself.

| Actual | Expected | Previous | |

| CPI YoY | 2.4% | 2.5% | 2.4% |

| CPI YoY | 0.1% | 0.2% | 0.1% |

| Core CPI YoY | 1.9% | 1.9% | 1.9% |

| HPI YoY | 3.5% | 3.3% | 3.2% |

| PPI Input MoM | 0.8% | 0.6% | 1.4% |

| PPI Output MoM | 0.3% | 0.2% | 0.4% |

As you can see, it is a mixed report. Although, I don’t see a jump in GBP even if inflation was higher because the market is totally concentrated on Brexit right now. Last night, there was a breakthrough in this issue and today, we will get a clear answer about what is exactly going on.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account