US Session Forex Brief, Dec 11 – Brexit and Italian Budget Go to Brussels

As we now know, the Brexit vote in the British Parliament was called off by Theresa May yesterday. She was set for a big defeat yesterday so this was the right decision from her. We have heard may British politicians oppose the deal from the opposition Labour Party obviously, from the Government coalition DUP Party of Northern Ireland, as well as from her own Conservative Party. Today she has flown over the Channel to Brussels. Her goal is to convince the EU to give her some legal assurance on the Irish border backstop. This would convince some British MPs that the backstop will end at some point in time and will probably change their mind and vote on Brexit.

EU and Irish officials have made quite a few comments this morning confirming that they won’t touch the deal, since this is the only Brexit deal available. Although, some sources from the EU say that May won’t get clarification that will carry legal weight regarding Brexit. So, it is quite a mess. We will be around to cover this event as it unfolds.

The Italian deficit issue is also near its end, or so it seems. Both problems, Brexit and the Italian budget for next year, keep being postponed so you never know when they will be resolved, but the deadline is getting ever close for both these issues. The European Commission wants the deficit for next year’s budget at 1.9%-2.0%, while the real Italian leaders Matteo Salvini and Luigi Di Maio want it at 2.2% at the lowest. Di Maio might even budge for 2.1%. In the middle, we have the Italian Prime Minister Giuseppe Conte and the Finance Minister Tria trying to bring both parties to the middle of the road but without much success so far.

The European Session

- Ireland’s Coveney on Brexit – The Irish Foreign Minister Simon Coveney commented early today that the backstop is not going to change and May did not ask that the backstop should be removed. He added that there is room for the EU to reassure Westminster on the backstop. Although, we don’t know if there will be a fixed end-date like the British want.

- Juncker Surprised by Brexit Turn of Events – These were the first words from the President of the European Commission Juncker. He added that the Brexit deal on the table is the only possible deal for the UK.

- No Backstop Clarification Rumours – We heard rumours citing EU sources that Theresa May won’t get clarification on the Irish backstop issue which hold legal weight. This is what the Brexiteers want so we will see if May gets legal assurance.

- UK Employment Report – Unemployment rate for October remained unchanged at 4.1% in Britain as expected, after having ticked higher from 4.1% in September. The claimant change count increased more than expected, but it didn’t affect the unemployment rate.

- UK Earnings Report – The average earnings index 3m/y jumped higher from 3.0% expected to 3.3%. The previous number was revised higher as well from 3.0% to 3.1%. Earnings excluding bonuses also increased to 3.3% from 3.2%, but the GBP didn’t take much notice because, well, Brexit.

- German And Eurozone ZEW Economic Sentiment – The ZEW economic sentiment expectations improved a little bit while they were expected to deteriorate further. Although, it is still in negative territory. The sentiment for the current situation declined from 58.2 points to 45.3 points.

- Juncker and Conte to Meet Tomorrow – The President of the European Commission and the Italian Prime Minister Conte are expected to meet tomorrow to talk on the Italian budget. Although, sources from the Italian Government say that it is unlikely that Conte will suggest new targets for the deficit. Sources say that it is really probable that the EU won’t discipline Italy if they agree to lower deficit to around 2%, but also added that neither Di Maio nor Salvini want to lower the deficit below 2.1%-2.2%.

- Brexit Vote in January? – Theresa May’s spokesman said a while ago that May made it clear to Rutte that she needs additional reassurance on the backstop and hopes to achieve that goal by January 21, when she will bring it to the UK Parliament. He added that tomorrow the Cabinet will meet to discuss Brexit and the preparations in case of a no-deal Brexit scenario.

- China to Move on Auto Tariffs As Promissed – Bloomberg posted a report a short while ago suggesting that the Chinese will go ahead with reducing the auto tariffs on US cars from 4% currently to 15%. Donald Trump tweeted on this after his meeting with the Chinese President Xi in the previous weekend meeting during the G20 summit in Argentina.

The US Session

- US NFIB Small Business Optimism Index – The small business optimism index for November was expected to tick lower from 107.4 points to 107.3 points. Although, it came much lower than expected at 104.8 points which is the lowest level since April.

- US PPI Report – The US producer price index (PPI) jumped higher to 0.6% in October as last month’s report showed. Today, the headline PPI number for November is expected to fall flat at 0.0%. Core PPI also jumped 0.5% higher in October and today it is expected to come at 0.1%.

- RBNZ Governor Orr Speaks – The Governor of the Reserve Bank of New Zealand will hold a speech in the evening today, at 19:15 GMT. The NZD has been on a downtrend for more than a week, so perhaps Governor Orr will add more fuel to the downtrend or reverse the trend to bullish.

Trades in Sight

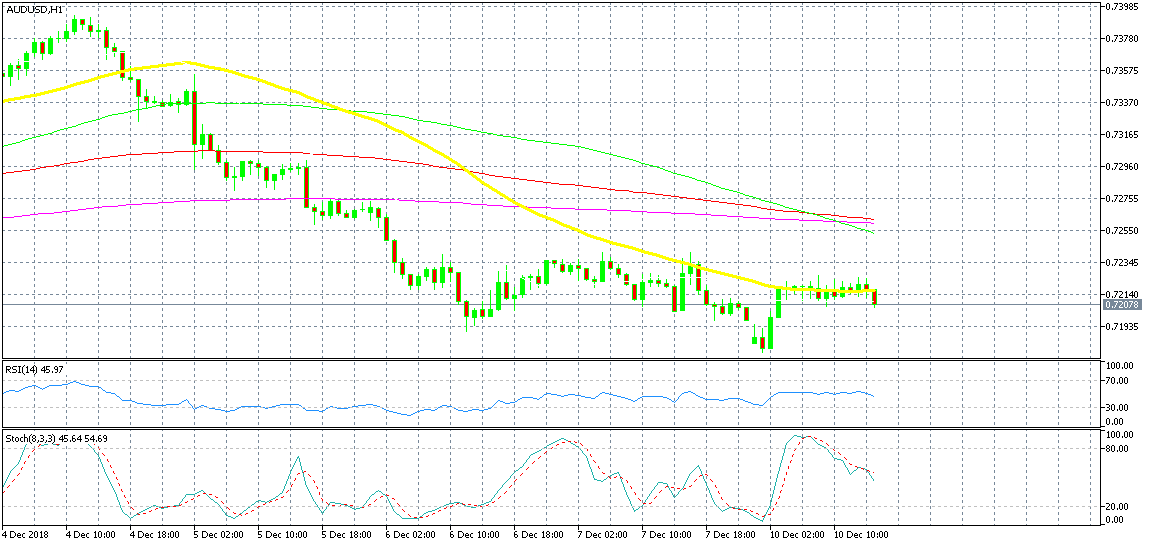

Bearish AUD/USD

- The trend has been bearish for more than a week

- The retrace higher looks exhausted on the H4 chart

- The 100 SMA should provide resistance

The 100 SMA has already turned into resistance

We opened a sell forex signal a while ago in this forex pair. AUD/USD has been on a bearish trend since early last week although it has traded in a range during this week. This looks more like a retrace in fact, but the buyers aren’t strong enough to put a decent fight and make a proper retrace higher, so AUD/USD has traded in a range. Now, the stochastic indicator is becoming overbought on the H4 chart, so the retrace is nearly complete. Besides that, the 100 SMA (red) has been providing support previously, but it has turned into resistance after being broken to the downside towards the end of last week. If the buyers try to push higher, the 100 SMA will be a big obstacle to overcome.

In Conclusion

The sentiment improved a bit late yesterday as Theresa May called off the Brexit vote and headed for Brussels again. Today, the rumours of the Chinese removing car tariffs as an answer to Trump has helped improve the sentiment further and stock markets are climbing higher. Although, the trade war is not over and the issues with Brexit and the Italian budget remain, so the negative sentiment will return again soon. So, I’m just looking to find a selling spot in the main indices.