US Session Forex Brief Nov 29 – Markets Unsure After Powell and the Approaching Brexit Vote

The market look a bit confused today after Powell's comments yesterday. But, the GBP knows its way as it turns bearish again.

Yesterday, the financial markets were waiting for the FED Chairman Jerome Powell to hold his speech in the afternoon. Today, a couple of sessions after his speech, the market is still uncertain what to think. The speech was pretty similar to recent ones we have heard from FED officials, apart from a couple of comments which sent the USD crashing lower for more than 100 pips against all major currencies. Those comments were “interest rates are near neutral rates” and “There’s no preset schedule for rate hikes“. Actually, the comments weren’t exactly like this, but that’s what I can put together right now and you get the meaning.

What the market understood yesterday was that the FED might stop hiking interest rates soon since they are near neutral and there is no preset schedule, so the FED doesn’t have an official plan to keep hiking interest rates forever. That’s why the USD got smashed during/after his speech. But, we knew that the FED won’t increase rates forever, so the market is in doubt today. Were Powell’s comments the beginning of a change in FED’s monetary policy which would reverse this year’s bullish trend for the Buck, or were they just a confirmation of what we already knew? The latter seems more credible to me, but the market is still trying to figure it out. The GBP has figured out its way, by the way. The British Parliament will vote on the Brexit deal on December 11 so the GBP is getting jitters as we approach the date.

The European Session

- Swiss Q3 GDP – The Swiss economy has been growing by 0.6%-0.7% in the last four quarters, but it was expected to have grown by 0.4% in Q3. That was a very positive assumption as the numbers showed that the Swiss economy contracted by 0.2% during that period. The CHF has entered a bearish phase now after those soft GDP numbers.

- French GDP and Consumer Spending – The growth of the French economy in Q1 and Q2 averaged at 0.2% but today’s GDP report for Q3 came at 0.4%, so that is a nice pickup. Consumer spending for October also increased more than expected by 0.8%, although the number from September was revised lower to -2.0%.

- China Wants to Meet US in the Middle – China’s Commerce Minister said this morning that US and Chinese officials have been in close contact ahead of the G20 Summit and he hopes that both countries move in the same direction to have positive results.

- DUP Party Still Wants A Better Brexit Deal – The leader of the Northern Ireland DUP Party Arlene Foster commented earlier today that there is a better way than May’s Brexit deal. She thinks that the deal won’t pass in the British Parliament vote and she added that they won’t vote for another referendum.

- This Is the Only Possible Brexit Deal for Barnier – EU’s chief Brexit negotiator Michel Barnier held a speech today where he said that the deal on the table is the “only deal possible” and negotiations are over. Now everyone should take responsibilities. Full stop.

- German Inflation – The regional CPI inflation numbers from Germany have come up mixed for the month, with Brandenburg and Saxony coming lower than the previous month, while some other regions were higher. But, the annualized CPI numbers were almost all lower than previous, so I expect the main German inflation figures to be weaker later when they release.

- This Is the Best Deal for Theresa May Too –Theresa May spoke in the UK Parliament today saying that this is the best deal and that the EU has made it clear this is the only deal. She added that if it gets voted down in the Parliament, then the UK will end up with no deal since there is no more time to negotiate.

- 2.2% Deficit Is the Minimum That Salvini Can Accept – Italian deputy PM Matteo Salvini said a while ago that 0.2% is the most that his government can cut from the deficit target for next year’s budget. I don’t know if that is enough, but the EDP procedure will follow if the European Commission doesn’t accept it.

- European Commission Doesn’t Expect US Car Tariffs Before Before Next Year – EU’s Oettinger presumably said earlier that he expects US tariffs on cars before Christmas. But the European Commission denied that. Although, a month or two earlier or later won’t change much, the tariffs are coming.

The US Session

- Donald Trump Won’t Let Go on Tariffs – US President Trump tweeted a while ago that billions of dollars are pouring into the US from tariffs on China and there is a long way to go. This might be some sort of pressure on the Chinese before the G20 summit, or not. We know now that Trump likes his tariffs.

- Oil Jumps on News That Russians Might Cut Output – Reuters published a report citing two Russian Oil industry sources saying that Russian Oil companies are willing to cut production output. Oil has jumped around $1.50 higher on this news.

- US Core Price Index – The core price index was expected to grow by 0.2% in October, bu it only grew by 0.1%. The annualized number also came lower, from 2.0% previously to 1.9%.

- US Personal Income – The pace of growth of personal income has slowed from 0.4% several months ago, to 0.2% in recent months. In October, it was expected to bounce back to 0.4%, but it beat expectations, posting a 0.5% for that month which is very positive.

- US Personal Spending – Personal spending has been growing steady at 0.4% a month for several months but today’s report showed that spending increased by 0.6% in October. That is yet another positive number from the US.

- US Unemployment Claims – The US unemployment claims have been steady at around 215k for many months, but they jumped higher to 224k last month. This month, they moved higher again to 235k, so there might be a trend forming here.

- US Pending Home Sales – We have seen three negative months in the last five for pending home sales in the US. Although, this month, they are expected to increase by 0.8%, but let’s see before making assumptions.

Trades in Sight

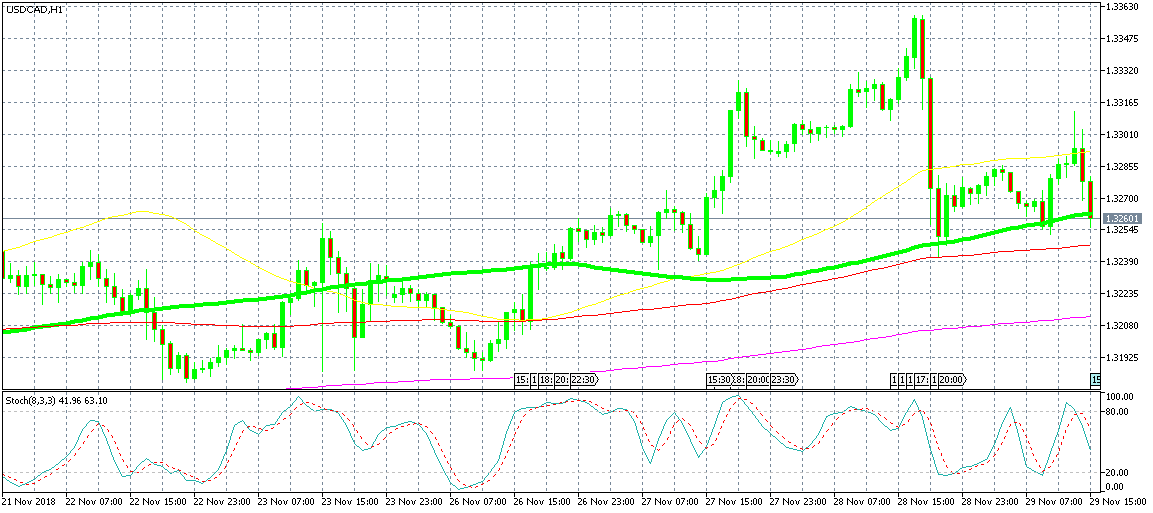

Bearish USD/CAD

- The trend is bullish

- Fundamentals are still bullish

- The pullback lower is complete

- The 100 SMA has turned into support

The stochastic indicator is almost overbought

We went long on USD/CAD earlier today. This pair has been on a bullish trend sine the beginning of October, although the uptrend hasn’t been very strong. The OPEC+ meeting is coming and Oil has been feeling pretty weak with US WTI crude Oil declining below $50. So, the CAD has been suffering because of this, but yesterday, USD/CAD reversed lower on Powell’s comments. Today we are seeing another bearish move, but the uptrend remains in place and the 100 SMA (green) is providing support to this pair, so we decided to open a buy forex signal.

In Conclusion

The German consumer price index inflation number for the whole country was just released and, as we expected, it declined from 2.4% previously to 2.3% on an annualized basis. It still is above the ECB target at 2% so this doesn’t change anything. The G20 summit will start tomorrow but before that, we have the FOMC meeting minutes to be released this evening, which could shed some more light on Powell’s comments yesterday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account