Moving Averages Helping us in AUD/USD

AUD/USD has tried to form a retrace higher, but two MAs haven't let the buyers push higher. So, it has just consolidated this week.

As we mentioned in one of our forex updates today, we opened a sell forex signal in AUD/USD last Friday as this pair was retracing higher after trading on a bearish trend the entire week. So, we decided to use that retrace for a sell signal in this pair.

But, the USD entered a phase of weakness this week and the sellers in AUD/USD haven’t been able to take things in control and resume the bearish trend. But, the buyers haven’t been able to put up a decent retrace either and push the price higher in AUD/USD.

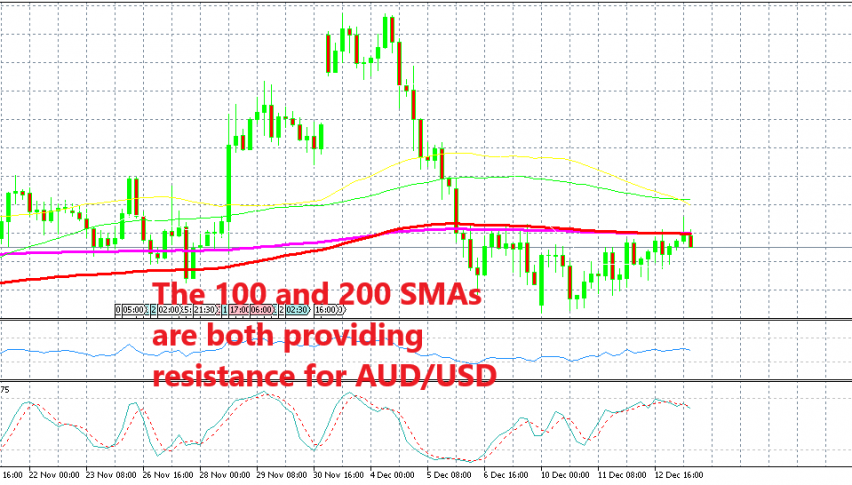

This means that the downtrend is likely to resume soon once the weakness period in the USD is over and the USD buyers return. So, we are waiting for that scenario to unfold soon. We have also been helped greatly by the 100 SMA (red) and the 200 SMA (purple) on the H4 chart.

These moving averages have been providing support before, if you scroll the H4 chart back. Now, they have turned into resistance and they have kept the buyers at bay the entire week. AUD/USD buyers haven’t been able to break these two moving averages.

They pierced these MAs today during the Asian session, but the price returned back below it and the previous H4 candlestick closed as an upside-down hammer, which is a revering signal after the retrace. The stochastic indicator is overbought as well and it is now turning down, so the retrace higher is complete.

Now, this pair should resume the downtrend, so our forex signal here looks safe now after having missed the SL by 1 mere pip.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account