US Session Forex Brief, Dec 7 – Markets Waiting on OPEC+ and US Employment Report

We had two surprises today from OPEC+ and the Canadian employment report. Both are positive for the CAD.

Alright, the OPEC+ meeting is finally underway today. It started about five hours ago and the participants have taken a break now after the morning talks offered no breakthrough. To do a quick recap, Saudi Arabia wasn’t very confident about reaching a deal today, even though Russia offered to cut production by around 200 million barrels per day, which is higher than the first proposal of 150 million barrels. But, only if OPEC agrees to cut production by more than 1 million barrels which doesn’t seem likely for OPEC. OPEC is aiming to reach an agreement on a million barrel cut together with non-OPEC countries, including Russia.

But the two arch enemies of the Islamic world, Iran and Saudi Arabia are at each other’s throats once again. Iran wants exemptions from the deal on production cuts, together with Venezuela and Libya and, in my opinion, they are correct about that because they are already under US sanctions. But, the rest of OPEC, meaning Saudi Arabia, don’t agree that Iran should be excluded, so we’re in a deadlock right now and the chances are that the meeting continues tomorrow as well.

Alright, according to Reuters, Iran is said to have accepted the deal and Oil has just jumped around $1 higher on that news, but until we get a signed deal from OPEC and non-OPEC embers nothing is really certain, and Oil is reflecting that as it has lost most of the gains from the latest jump. Anyway, let’s list all the events of today below.

The European Session

- German October Industrial Production – Industrial production finally turned positive in September in Germany after declining in the previous three months, growing by 0.1%. Although it was revised lower today to just 0.1%. Production was expected to grow in October by 0.3%, but today’s report showed that it declined by 0.5% instead.

- French October Industrial Production – Unlike in Germany, industrial production declined by 1.8% in France in September after three positive months previously. The decline was revised lower today to 1.6%. Production was expected to grow again in October by 0.8%, but it increased more than that, by 1.2%.

- OPEC+ Meeting – As we highlighted in the opening of this article, OPEC was in a bit of a deadlock as Iran wanted exemptions from production cuts quotas and Saudi Arabia was objecting to it. The Saudis lead the OPEC cartel so they got their way and it seems that Iran has accepted the deal. From the latest comments, it is said that OPEC has agreed to cut production of 800,000 barrels per day. Russia now has to make up for the rest, so it seems that the cut will be by 1 million barrels as expected.

- Eurozone Final Q3 GDP – The final reading of the Eurozone GDP showed that it grew by 0.2% as expected. It’s still half of what it grew in Q2 by, and the components of this report such as household consumption and government expenditure also ticked lower. The GDP for 2018 slipped lower to 1.6% from 1.7% previously.

- Eurozone Employment Change – The employment grew by 0.2% in Q2, but again, this is still half of the growth that we saw in Q2 which was 0.4% in that quarter, so the growth of the Eurozone economy has slowed in Q3 compared to Q2.

- UK Halifax HPI MoM – The Halifax house price index was expected to grow by 0.3% in November, but instead, it declined by 1.4%. This is yet another economic figure for the Bank of England to take into consideration together with Brexit.

- Italians Postpone Sending the Revised Budget – It was said yesterday that Italy would send the revised budget to the European Commission next Tuesday. Now, we hear that they will send it on Wednesday. It seems like Italian politicians are trying to solve the riff because the Prime Minister and the Finance Minister have accepted a lower deficit of around 1.9-2.0%. But the actual leaders Di Maio and Salvini want it higher to around 2.2%, so we will see who will win.

The US Session

- US Unemployment Rate – The US unemployment rate remained unchanged at 3.7% as expected. Although, the average weekly working hours ticked lower to 34.4 from 34.5 previously. The U6 underemployment rate moved higher to 7.6% from 7.4% previously.

- US Average Hourly Earnings – Average hourly earnings were expected to increase by 0.3%, but the pace remained unchanged from last month at 0.2%. The USD lost around 50 pips on the average hourly earnings miss, but has now recuperated all losses.

- US Non-Farm Employment Change – New jobs on non-farming industries were expected to grow by 198k in the US last month, but they fell short to 155k instead. Last month was revised lower as well, from 250k to 237k, so that had an impact on the USD too.

- Canadian Unemployment Rate – The unemployment rate was expected to remain unchanged at 5.8% after it ticked 0.1% lower last month. Instead, it declined to 5.6% which is the lowest level in quite a few decades. That was a bit of a surprise and the CAD gained more than 100 pips.

- Canadian Employment Change – The surprise isn’t over from Canada. New jobs increased by 94.1k against 10.5k expected. Although, this increase in new jobs must have come from the opening of the Oil refineries in Alberta after a glut which lasted quite some time.

- US Prelim Consumer Sentiment – Consumer sentiment has declined in the last two months from 100.8 points in September. November’s number was revised lower as well from 98.0 points to 97.5 points. This month, the UoM consumer confidence indicator is expected at 97.0 points.

- US Final Wholesale Inventories – Wholesale inventories are expected to increase by 0.7% in October after they beat expectations in September. Higher inventories mean less work for manufacturing in the coming weeks, but it helps increase the GDP.

Trades in Sight

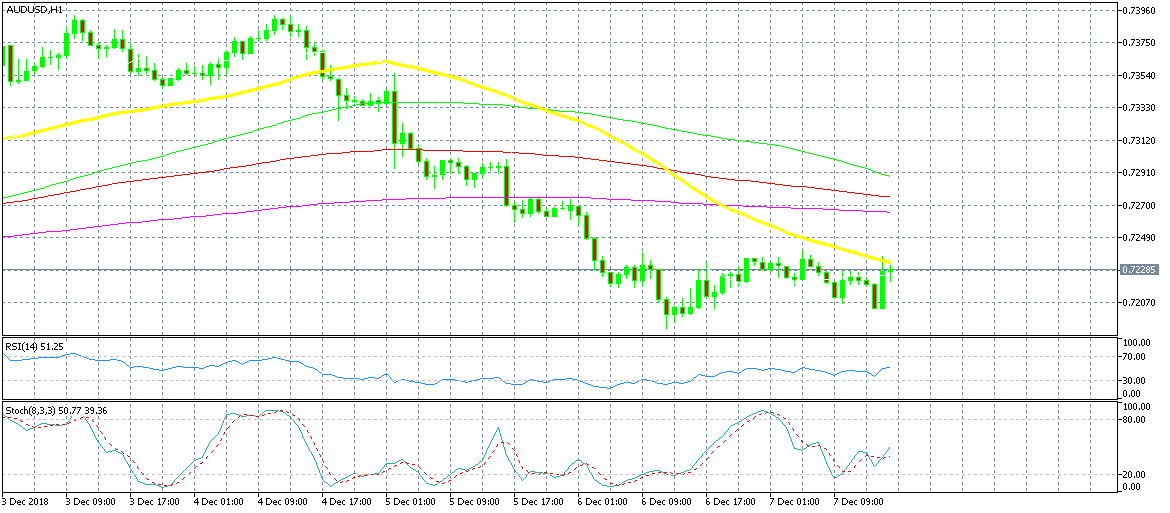

Bullish AUD/USD

- The trend has turned bearish

- The retrace higher looks exhausted

- The 50 SMA is providing resistance

We missed the chance to buy at the 100 SMA today

We just opened a sell forex signal in AUD/USD. This pair jumped more than 30 pips higher as the US average earnings missed expectations. But, the actual number was still positive, so it seems that the buyers are giving up already. The last upwards move seems exhausted now as as AUD/USD buyers failed to keep the price above 0.7230. The trend has turned bearish this week and the 50 SMA (yellow) provided resistance, so that’s why we decided to sell this pair.

In Conclusion

OPEC has decided to cut production by 800 million barrels per day and Russia increased their share to 400 million barrels, so we’re now at 1.2 million barrels. Oil is up and running now with UK Brent Crude more than $3 higher on the day. It seems like the gifts for the Canadian Dollar are not ending today.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account