US Session Forex Brief Nov 30 – Markets in Limbo Ahead of the G20 Summit

The G20 summit is the highlight of the day and of this week. The market is just trading water now in anticipation of what might happen there

The G20 summit is set to begin today, although it is taking place in Argentina so it’s not morning yet there, so we haven’t got any news yet. But, forex traders are already sidelined because you never know how the summit will end up with Donald Trump in there.

In fact, this summit might just be called the Trump-Xi summit as some economists are referring to it. The trade war between the US and China has precipitated and we will see tariffs on $200 billion worth of Chinese goods on top of the $50 billion that are already in place.

But, if the two Presidents of the two giant economies don’t come to an agreement, the trade war will precipitate further. Donald Trump has warned another round of tariffs worth more than $250 billion on top of the $200 billion that are coming soon.

That would turn the market sentiment pretty negative which would weigh on risk currencies, particularly on the AUD and the NZD since the Australian and the New Zealand economies are heavily dependent on exports of raw materials to China.

The US tariffs on Cars are also coming pretty soon and I don’t think there will be a consensus between the EU and Donald Trump which will hurt the sentiment on financial markets further, because Europe is already going through some economic weakness. Although, we can’t predict how things will end up after this summit, and that’s the reason forex traders are staying on the sidelines today, so don’t expect much action, unless we get some breaking news from the G20 summit later today in the US session.

The European Session

- UK Nationwide House Price Index – The house price index rose by 0.3% in the UK this month against 0.1% expected. This is a turnaround from the declining trend but it is just one month, so we will have to wait and see the numbers for December.

- German Import Prices – Import prices increased by 1.0% in Germany in October against 0.4% expected. Let’s hope that this translates into higher CPI inflation later, probably next year.

- German Retail Sales – Retail sales declined by 0.3% in Germany in October while expectations were for a 0.4% increase. This is the fifth time out of the last six months that retail sales miss expectations in Germany and the fourth time that they come up negative, so not a good sign.

- Italy Working on A 2% Deficit Regarding Conte – Italian PM Conte and Finance Minister Tria are said to be working towards cutting the deficti for next year’s budget to 2.0% from 2.4% planned. They say they can do this by delaying the welfare and pension reforms by a few months, but the two real leaders, Di Maio and Salvini said to accept only a minimum of 2.2% for the deficit, so we will see how this goes.

- China Wants the US to be Sincere in G20 – This was the headline comment from the Chinese Foreign Ministry. They repeated again that they want to meet the US halfway but Trump doesn’t like halfway.

- Eurozone Unemployment Rate – The unemployment rate was expected to fall to 8.0% in Europe but remained unchanged at 8.1%. I think this was due to the surge in the Italian unemployment rate to 10.6% from 10.1% previously.

- Eurozone Inflation Report – Inflation ticked lower in the Eurozone today. It declined to 2.0% from 2.2% on an annualized basis, which is close to the minimum limit/target for the ECB. Core inflation also declined to 1.0% which is another minimum target for the ECB, so Euro traders take notice.

The US Session

- FED’s Kashkari Tries to Explain Powells Comments –FED member Kashkari commented on CNBC a while ago that it is tough to know where “neutral rates”should be, that’s why they keep watching the data. These should hawkish comments for the USD.

- Tusk Being Honest on Brexit – Donald Tusk said just now that if the UK votes against the Brexit deal, then the UK will end up either without a deal or without Brexit, meaning that the UK might remain in the EU.

- Canadian Economy Finally Contracts – The economic data from Canada has been getting softer and the GDP has been getting weaker, although it has kept growing. But this month, the GDP contracted by 0.1% while it was expected to increase by 0.1%.

- Canada Industrial Products Prices – The prices for industrial products increased by 0.2% against -0.5% expected. Prices of raw materials declined by 2.5% on the other hand, but that’s much smaller than -5.3% expected.

- G20 Meeting – The G20 meeting has already started in Argentina now that the sun has dawned there. Not much coming out of it, but keep an eye on it guys,since it will set the mode for trading next week.

Trades in Sight

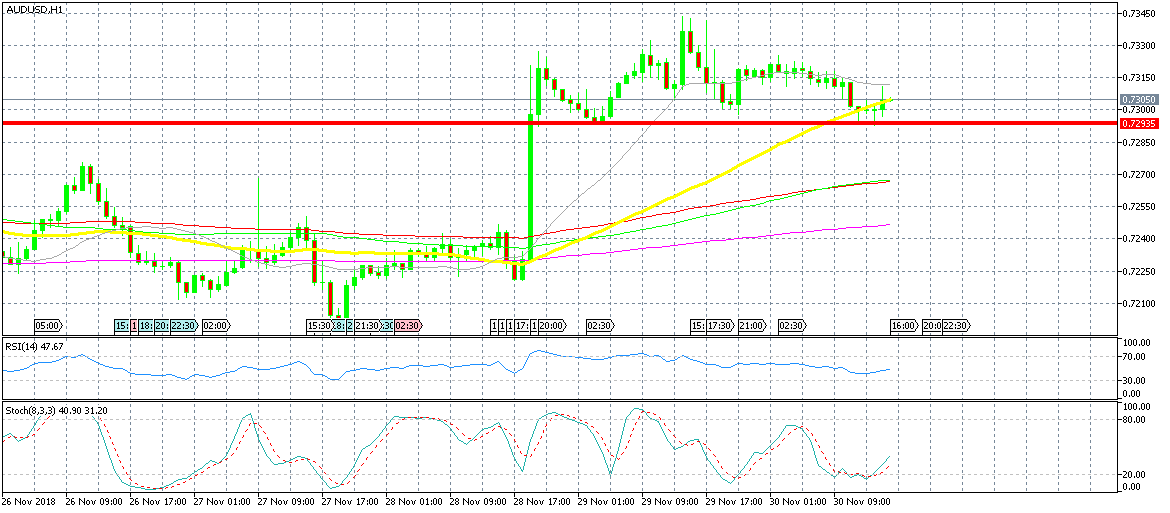

Bearish AUD/USD

- The trend is bullish

- The retrace lower is complete

- The 50 SMA is providing support

- A support level has formed

The stochastic indicator is almost overbought

AUD/USD is on a bullish trend, although it has moved lower in the last two days. But the retrace is now complete since the stochastic indicator is now oversold. The 50 SMA (yellow) is also providing support to this pair and the last few candlesticks point to a bullish reversal soon. Besides, a support level has formed at 0.7290 in this forex pair so this looks like a good opportunity to go long from here.

In Conclusion

The G20 summit is already underway now that it is afternoon in Europe and early morning in the Americas. The main clash of this summit will be between Trump and the Chinese President Li, but the European leaders will also likely try to convince Trump to lay off car tariffs. Anyway, we will follow the summit as it evolves.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account