Selling the Retrace in USD/PY Ahead of the Risk Events

USD/JPY has retraced higher during the European session but the trend remains bearish, so we decided to go short on this pair.

We decided to open a sell forex signal in USD/JPY a while ago today. The fundamentals point down for this pair, at least for the next two days. The British Parliament will vote on Theresa May’s Brexit deal tomorrow and the European Commission will decide on the Italian budget for next year.

Both events are major risk events for forex traders, so the safe havens are expected to remain in demand for the time being, until these events are over. That’s one of the reasons we bought the Yen by selling USD/JPY. The other reason is the technical setup in USD/JPY H1 and H4 charts.

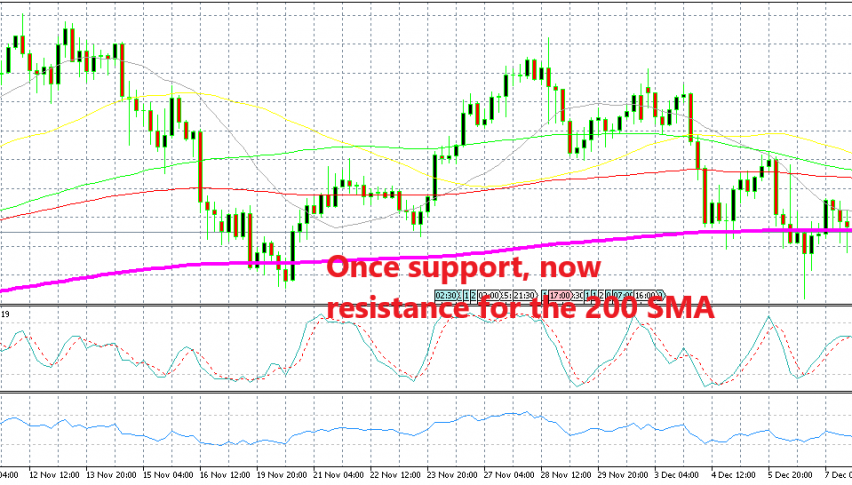

As you can see from the H4 chart above, the price broke below the 200 SMA (purple) last week, although the proper break only came last night during the Asian session as the price opened with a bearish gap lower.

The sellers continued to push lower. During the European session we have seen a bullish retrace, but the 200 SMA has now turned into resistance, so we came to the conclusion that this moving average isn’t going to let go that easy.

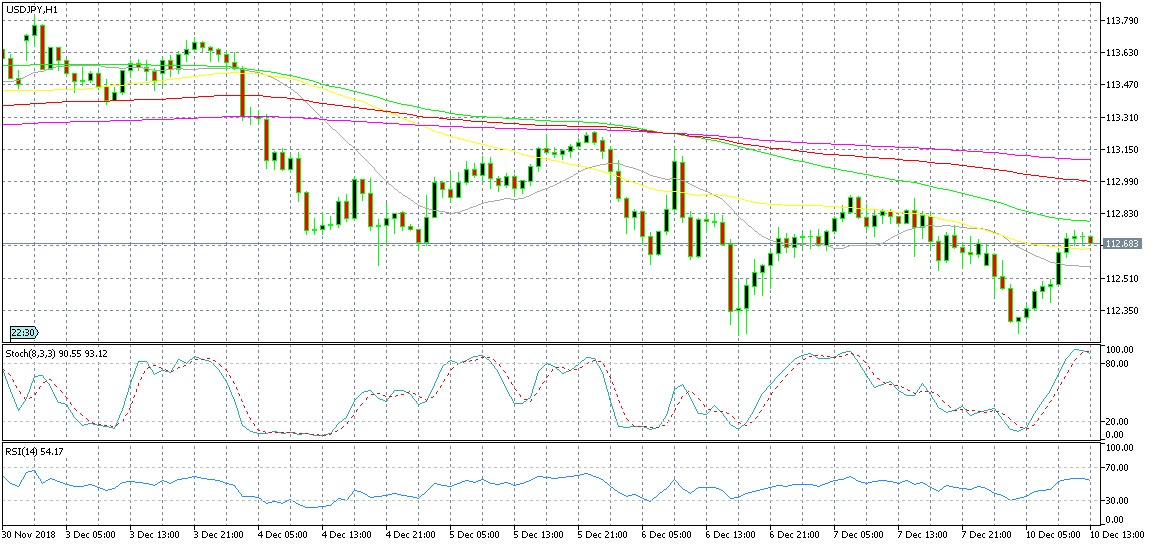

USD/JPY is overbought on the H1 chart

Switching to the H1 chart, we see that the downtrend is well in place here and the retrace higher is now complete as stochastic has now become overbought. The previous two candlesticks closed as dojis which are reversing signals after the pullback. So, all indicators, technical and fundamentals, point down for this pair.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account