US Session Forex Brief, Dec 6 – OPEC and Oil in Focus Today

The sentiment has turned negative again today and OPEC is doing their part. The USD and crude Oil are under pressure today.

Oil has been under a lot of attention recently. Oil prices have been on a slippery slope in the last two months, but everything was fine until a few weeks ago because the consensus was that the uptrend of the last two years wasn’t going to be challenged. But, it turned out that the uptrend wasn’t that strong and global fundamentals were more important than just the market sentiment. WTI crude Oil broke below $50 last week, but talk of production cut offered some relief for Oil which helped Oil reverse higher for a few days. But, it only lasted that long and Oil is back on the downtrend now.

Oil traders were hoping for a decent cut on production, but recent comments from OPEC members and particularly the comments from the Oil Minister of Saudi Arabia this morning turned the sentiment pretty negative for Oil and it lost more than $3 today, which is more than 5% of its value. The OPEC meeting is going on in Vienna today and the consensus now is that the OPEC+ countries are going to cut production by around 1 million barrels per day. That doesn’t satisfy the markets which were expecting a bigger cut.

So, the sentiment overall sentiment has been pretty negative today and comments from Italian politicians on the budget haven’t helped much. Safe haven assets remain near the highs, while risk currencies are again in danger.

The European Session

- DUP Party Won’t Vote Theresa May’s Deal – Sammy Wilson of Northern Ireland DUP party commented this morning that they won’t vote the Brexit deal next Tuesday if they don’t amend it. Well, no more time for changes. He added that they won’t vote to topple Theresa May on a no confidence vote, but might do that at a later date.

- Real Dialogue has Begun on Italian Budget for Moscovici – The European Affairs Commissioner Pierre Moscovici said this morning that the real dialogue with Italy has just began. We are on the right path, he added, but the 2% line is what both sides are fighting over right now.

- It’s My Deal, No Deal or No Brexit at All for May – UK Prime Minister Theresa May had an interview on the BBC radio saying that the risk now is that of no Brexit at all. The UK cannot pull out of the backstop unilaterally. Backstop would be integral to any deal with the European Union and there should not be another referendum on Brexit.

- ECJ to Rule on Article 50 on December 10 – Yesterday we heard rumors that the European Court of Justice would rule to give Britain a chance to scrap Article 50 if they wanted to go back to the EU. I don’t think that will happen, but the ECJ has a set date for December 10 to rule on that decision.

- RBA’s Debelle With Contradictory Signals – The Reserve Bank of Australia deputy Governor Debelle said this morning that the next move in interest rates is likely to be higher. But he also added that should that turn out not to be the case, there is scope for further rate cuts and it is the level of rates that matter and that they can still move lower. AUD/USD turned even more bearish after his comments.

- German Factory Orders – German factory orders were expected to decline by 0.4% in October, but instead, they increased by 0.3%. Although, last month’s number was revised lower to 0.1% from 0.3% previously. These are still positive numbers nonetheless.

- Italians are Sticking to the Deficit Above 2% – The Legga Nord Party doesn’t accept the deficit lower than 2.2%, while the Cinque Stelle can go for a minimum of 2.1%. But, the European Commission wants it below 2%. 1.9% would be ideal for them, so this looks like it is going to be a long battle.

The US Session

- US Non-Farm ADP Employment Change – US ADP non-farm employment change was expected to decline to 195k this month from 227k previously. It declined to 179k and last month was revised lower to 225k, so it is a negative report.

- Canadian Trade Balance – The trade balance in Canada was expected to come at -$0.7 billion today, but it came at $-1.2 million. The trade deficit has been growing in Canada recently, and to think that Canada was running a surplus for quite some time, so the tariffs are working already.

- BOC Rate Decision – The Bank of Canada decided to leave interest rates unchanged at 1.75% today. Although, no one was expecting them to increase interest rates today, so the comments from the BOC Governor Poloz will steal the attention.

- BOC Governor Poloz Speaks – The Governor of the Bank of Canada Poloz is holding the speech right now. He said that the current level of interest rates is appropriate for the time being. This means that the BOC is pausing rate hikes for now after increasing them twice this year. He added that the pace of increases remains ‘decidedly data dependent’, but the economic data hasn’t been very good from Canada recently.

- US Trade Balance – The US trade deficit came at $55.5 billion for October against $55.2 billion expected and up from $54.0 billion previously. The deficit continues to grow despite trade tariffs from Donald Trump.

- Revised US Labour Costs – US labour costs were expected to grow by 1.1% in today’s report, but they increased by 0.9% on an annualized basis. At least, that’s much better than the preliminary number which was standing at -1.0%.

- US Final Services PMI – The US services PMI indicator will be released shortly and it is expected to remain unchanged at 54.4 points, the same as last month. This indicator has declined constantly because it used to be at 56 points in summer, but the decline might stall this month.

- US ISM Non Manufacturing PMI – The manufacturing PMI indicator is expected to cool off slightly to 59.1 points from 60.3 points previously. But, that would still be a very decent level for this indicator, much better than the European counterparts.

Trades in Sight

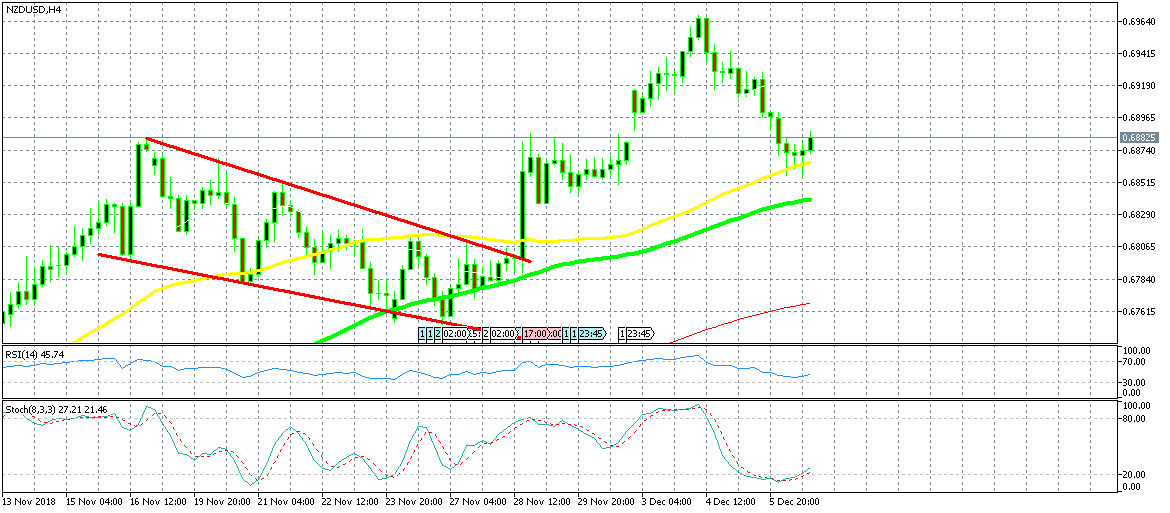

Bullish NZD/USD

- The trend is bullish

- The retrace lower is complete on the H4 chart

- Candlesticks pointed to a bullish reversal

- The 50 SMA provided solid support

We missed the chance to buy at the 100 SMA today

A while ago, we went long on NZD/USD as this pair was retracing lower. The main trend on the H4 chart is still bullish as you can see on the chart above. Although, the 50 SMA provided solid support and the stochastic indicator was severely oversold. So, that was a great chance to go long on this pair. The last two candlesticks formed two dojis which are reversing signals and this H4 candlestick is already starting to look bullish, so the the bullish reversal is happening.

In Conclusion

The USD is under some pressure right now as the JPY and Gold are both gaining on the back of the USD. Risk currencies are also attracting some bids. It is turning into a broad USD selloff at the moment without much reason, so I suggest to be careful in the next hour or so until this move comes to a halt.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account